-

Wall Street traded mixed yesterday, following Fed decision. S&P 500 traded flat, Nasdaq dropped 0.1%, Dow Jones moved 0.2% higher and Russell 2000 jumped 0.6%

-

FOMC delivered a 25 basis point rate hike yesterday, putting Fed funds rate in the 5.25-5.50% range - the highest level since early-2001

-

Fed Chair Powell did not rule out another rate hike at September meeting but warned that decision will depend on the intermeeting data

-

Powell ruled out rate cuts this year but said that some FOMC members expect rate cuts to occur next year. Money markets currently see the first Fed rate cut in March 2024

-

Indices from Asia-Pacific traded higher today - Nikkei and S&P/ASX 200 gained 0.8%, Kospi added 0.5% and Nifty 50 traded little changed. Indices from China traded up to 1.3% higher

-

DAX futures point to a slightly higher opening of the European cash session today

-

Goldman Sachs cut its RBA terminal rate forecast from 4.8 to 4.6%. Nomura expects RBA to hike again but decision may not be made until November

-

Meta Platforms traded almost 7% higher in the after-hours trading following the release of Q2 earnings report. Company reported beats in revenue, profit and user numbers, and has issued an upbeat guidance for Q3 2023

-

Chinese industrial profits were 8.3% YoY lower in June. Profits were 16.8% YoY lower year-to-date

-

According to industry data, UK car production rose for the fifth straight month and was 16.2% YoY higher in June as pandemic chip shortages continue to ease

-

Major cryptocurrencies trade mixed - Bitcoin drops 0.1%, Ripple trades 0.3% lower, Dogecoin gains 0.1% and Ethereum adds 0.5%

-

Energy commodities trade mixed - oil gains 0.7% while US natural gas prices trade a touch lower

-

Precious metals gain - gold, silver and platinum trade around 0.2% higher each

-

AUD and NZD are the best performing major currencies while USD and JPY lag the most

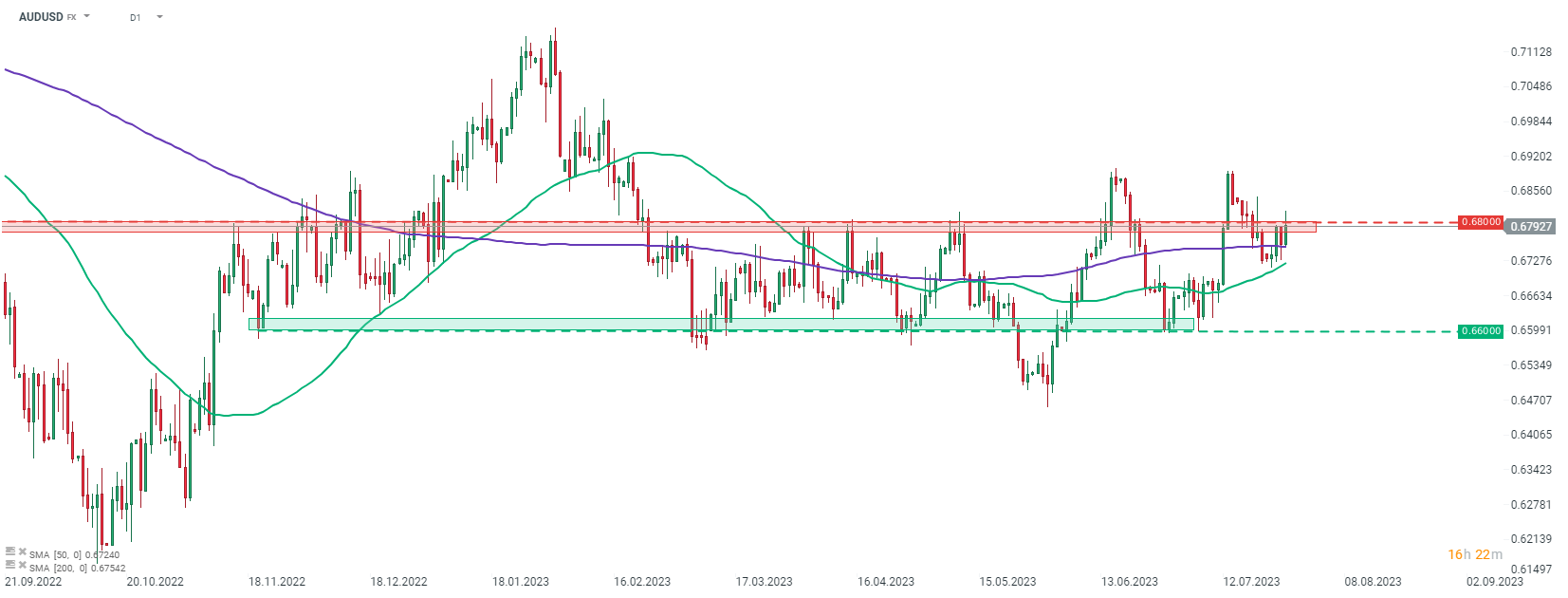

AUDUSD is trading higher today, thanks to the post-FOMC US dollar weakening. The pair is attempting to climb back above the 0.6800 resistance zone. Source: xStation5

AUDUSD is trading higher today, thanks to the post-FOMC US dollar weakening. The pair is attempting to climb back above the 0.6800 resistance zone. Source: xStation5

Daily Summary: "Sell America" pushes US assets off the cliff (20.01.2026)

Dollar crumbles under geopolitical chaos 📉 Sell America is back in play❗️

Daily summary: Its fear, but not panic yet. Trump has shaken the markets again.

New front in the trade war: Greenland❄️Will Gold rise further❓