- RBNZ unexpectedly cuts the OCR by 50 basis points to 2.50%

- Significant demand gap after a larger-than-expected GDP decline in Q2 2025

- Monetary Policy Committee remains open to further cuts if needed

- RBNZ unexpectedly cuts the OCR by 50 basis points to 2.50%

- Significant demand gap after a larger-than-expected GDP decline in Q2 2025

- Monetary Policy Committee remains open to further cuts if needed

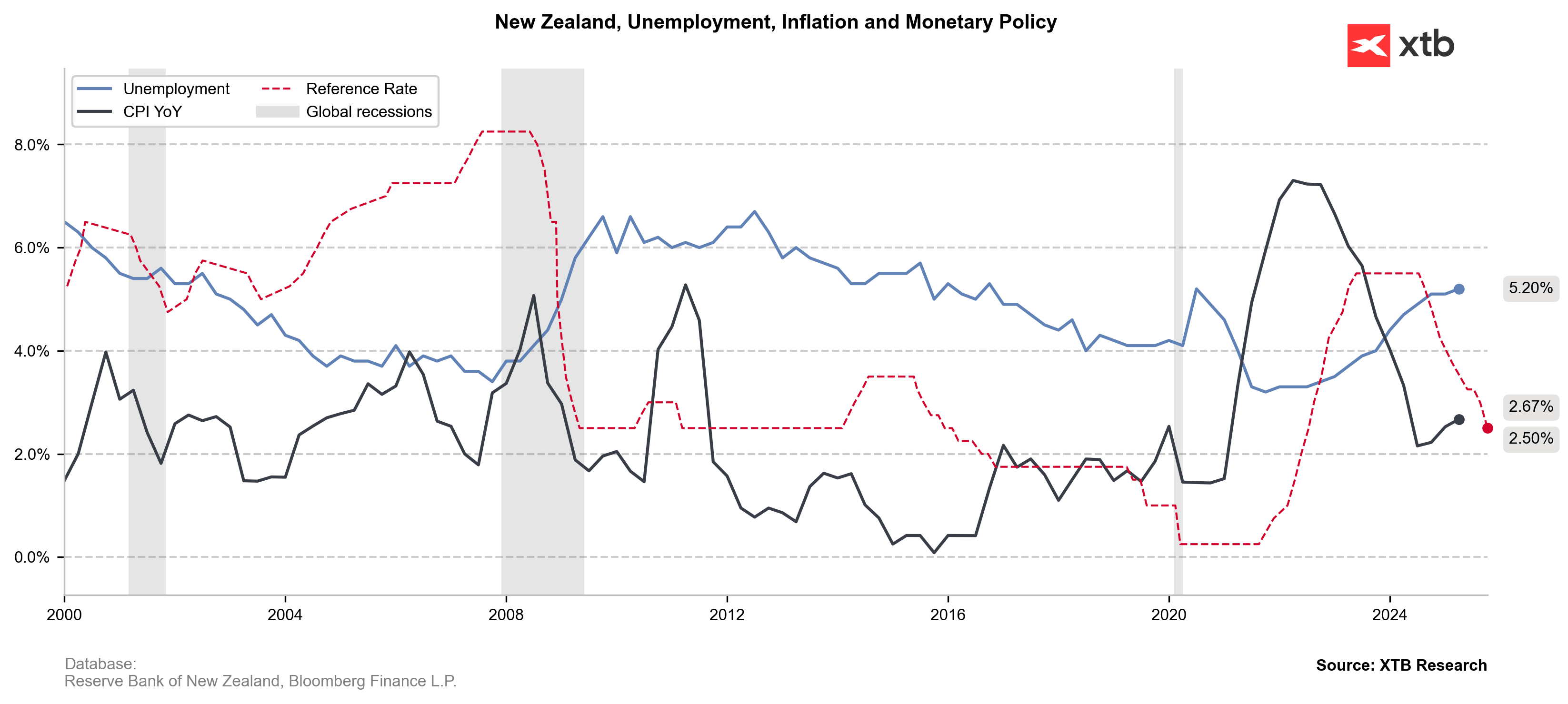

The Reserve Bank of New Zealand (RBNZ) delivered a larger-than-expected 50 bp rate cut, bringing the Official Cash Rate (OCR) down to 2.50% in response to weaker economic growth and a widening demand gap. The Committee noted that domestic inflationary pressures are easing. Core inflation excluding administered prices is consistent with the target, even though headline CPI remains near the upper end of the 1–3% band. Moreover, CPI inflation likely stood around 3.0% in Q3 2025, driven by higher food and regulated service prices. With clear excess capacity in the economy and a stronger policy transmission (lower wholesale, mortgage, and corporate lending rates), the Bank expects inflation to move toward 2% in the first half of 2026.

Unemployment remains worryingly high and, according to the RBNZ Board, poses a greater risk than CPI inflation staying near the upper bound of the Bank’s tolerance range.

RBNZ stance

Ultimately, a majority of members concluded that a 50 bp cut was justified to counter a prolonged demand gap and support economic activity. The Bank left the door open for further monetary easing if conditions warrant.

Macroeconomic situation according to the RBNZ

Macro indicators remain mixed but lean to the weaker side. GDP in Q2 2025 contracted -0.9% QoQ versus expectations for a -0.3% decline (partly due to seasonal factors). Supply constraints — including energy shortages, weather impacts on agriculture, and industrial bottlenecks — have curbed production. Domestically, housing prices are stable, while residential and business investment remain weak, although lower interest rates are beginning to support household spending and should gradually reduce debt-servicing costs.

Market reaction

Markets immediately priced in a more dovish outlook. The New Zealand dollar is the weakest G10 currency today, falling between 0.6% and 1.0%. NZDUSD dropped to a 6-month low, down 1.00% to 0.5740 USD. Swaps now fully price another 25 bp cut in November (to 2.25%) and assign a significant probability to a 2.00% terminal rate.

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths