The OPEC organization, which brings together the largest oil producers to control prices, has published its monthly report, and oil prices fell by more than 1% following the publication.

The organization points to the continuation of several trends regarding oil production and consumption worldwide.

Demand for oil continues to grow, but the growth rate is increasingly slowing down.

- By the end of 2025, it is expected to reach 105.1 million barrels of oil per day, and in 2026, it is expected to average as much as 106.5 million barrels of oil per day.

The growth is primarily visible among non-OECD countries, while the demand for oil in developed countries remains stable at 46 million barrels.

In terms of product breakdown, LPG gas is the leader in growth, followed by gasoline and so-called light oil distillates. Diesel shows meager growth, and the demand for heavy distillates is declining in nominal terms.

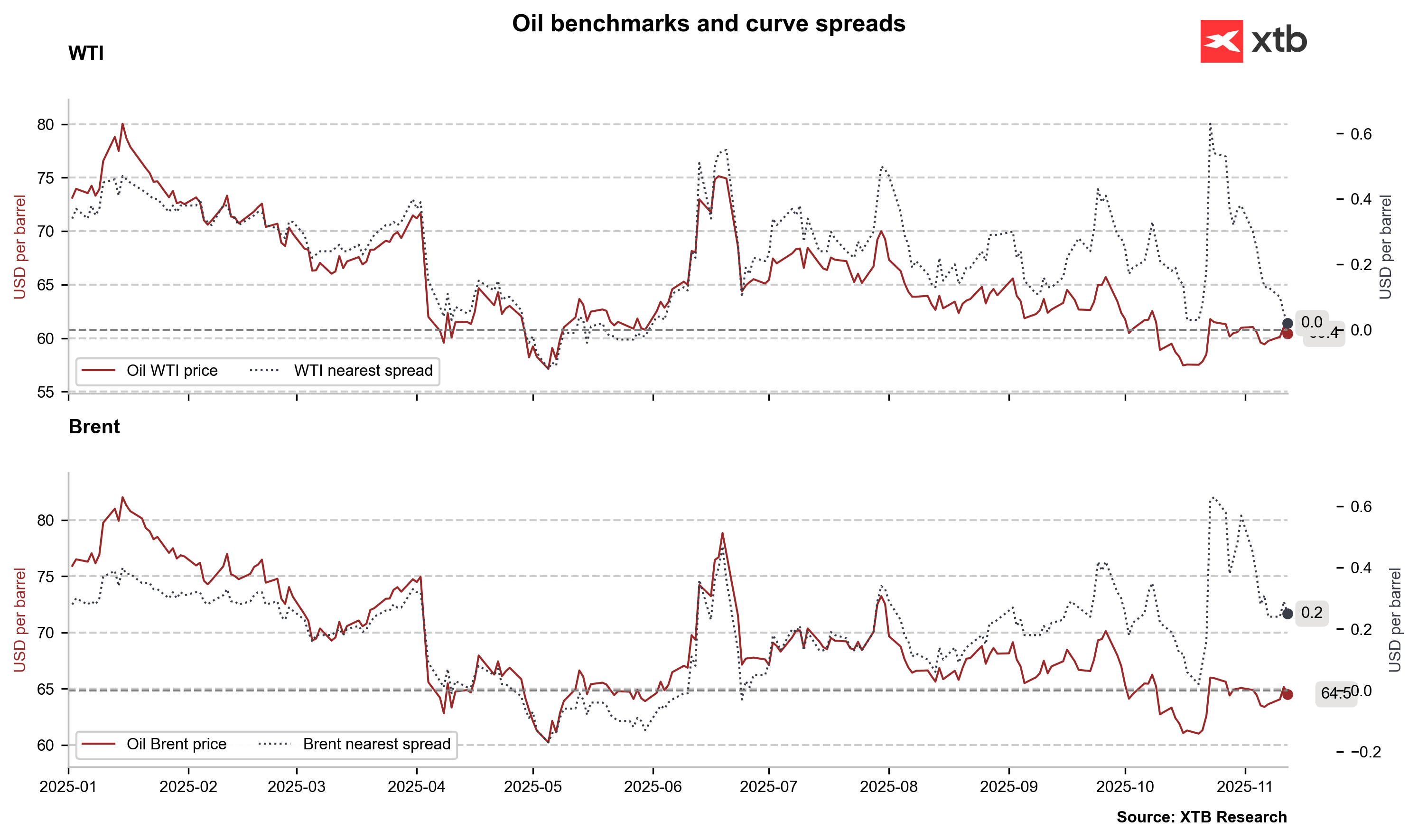

