-

Indices from Asia-Pacific traded higher today. Nikkei gains 1.6%, S&P/ASX 200 added 0.6%, Kospi jumped 0.7% and Nifty 50 traded 0.3% higher. Indices from China traded 1.3-2.0% higher

-

Gains during the Asian session were made in response to solid trading on Wall Street on Friday. However, gains in case of Chinese equities are driven by more domestic factors

-

China halved stamp tax on securities trading, starting from today. Deposits required while margin trading have also been lowered. Last but not least, short selling by institutions was restricted

-

European index futures point to a higher opening of the cash session on the Old Continent

-

US index futures trade more or less flat compared to Friday's cash closing levels

-

Fed Chair Powell warned that more rate hikes may come in the future but the US central bank will proceed carefully

-

Fed Mester said that case is building for another rate hike and that cuts may have to wait

-

BoJ Governor Ueda said that Bank of Japan is sticking to its ease monetary policy as it thinks that underlying inflation is still a bit below target

-

BoE Broadbent said that rates may have to stay high for some time. Broadbent said that while core inflation is expected to ease in the coming months, it is uncertain for how long will wage pressures last

-

Chinese industrial profits dropped 6.7% MoM in July. Profits were 15.5% YoY lower in the year-to-date period (January - July 2023)

-

Australian retail sales increased 0.5% MoM in July (exp. +0.3% MoM)

-

Cryptocurrencies launched new week's trading lower - Bitcoin drops 0.4%, Ethereum trades 0.7% lower and Dogecoin declines 1.2%

-

Oil trades flat while US natural gas prices jump 2.5%

-

Precious metals gain - gold adds 0.1%, platinum gains 0.2% and palladium jumps 1.2%. Silver is a laggard with 0.2% drop

-

AUD and NZD are the best performing major currencies while USD and CAD lag the most

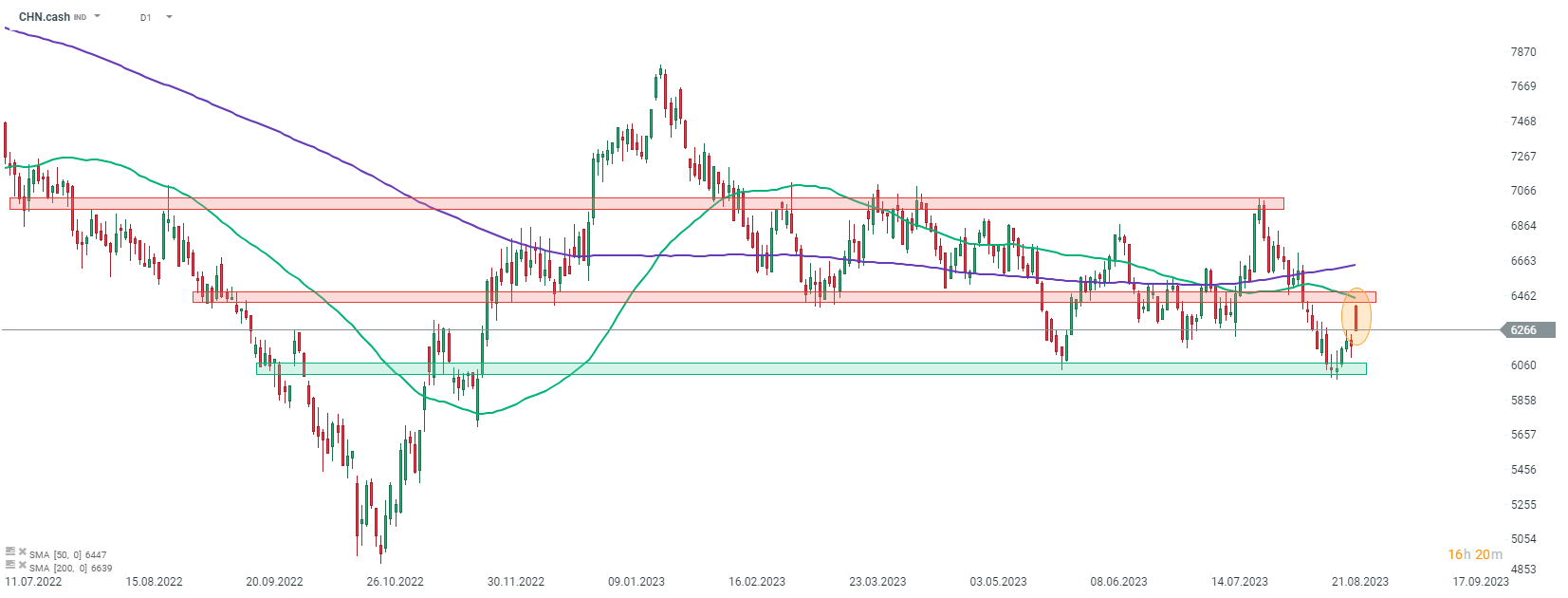

Chinese index CHN.cash launched new week's trading with a massive bullish price gap. This was in response to Chinese authorities announcing a number of measures over the weekend, aimed at supporting domestic stock market. However, index started to erase gains following the opening. Source: xStation5

Chinese index CHN.cash launched new week's trading with a massive bullish price gap. This was in response to Chinese authorities announcing a number of measures over the weekend, aimed at supporting domestic stock market. However, index started to erase gains following the opening. Source: xStation5

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments