US natural gas prices (NATGAS) continue to pull back, dropping another 3% today. NATGAS dropped below June 17, 2024 low and reached the lowest level since June 6, 2024 - almost a 3-week low. US weather forecasts suggest that the heatwave US is facing right now, should be receding eastwards in the next 8-14 days. Probabilities of above-average temperatures are dropping, although their remain high and point to an over-50% chance in majority of a key Midwest region. However, there is a less than 50% chance of above-average temperatures on the West Coast in the next 8-14 days.

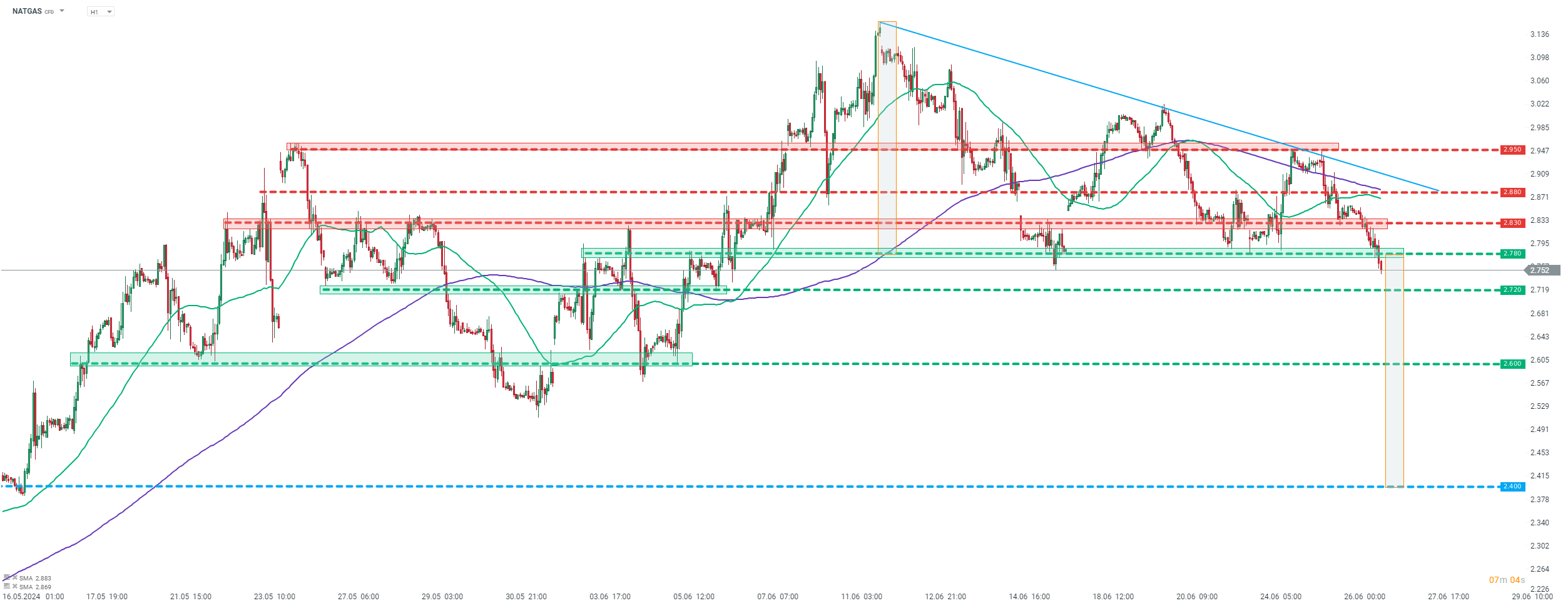

Taking a look at NATGAS chart at H1 interval, we can see that the price dropped below last week's and this week's lows in the $2.78 area and tested June 17 lows in the $2.75 area. Bears managed to push the price below those, printing a new 3-week low. Should bearish momentum continue and price continues to drop, the next short-term support zone to watch can be found in the $2.72 area, followed by $2.60 area. A point to note is that the aforementioned $2.78 area also marked the lower limit of the descending triangle pattern, with a textbook target of the downside breakout being $2.40 area. However, price would need to break below aforementioned $2.72 and $2.60 zones first.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