Yesterday's jump on US natural gas prices (NATGAS) turned out to be short-lived. NATGAS is plunging over 5% today, erasing all of yesterday's gains and returning to the $1.65 per MMBTu area. While natural gas prices in Europe extended rebound into another day amid signs of strong Asian demand and expectations of low wind power generation in the coming days, signs pointing to oversupply in the United States continue to mount.

Bloomberg reported today, based on information from traders, that natural gas prices for next-day delivery at Waha hub in Permian basis dropped into negative territory today, to around -$0.02 per MMBTu. This is due to booming US production and lower power demand. Negative prices mean that producers are willing to pay another party to take gas from them. This usually means that inventories are full, but the situation is expected to be short-term with paying someone to take natural gas being a cheaper option than halting production. This was the case with oil in April 2020, when it briefly slumped into negative territory amid pandemic-related plunge in demand.

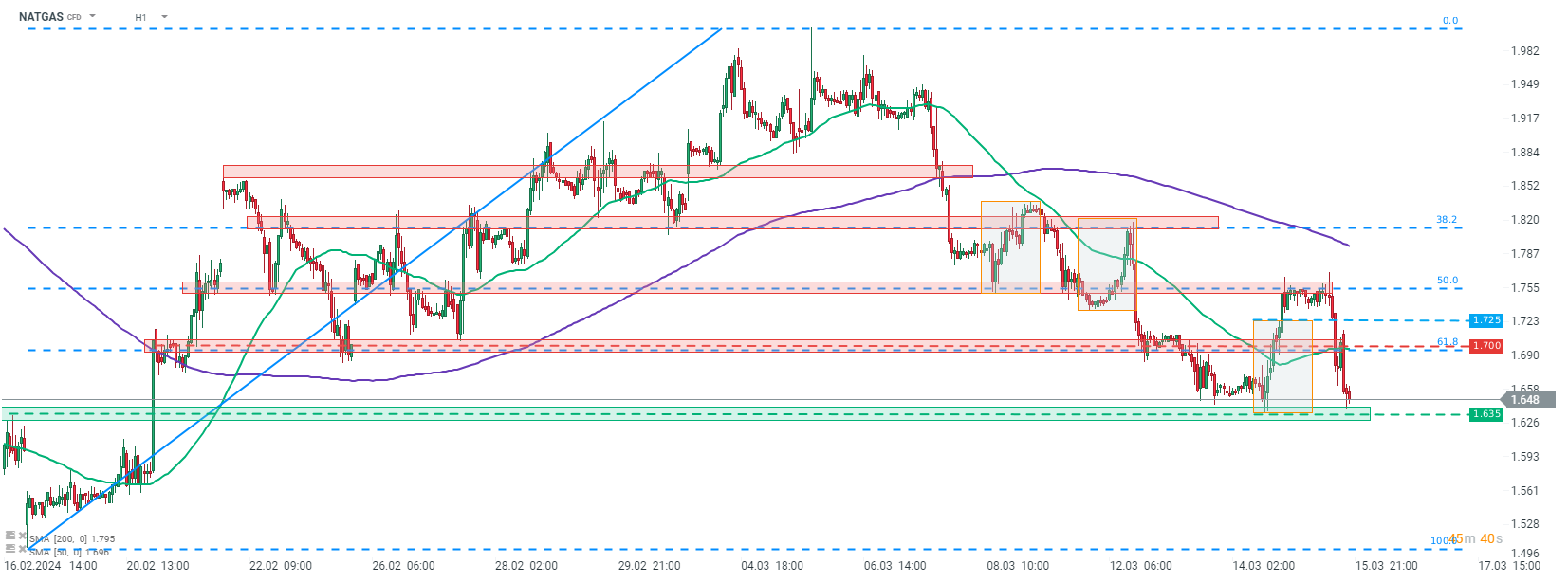

Taking a look at NATGAS chart at H1 interval, we can see that price jumped above the upper limit of local market geometry yesterday, hinting at a possible reversal in short-term trend. However, the advance was later halted at the 50% retracement of the upward move launched on February 19, 2024. Sell-off resumed today with price erasing all of yesterday's gains and testing $1.635 support zone. The first attempt to break below was a failed one, but prices remains nearby, and another test cannot be ruled out.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30