Nvidia (NVDA.US) shares are trading down more than 1% ahead of the U.S. market open after executives at UXL, which is backed by Intel (INTC.US), Alphabet (GOOGL.US) and Qualcomm (QCOM.US), told Reuters that they are in the process of preparing technical specifications for AI software to compete with Nvidia's AI services, later in the first half of 2024. Executives from the three US giants have indicated that the obvious goal is to fight market dominance and take market share away from UXL technology. The announcement may signal a bit more caution on Wall Street, and while the AI market appears to be huge, concern about maintaining huge margins may put some short-term pressure on Nvidia's stock.

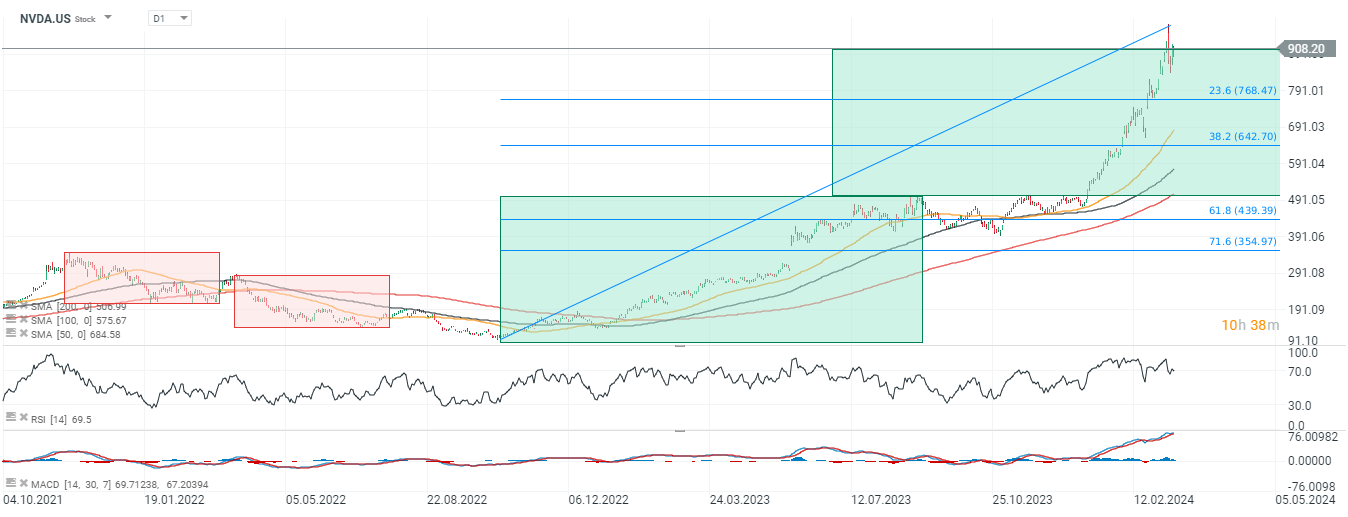

Nvidia shares (D1 interval)

Looking at the magnitude of the recent upward impulse, we see that it was slightly larger than the previous upward movement, but it seems that the scenario of consolidation after strong increases may continue. The first significant resistance is the level around $770, where we see the 23.6 Fibonacci retracement of the 2022 upward wave.

Source: xStation5

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street