Natural gas futures are rallying, gaining 4% as a cold snap across the United States fuels a surge in demand. Gas consumption is projected to average 124.2 billion cubic feet per day (bcfd) on Wednesday, marking an 18.6% year-over-year (YoY) increase. This demand surge contrasts with production figures of 100.7 bcfd, down 6.7% YoY. Pipeline exports to Mexico saw a slight uptick, while LNG exports experienced a decline.

The Energy Information Administration (EIA) released its weekly natural gas storage report, revealing a 40 bcf withdrawal, slightly exceeding market expectations of 39 bcf. This compares to a previous week's withdrawal of 116 bcf and a five-year average decline of 93 bcf. The report's release was brought forward due to Thursday's national day of mourning for former President Jimmy Carter.

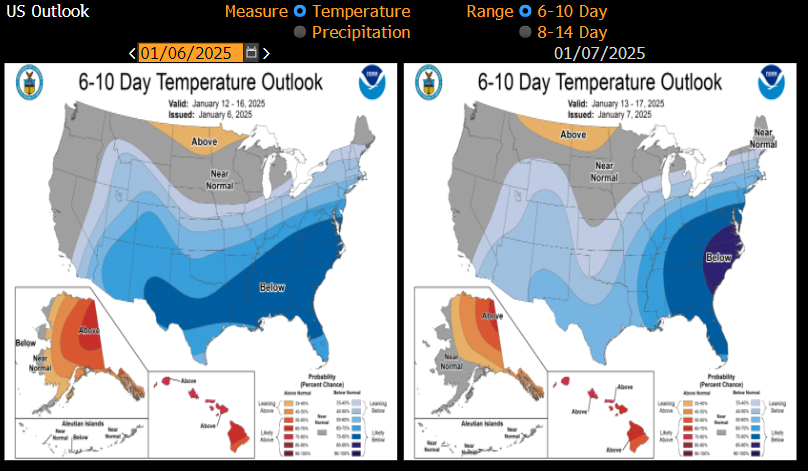

The combination of heightened demand and curtailed production due to freezing temperatures is placing significant strain on supply. Extreme cold can lead to infrastructure disruptions and pipeline freeze-offs, further impacting output. Weather forecasts for the next 6-10 days indicate a continuation of below-average temperatures across key consumption regions. At the current burn rate, analysts project potential storage withdrawals of 200-300 bcf for the current week, to be reported next week.

Front-month natural gas futures tested the $3.6/MMBTU level today, following a breach of the $4.0/MMBTU threshold at the turn of the year. Prices have encountered resistance at the 23.6% Fibonacci retracement level but remain supported above key moving averages (14-day and 50-day), suggesting underlying bullish sentiment.

Daily summary: Precious metals madness 🚨SILVER breaks through $101 and rises 5%❗

Cocoa crashes 7% 📉

Market overview: PMI shapes European markets🚨

Silver surged 40% in January moving toward $100 per ounce📈