Summary:

- Price growth in the third quarter slowed down, though a deceleration was a touch smaller than expected

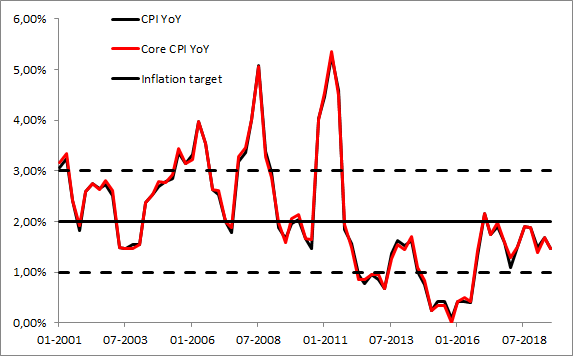

- Core prices keep hovering slightly below the midpoint of the RBNZ’s target

- RBNZ’s Bascand signals more rate cuts could be needed

New Zealand’s inflation kept losing momentum during the third quarter slowing to 1.5% from 1.7% in annual terms, the result turned out to be a bit better than expected though as the consensus had called for a 1.4% YoYo pick-up. In quarterly terms, price growth remained unchanged at 0.6%. Although the outcome proved to be stronger than the RBNZ predicted in August (1.5% vs. 1.3% expected by the central bank), it does not mean any rapid change in monetary policy there. Moreover, the NZ economy could even require more monetary accommodation going forward, as a RBNZ’s member Bascand said on Wednesday. Let us recall that the RBNZ does not expect to reach its inflation target until late 2021, as per August forecasts. Other details showed that tradable price fell 0.7% from a year earlier mainly due to cheaper fuel, while non-tradable prices increased 3.2% in annual terms, reaching its highest pace since 2011. Taking into account a current stance of the NZ central bank it is hard to envisage any more sustained rally in the NZ dollar in the foreseeable future.

Price growth in New Zealand remains lacklustre suggesting the currency may not already be out of the woods. Source: Macrobond, XTB

Price growth in New Zealand remains lacklustre suggesting the currency may not already be out of the woods. Source: Macrobond, XTB

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