NATGAS continues to gain after last week's rollover and trades above $2.80 per MMBTu already, what may suggest that seasonal rebound has already started. On the other hand, seasonal indicator available on xStation5 platform suggest that the next local low may be reached by the end of this week.

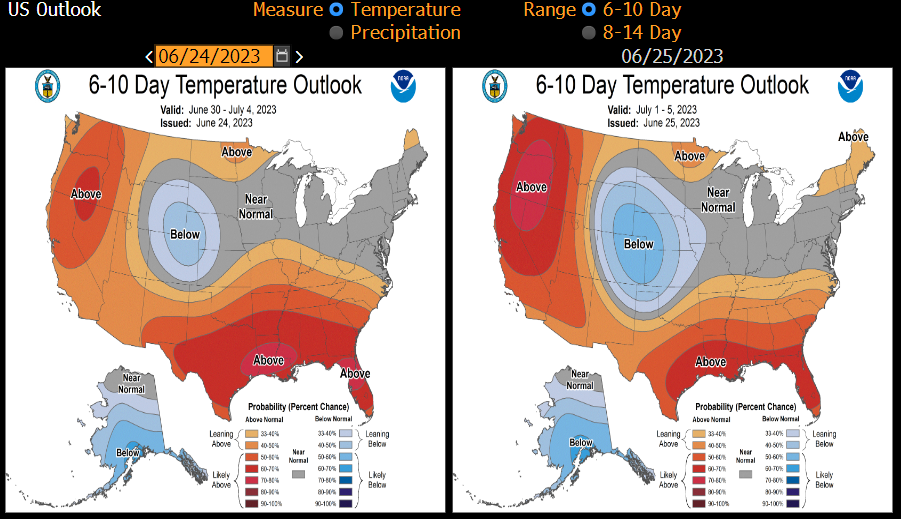

Weather forecasts for the United States are changing. While previous set of forecast suggest that very high temperatures should be expected in Texas, new set suggests high temperatures across the West Coast. Central and eastern states should not experience extremely high temperatures. While new forecasts point to a significant pick-up in temperatures in the western part of the United States, forecasts become cooler for the remainder of the country.

Source: Bloomberg

NATGAS gained at the start of a new week and reached the upper limit of the upward channel. NATGAS jumped last week due to contract rollover but price continued to move higher later on and broke above a previous local high. NATGAS launched today's trading higher but the bullish price gap has been almost completely filled already. Performance of natural gas ETF NGAS.UK is also of note as it takes into account negative impact of swaps. In this case we have also seen a break above a recent trading range. Should we see a break below $2.80 and a 78.6% retracement, one cannot rule out an attempt to fill post-rollover gap near 61.8% retracement.

Source: xStation5

Oil Under Pressure as G7 Decision Remains Pending

US Open: Oil too expensive for Wall Street!

OIL: Prices soar to $120 a barrel; Israel bombs Iran's oil facilities 📌

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher