The US contract gas price is up 6%, while the spot price is even up nearly 10%. Prices in Europe are rising by 4-5%, while in the UK there is a price jump of up to 15%. This is a result of recent expectations of increased gas demand in the coming weeks and months. The UK weather bureau indicates that temperatures this winter in the British Isles will be cooler than usual.

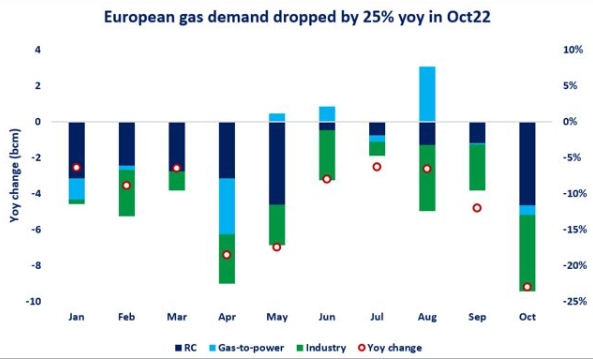

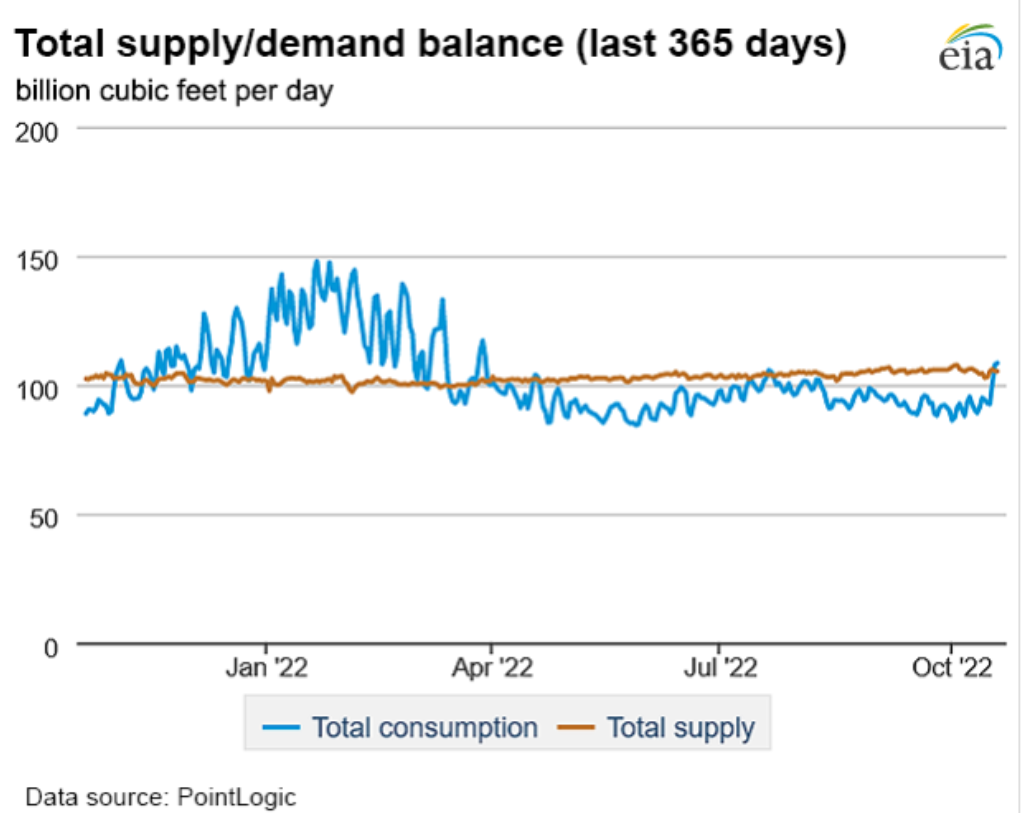

In addition, last weekend's data showed that the actual heating season may have begun. Gas consumption exceeded the supply supplied to the system, which may indicate that the weekly drop in stocks will begin soon. On the other hand, IEA data show that gas demand in October in Europe was more than 20% lower than a year ago. However, this is largely the result of lower consumption by businesses, which in turn is a sign of reduced economic activity.

Gas demand in the US exceeded the available supply supplied to the system over the weekend. The heating season is starting in the US. Source: EIA

Gas demand in the US exceeded the available supply supplied to the system over the weekend. The heating season is starting in the US. Source: EIA

Gas in the US is starting a strong rebound, finding its highest since mid-October. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?