US100 futures are up about 1.5% today before the U.S. market open, recovering part of the recent losses amid improving sentiment around the ongoing U.S. government shutdown.

- Recent Senate votes have brought the passage of a temporary funding package closer. The market interprets this as a genuine step toward ending the more than 40-day government shutdown, even if the legislative process is not yet fully completed.

- In this environment, investors prefer to be “early rather than late,” already pricing in a scenario of government reopening and a return to greater fiscal predictability, which supports U.S. asset valuations.

- Additional fuel for the rebound comes from reports that China has temporarily suspended some export restrictions on rare earth metals.

- This trend is further reinforced by very strong data from TSMC. Record revenues are reassuring the market about the durability of demand driven by artificial intelligence development, which remains a key engine of growth on Wall Street.

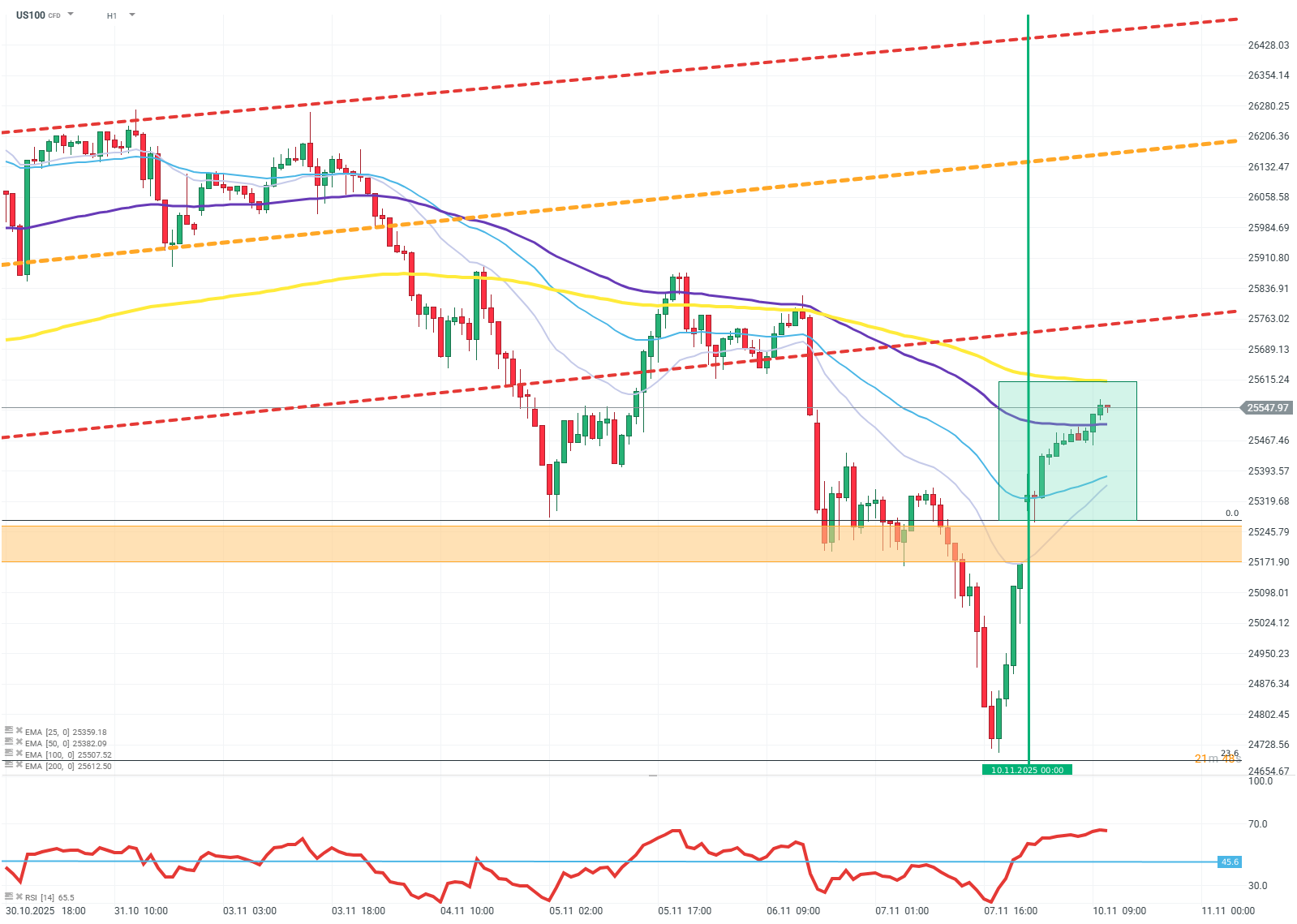

US100 (H1)

Source: xStation5

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

US OPEN: War in Iran hits the markets

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings