-

US and European index futures launched new week lower as the West moved to impose harsher sanctions on Russia over the weekend

-

The United States and EU decided to impose harsh sanctions on Russia and its ability to finance war. Allies announced that part of Russian banks, that are not handling energy financing, will be cut off from SWIFT while assets of the Central Bank of Russia were frozen

-

Central Bank of Russia forbade domestic brokers from accepting sell orders for Russian securities from foreign investors. Launch of Russian stock trading session was postponed from 7 am to 12 pm GMT

-

Ruble crashed after the West moved to target the Russian financial sector. USDRUB launched a new week near 120.00, up from around 82.00 at the close of the previous week. However, it is hard to say at what levels ruble trade right now as liquidity on the market is very thin and most brokers have not resumed RUB trading yet

-

ECB assesses that European unit of Russian state-owned Sberbank is likely to fail following sanctions

-

Fighting in Ukraine continued over the weekend. According to media reports, Russian offensive is unsuccessful with Russian army being unable to capture any major locations over the weekend

-

Belarus voted in a referendum to change law and allow Russian nuclear warheads to be located on its territory. International community claims that results were forged

-

Russian jet fighters and rockets were launched against Ukraine from Belarus territory. According to media reports, Belarus will officially join Russian invasion today and send its troops to Ukraine

-

Russian and Ukrainian delegations arrived at locations of talks near Ukraine-Belarus border

-

According to UK Times, 400 Russian mercenaries were deployed to Kyiv with task of assassination Ukrainian President

-

Putin ordered nuclear deterrence forces to be in state of readiness

-

Norway's sovereign wealth fund will exit the $2.83 billion position it has in Russian equities and bonds. French BP said it will entirely divest its stake in Russian Rosneft, taking a $25 billion charge in the process

-

More European countries announced aid to Ukraine over the weekend, including military and humanitarian aid

-

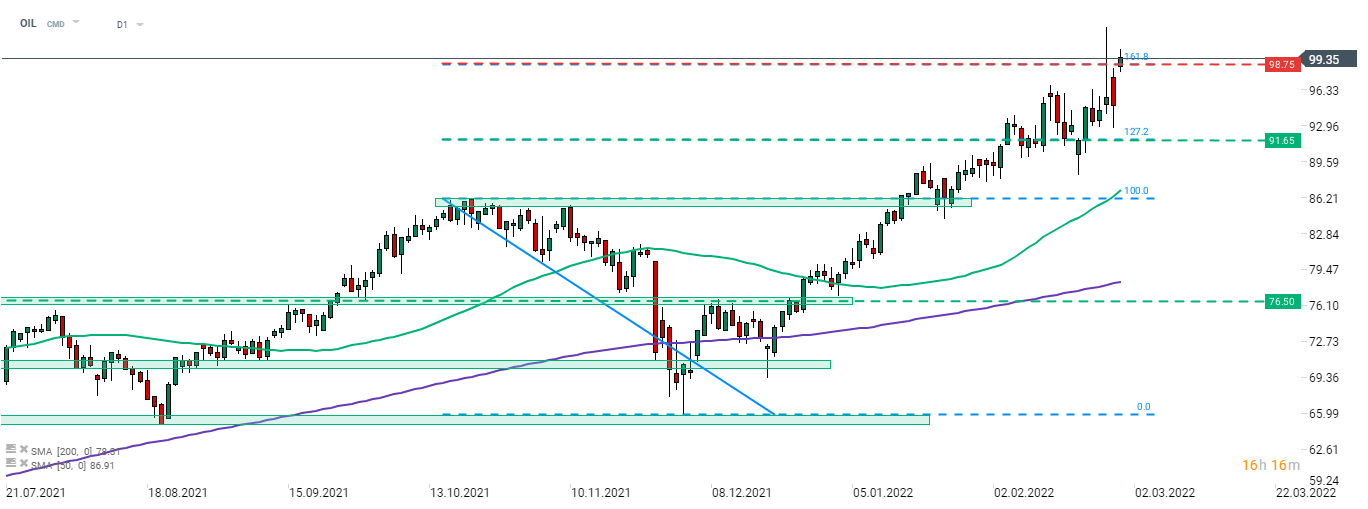

Oil trades higher as risk of disruption to energy flows from Russia increases. Brent gains over 4% and trades back above $99 per barrel

-

Precious metals trade higher. Gold and platinum gain around 1% while palladium rallies 5%

-

AUD and GBP are the best performing major currencies while CAD and USD lag the most

Western countries moved to target Russian reserves as well as cut off part of Russian banks from SWIFT. There is a risk that Russia may retaliate by cutting off energy exports to Europe. However, this would be a massive hit to Russian revenues. Brent (OIL) jumped at the start of a new week and once again trades above $99. Source: xStation5

Western countries moved to target Russian reserves as well as cut off part of Russian banks from SWIFT. There is a risk that Russia may retaliate by cutting off energy exports to Europe. However, this would be a massive hit to Russian revenues. Brent (OIL) jumped at the start of a new week and once again trades above $99. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30