Summary:

-

BOE keep rates unchanged at 0.75

-

MPC vote 9-0 in favor of the decision

-

GBP pairs and UK100 little changed

The fifth interest rate decision in less than 18 hours has seen the Bank of England leaves its base rate unchanged at 0.75% as was widely expected. Ratesetters were unanimous in their view to keep the interest rate at current levels and the bank appear to have broadly maintained their prior stance, offering little by the way of any dovish signs despite the recent softness in data.

There was a small reaction seen in the pound with GBPUSD still lower on the day and trading not too far from prior support around the 1.2440 region. Source: xStation

There was a small reaction seen in the pound with GBPUSD still lower on the day and trading not too far from prior support around the 1.2440 region. Source: xStation

Selected comments from the statement were as follows:

-

If Brexit uncertainty persists, inflation likely to become weaker

-

Inflation will stay under 2% target for the rest of 2019 based on staff forecasts

-

Outlook for global growth has weakened due to US-China trade war

-

Entrenched Brexit uncertainties have led to reemergence of spare capacity

-

Labour market appears to remain tight, too early to judge that it is starting to loosen

All in all this latest message is very much in keeping with what was expected and as such the market reaction has been minimal. Governor Carney and his fellow MPC continue to toe a fairly hawkish line with suggestions that they would be considering higher rates were it not for political uncertainty but we don’t expect any significant moves on the policy front while Brexit continues to loom large on decision makers’ minds.

Retail sales disappoint

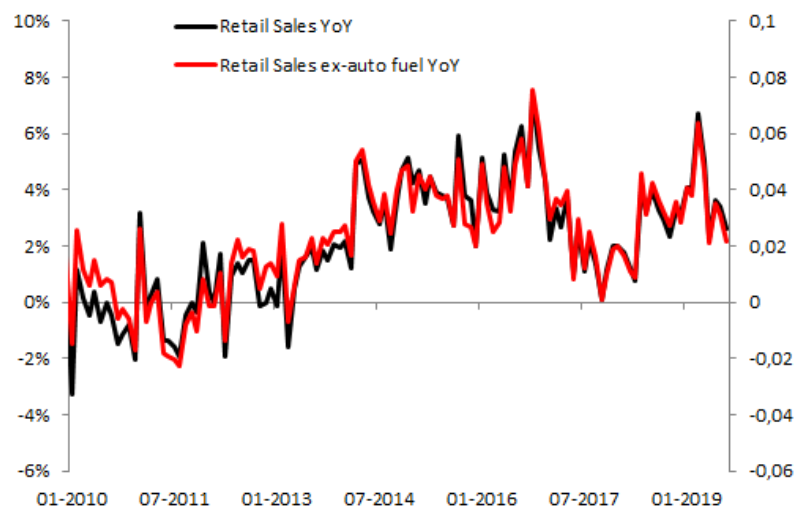

Despite the recent improvement in economic growth figures, several other metrics continue to point to a weakening UK economy. While the UK looks set to avoid a technical recession the outlook remains fairly fragile with the latest look at consumer spending revealing some softness. The consumer has been remarkably resilient in the face of unprecedented political uncertainty, but their confidence and spending does appear to be waning with the latest retail sales figures the weakest since May. One particular point to highlight is the fall of 3.2% in non-store retailing for August which was the largest monthly decline in 4 years and marks a reversion following a boost in July after significant promotions.

Consumer spending continues to soften in the UK with both the headline and core retail sales figures pulling back. Source: XTB Macrobond

Morning wrap (15.12.2025)

Three Markets to Watch Next Week (12.12.2025)

Daily summary: SILVER at a new ATH, EURUSD at its highest since October

Turkey has decided to lower the weekly repo rate to 38%