- Cross-atlantic relations worst in decades

- Trump uses tariffs to get greenland, Europe considers retaliation

- Economic dependencies still favor Europe

- US crippling debt problem, Gold likely to benefit

- Cross-atlantic relations worst in decades

- Trump uses tariffs to get greenland, Europe considers retaliation

- Economic dependencies still favor Europe

- US crippling debt problem, Gold likely to benefit

Tensions between the USA and Europe due to the uncompromising desire to acquire Greenland recently resembled only a spark, but today it is already a fire. This weekend, Donald Trump decided to turn words into actions and started another customs and trade war.

On February 1, 2026, 10% tariffs are set to be imposed on goods from Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland. The tariffs apply only to countries that decided to send their troops to Greenland after a series of threats in recent weeks. If a "agreement," as Donald Trump calls the transfer of Greenland under US rule in one way or another, is not reached, the tariffs will be increased to 25%.

Europe's reaction to the latest attempts at blackmail differs significantly in tone from the trade negotiations of 2025. Instead of a policy of compromise, Europe began by setting unbreakable boundaries for American expansion and threatened a range of financial and regulatory instruments whose implementation will have a devastating impact on both sides. This includes the Anti-Coercion Instrument (ACI). Currently, a package of restrictions on the USA worth 93 billion euros is on the table.

The reaction is also visible on the other side of the Atlantic. In the mainstream of US politics, cracks and doubts about Trump's policy are becoming increasingly apparent, not only from the opposition but also within his own party. Many prominent Republicans clearly state that the attempt to acquire Greenland will end Trump's presidency. Congress is not wasting time and is currently taking a series of measures to prevent further aggressive policies.

EURUSD (D1)

Euro making gains after escalation

Source: xStation5

Both the asymmetry of dependence and time work against the USA. This is the reason for the unprecedented aggression of the administration, which knows it cannot afford to open another front in the economic and trade war it is clearly losing. What economic pressure measures do individual European countries hold in the confrontation with the USA?

Denmark

The current owner of Greenland. Denmark is a small country but has a significant share in the pharmaceutical and maritime logistics markets. Novo Nordisk provides Americans with breakthrough obesity drugs, and Maersk controls a significant part of the consolidated insurance and container markets.

Norway

Norwegians also have reasons to be angry because the Norwegian islands of Svalbard and Jan Mayen also appeared on the USA's "wish list." Norway is a powerhouse in the natural gas market and a significant oil supplier. Limiting the USA's access to deposits in Norway will be a blow to American extraction companies. Europe can also reduce dependence on the USA in the LPG segment by increasing exploitation in Norway.

Germany

The Federal Republic of Germany has become synonymous with industrial decline in recent years. However, Germany is still the third-largest economy in the world, and this title is not undeserved. CNC machines, sensors, industrial chemistry, control systems, pharmaceuticals, and lasers. They are provided by companies like BASF, Siemens, and Infineon. These are just some areas where the USA is critically dependent on Germans. On the other hand, Germany's imports are mainly agricultural products and digital goods, which is not a symmetrical dependence. In this field, the USA can replace many, but no one can replace Germany.

France

The French have taken the lead in defending European interests in Greenland. They are exceptionally well-prepared for this. France is a leader in nuclear energy both in Europe and globally, a military power that even the USA must reckon with, and a participant in the market with no competition in many fields. Dependencies here are similar to those in the case of Germany. France sends jet engines (Dassault, Airbus, ATR) and luxury goods (LVMH) to the USA and imports IT services (Oracle, Microsoft, Google) and agricultural products. This dependence, already small, is also a matter of time. The key here is the "Mercosur" agreement, which will allow Latin American countries to replace miners and farmers from the so-called "Red States" of the USA, and local alternatives like SAP or Mistral will eventually replace the oligopolies from Silicon Valley.

Netherlands

The Kingdom of the Netherlands, despite its small size, is a super heavyweight boxer in the ring fighting for independence from the USA. The Netherlands controls ASML, without which the "tech" industry in the USA would regress 20 years overnight, and a large part of it would cease to exist. A similar, though smaller, dependence also exists in the case of products from NXP. At the same time, as some forget, the Netherlands, despite being smaller than most American states, is the second-largest food exporter in the world, with the USA being the first. Replacing agricultural products from the USA with those from the Netherlands for Europeans is a matter of a few signatures from EU dignitaries, and it would simultaneously mean an economic cataclysm in many agricultural states in the USA.

United Kingdom

The United Kingdom has not been doing well economically in recent years, but the USA's dependence on institutions and companies on the islands remains enormous. British is, among others, Rolls Royce, without RR engines, the American defense industry is lost like a child in the fog. The production and repair of aircrafts already face constant delays, and cutting off RR engine supplies would collapse Pentagon supply chains. At the same time, the UK is the second-largest holder of American debt.

