-

Indices from Asia-Pacific traded mixed during a session today. Indices from Australia and Japan dropped while equities from South Korea and China gained

-

European index futures trade slightly below yesterday's cash close

-

Members of the European Union reached an agreement on the Russian oil embargo. Seaborne imports will be banned while pipeline imports will be exempted from the embargo. 90% of Russian oil exports to EU will be banned by the end of this year

-

Oil embargo will be a part of a larger EU sanction package that will also include removal of Russia's largest bank, Sberbank, from SWIFT system

-

Chinese manufacturing PMI improved from 47.4 to 49.6 in May (exp. 49.1) while services gauge improved from 41.9 to 47.8 (exp. 45.2)

-

Executives from Samsung and Intel met to discuss cooperation amid a global semiconductor shortage

-

Japanese retail sales increased 2.9% YoY in April (exp. 2.6% YoY)

-

Japanese industrial production dropped 1.3% MoM in April (exp. -0.2% MoM)

-

Australia's building approval dropped 2.4% MoM in April (exp. +2.0% MoM)

-

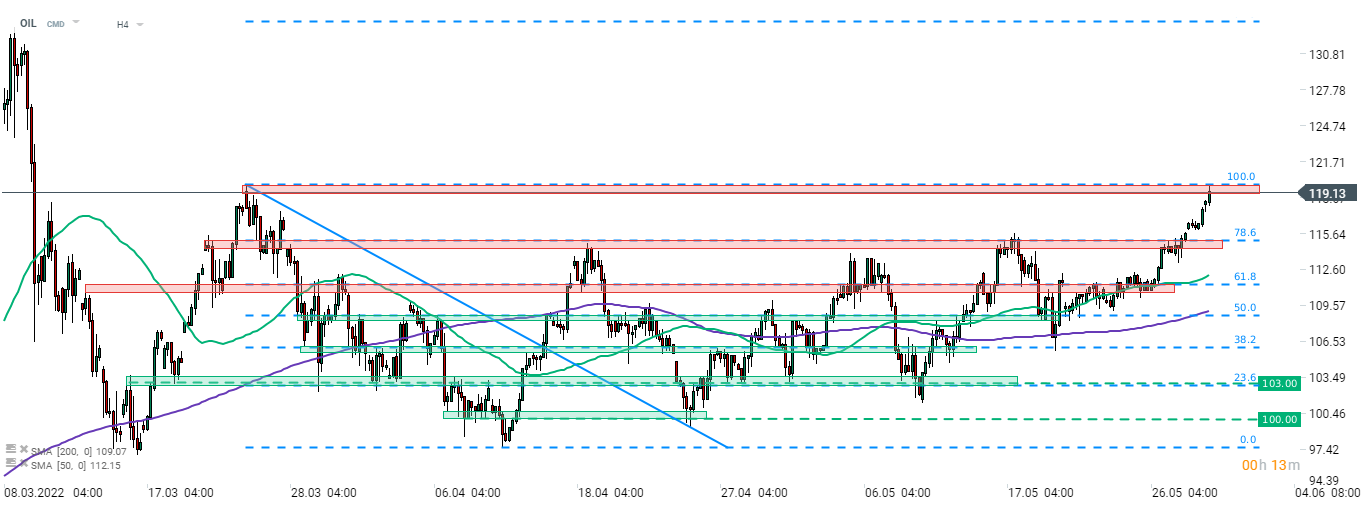

Oil is trading higher following news on EU embargo on Russian oil. Brent gains 1.4% and trades at 2-month high above $119 per barrel

-

Precious metals trade mixed - gold and silver drop while platinum and palladium gain

-

USD and AUD are the best performing major currencies while NZD and CHF lag the most

Oil jumped after EU members agreed on embargo on Russian oil. Brent (OIL) is trading over 1% higher and is testing the resistance zone marked with a late-March high in the $119-120 per barrel area. Source: xStation5

Oil jumped after EU members agreed on embargo on Russian oil. Brent (OIL) is trading over 1% higher and is testing the resistance zone marked with a late-March high in the $119-120 per barrel area. Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)