US natural gas prices (NATGAS) launched a new week's trading with a bullish price gap. NATGAS currently trades around 2% higher on the day. An uptick in natural gas prices seems to be driven by an overall improvement in risk sentiment as well as some more commodity-specific news. Namely, it was reported that workers at Chevron's LNG plant in Australia voted in favor of a potential strike action. Workers at Chevron's Gorgon LNG facility as well as Wheatstone downstream processing facility voted in favor of strikes last week. However, it should be noted that votes give workers a mandate but not an obligation to go on a strike. Chevron said that while it continues to negotiate with employees, it expects minor disruptions in output.

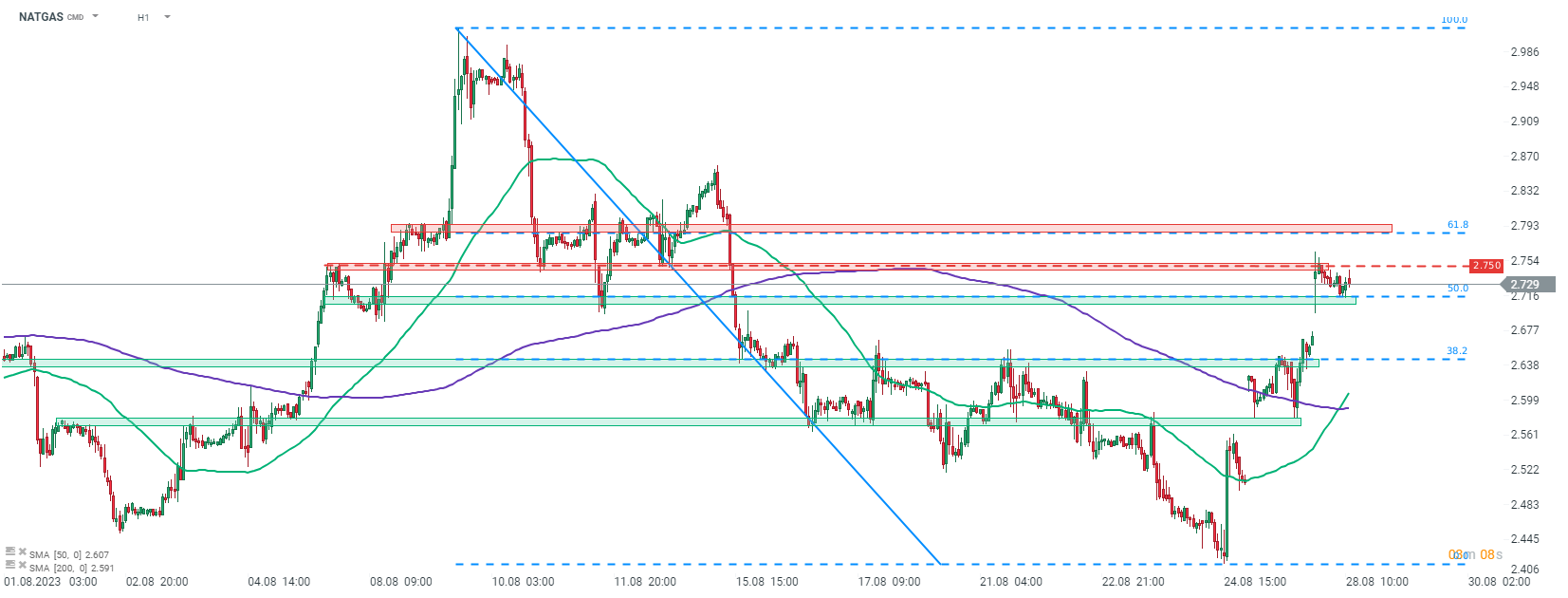

Taking a look at NATGAS chart at H1 interval, we can see that the price launched today's trading with a bullish price gap and continued to move higher later on. However, gains were halted after $2.75 swing area was reached and bears started to take over later on. While NATGAS has trimmed part of gains, it has found support at 50% retracement of the downward move launched at the beginning of August.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30