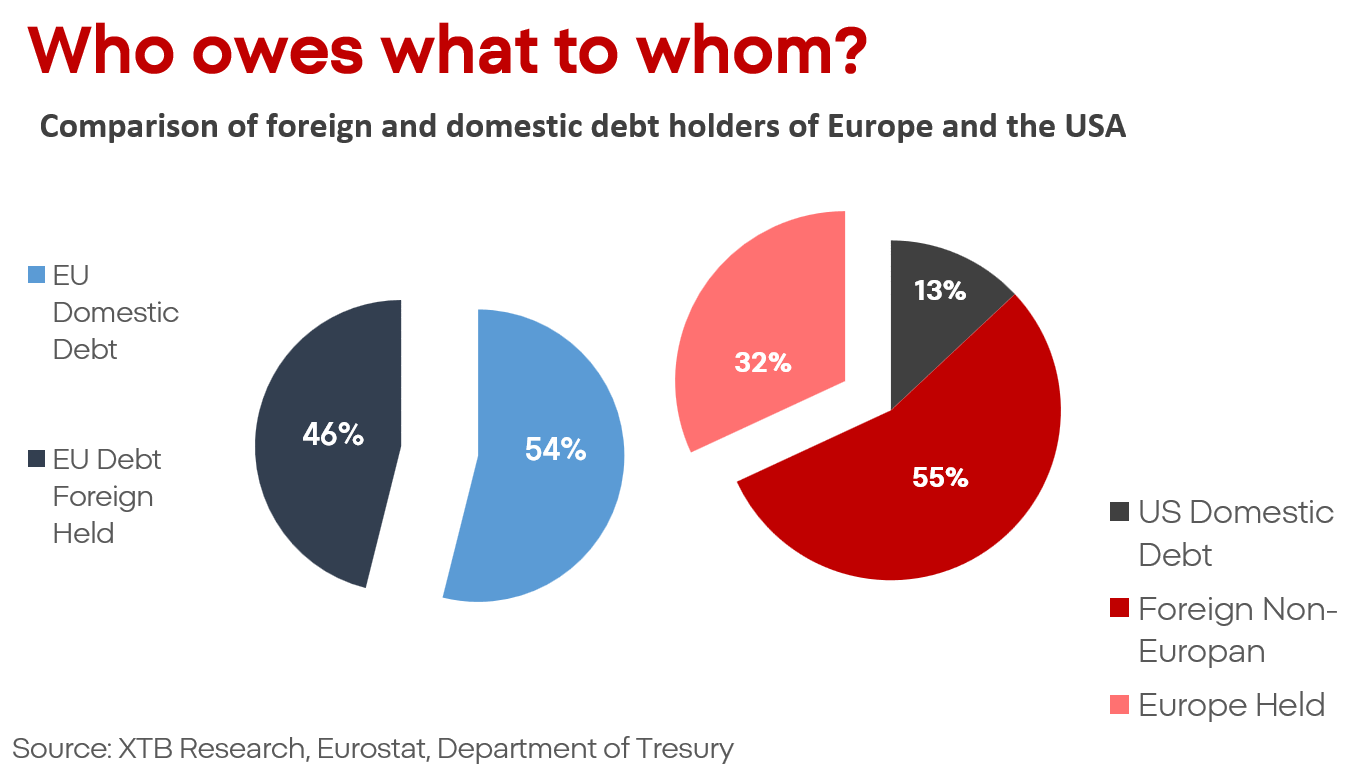

This is a good moment to move to the market essence. Americans have a huge problem with debt, much larger than Europe. At the same time, their dependence on foreign creditors is significantly greater.

The current policy of the president's administration has the following effects:

- It lowers trust in the USA, the American market, and institutions.

- This makes US debt less trustworthy as well.

- Demand for US debt falls, the dollar depreciates, and yields rise.

- This supports exports and the economy in the short term, as is clearly visible in US data.

- In the long term, however, it will make the burden of US debt unbearable.

As a result, the USA faces a choice between ultra-loose monetary policy to devalue its debt or at least maintain yields at a level allowing its servicing, or it will be forced to unprecedented spending cuts. In any case, the result is an economic and fiscal crisis, and this is also the reason for the administration's hostility towards Jerome Powell, who does not want to be part of these events.

In the case of escalating confrontation, most asset classes will lose, but a potential oasis that will benefit from the allocation of huge amounts of capital released from the stock market and bond market will be precious metals, and above all gold, as already seen in central bank purchases.

Kamil Szczepański

Junior Financial Markets Analyst at XTB

Morning wrap (05.03.2026)

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing