- Wall Street indices finished yesterday's trading higher. S&P 500 gained 0.10%, Dow Jones moved 0.24% higher and Nasdaq jumped 0.29%. Small-cap Russell 2000 was a laggard with an almost-0.5% drop

- Indices from Asia-Pacific traded mixed today - indices from Japan, South Korea and China dropped while indices from Australia and India gained

- DAX futures point to a slightly higher opening of the European cash session today

- Reserve Bank of New Zealand left interest rates unchanged at a meeting today, with the main interest rate staying at 5.50%. RBNZ forecast point to official cash rate of 5.63% in March 2024 (prev. 5.58%) and 5.66% in December 2024 (prev. 5.50%)

- RBNZ Governor Orr said that risk to inflation is still more to the upside and that discussion on hiking rates was held at the meeting today

- BoJ Adachi said that positive wage-inflation cycle has not happened yet but should chance of it happening increase, Bank of Japan may begin discussions on negative rates exit

- Fed's Goolsbee said that has some concerns over keeping rates too high for too long and that Fed should be less restrictive once it believes it is on path to 2% inflation

- Australian CPI inflation decelerated from 5.6 to 4.9% YoY in October (exp. 5.2% YoY). On a monthly basis, CPI was 0.4% MoM lower, compared to 0.3% MoM increase in September

- API report pointed to a 0.817 million barrels drop in oil inventories (exp. -2.0 million barrels). Gasoline inventories dropped 0.898 million barrels (exp. +0.2 mb) while distillate inventories increased by 2.806 million barrels (exp. +0.4 mb)

- Cryptocurrencies are trading higher today - Bitcoin gains 0.5%, Ethereum trades 0.2% higher and Dogecoin gains 0.9%

- Energy commodities trade a touch higher - oil gains 0.2% while US natural gas prices are up 0.3%

- Precious metals trade mixed - gold gains 0.2%, silver drops 0.2%, platinum declines 0.3% and palladium jumps 0.5%

- NZD and JPY are the best performing major currencies, while AUD and USD lag the most

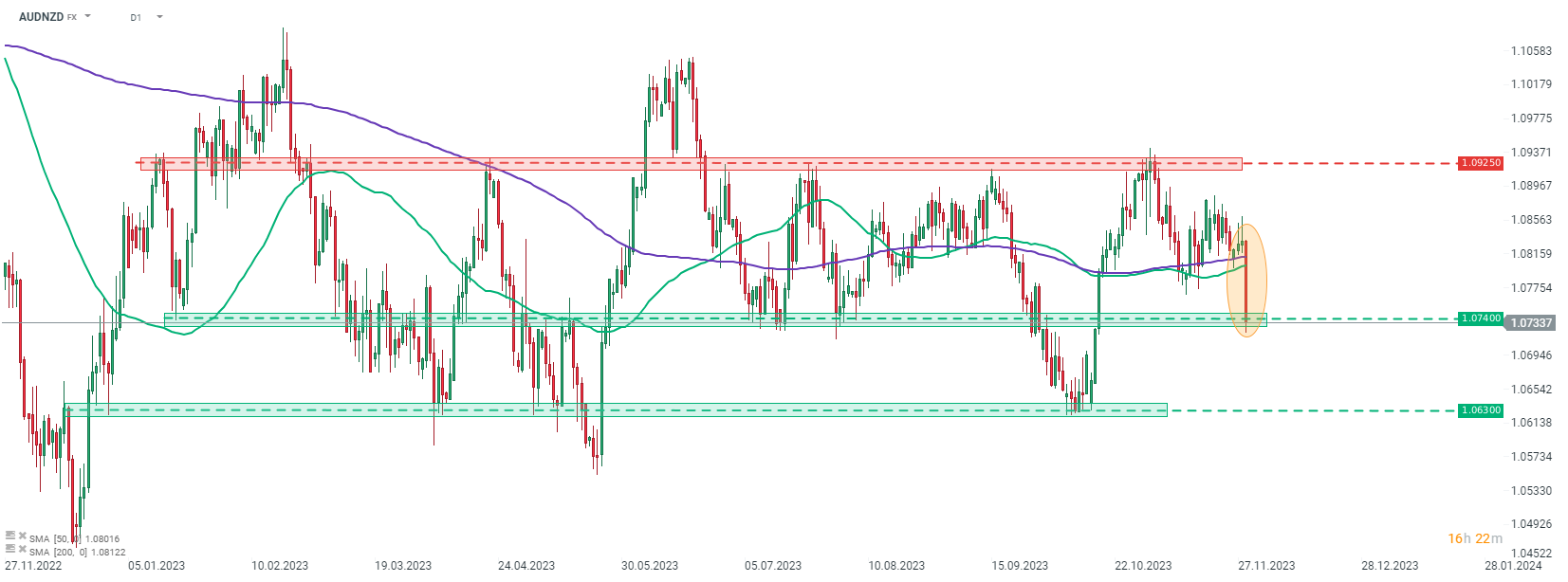

AUDNZD is slumping today as NZD got a boost from hawkish RBNZ narrative while AUD is slumping after deeper-than-expected slowdown in CPI in October. Source: xStation5

AUDNZD is slumping today as NZD got a boost from hawkish RBNZ narrative while AUD is slumping after deeper-than-expected slowdown in CPI in October. Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

🚨 EURUSD deepens decline, falls to key support zone

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Three markets to watch next week (27.02.2026)