Gas prices continued their strong pullback during today's session, losing more than 3% during European morning hours. Yesterday, US inventory data showed a 75 bcf decline in stocks, which was in line with expectations but small for the winter period. This shows that demand remains low and further reports may bring equally small declines.

Earlier this week there was a cooling outlook for the second half of February, but we are now seeing a slight reduction in temperature drop expectations. The key region, the Midwest, is expected to experience standard temperatures.

Gas is approaching support at $1.8/MMBTU. It is worth noting that seasonality shows a potential local low. A potential cooling in the second half of February could lead to a similar price increase to last year, although it is worth noting that at that time, following a local low on the seasonality indicator, the price then still fell by 20% and reached the vicinity of US$2.1/MMBTU. In addition to this, it is worth noting that in recent months, confirmation of the exit from the downward trajectory was the breakout of the 15-session average. After this average was broken, the price increase was around 20%. At the moment, this average is in the vicinity of USD 2.0/MMBTU. Source: xStation5

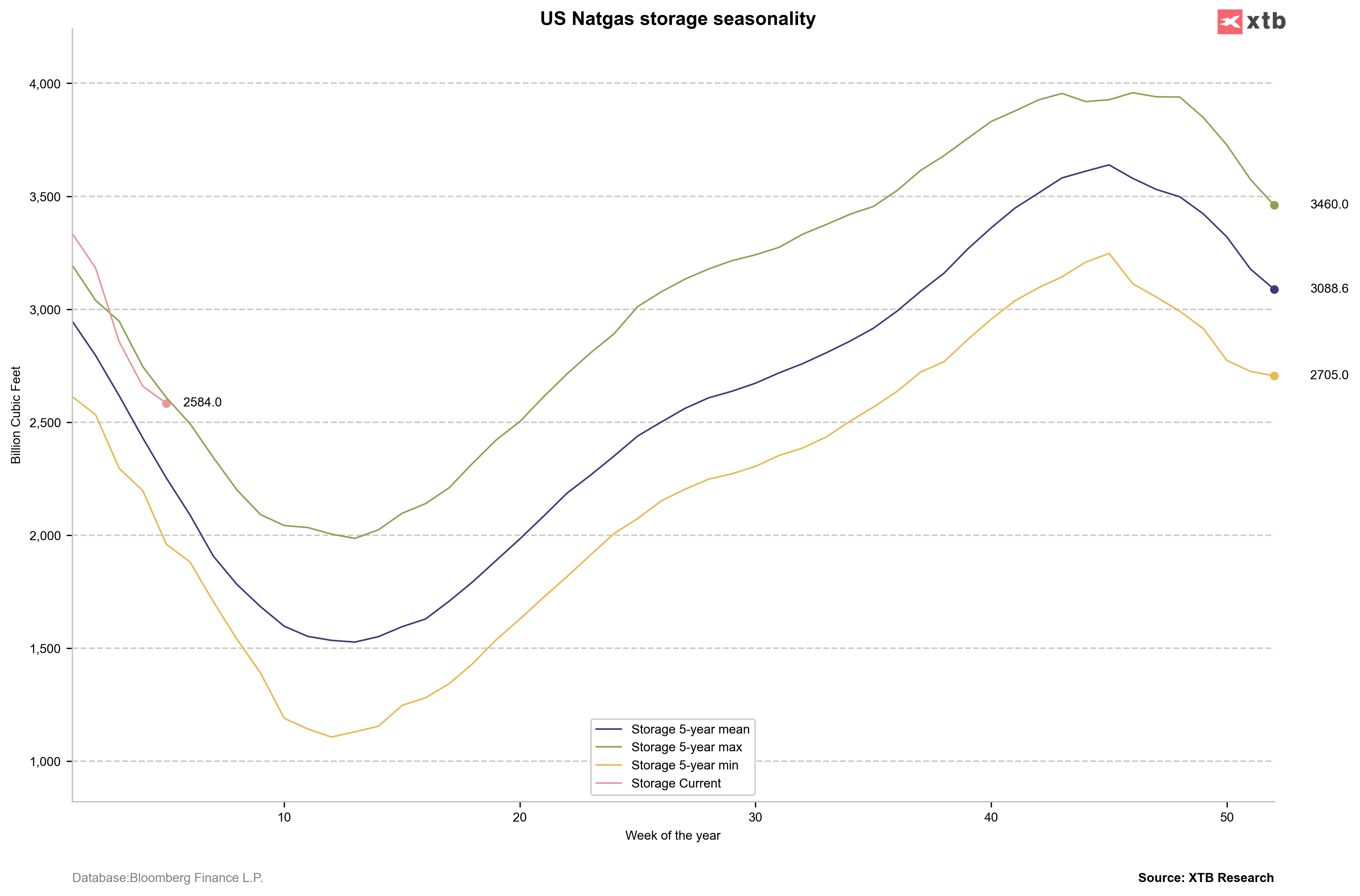

Stocks have returned to 5-year highs for the period and it is expected that we should experience new 5-year highs for US stock levels in the coming weeks. Source: Bloomberg Finance LP, XTB

The gas price has had its worst opening in 5 years and the price decline is already 30% (of course, it is important to remember that we have a large rollover in this as well. Without factoring in the rollover, the decline would still be above 15%. Source: Bloomberg Finance LP, XTB

Morning Wrap: Russian Oil with a 30-Day Purchase Permit

Cattle futures fall amid JBS plant strike, rising corn and Middle East 📌

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)

Daily summary: Oil still pressures Wall Street despite favorable CPI data 🗽