In the futures market, the number of net long positions on WTI oil continues to decline and remains at local lows. Much larger net long positioning can be observed on Brent oil.

Looking at the prices of oil varieties, the biggest losses are recorded by Zafario oil from Guinea and Ural oil from Russia.

OPEC is optimistic about the economic development forecasts worldwide in 2026.

- The organization expects an average growth of 3.1%, with India and China being the leaders in growth. OPEC also forecasts an improvement in the economic situation in the USA, a stable situation in Europe, and further slowdown in Russia.

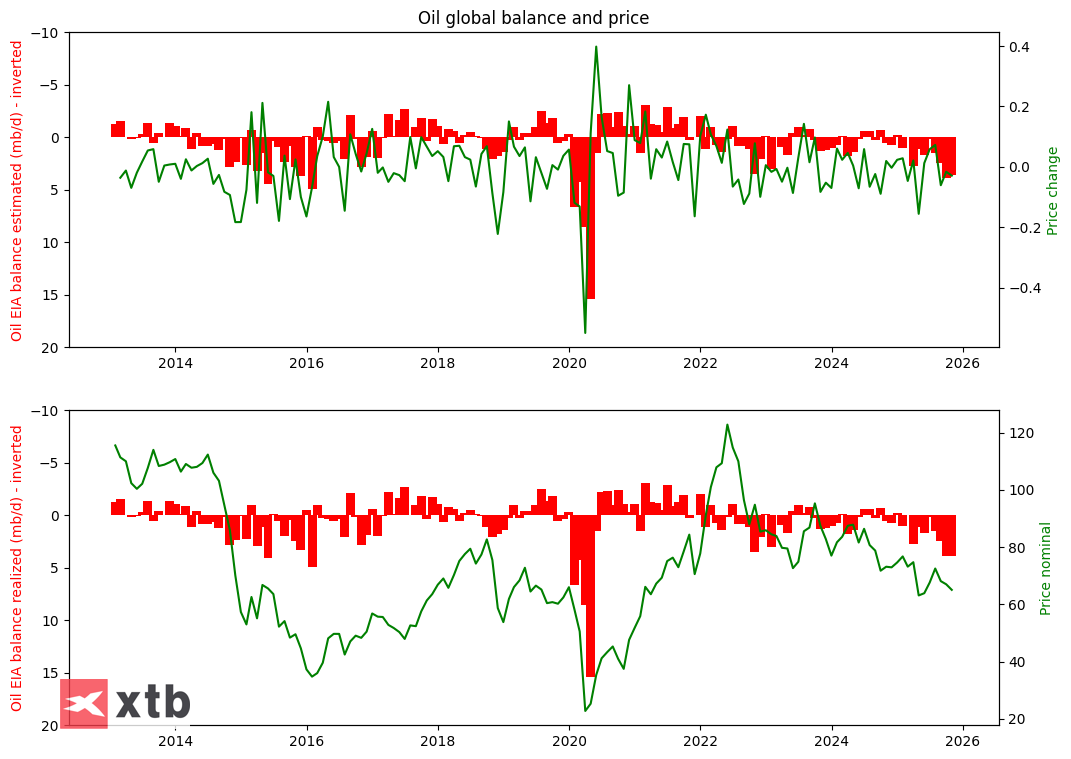

The most important part of the report in the context of the current market situation is the supply side of oil. OPEC points to significant and stable growth in oil production in non-OPEC countries.

The leader in the ranking is the USA, with an average production increase of 22.07 million barrels of oil in 2025, which represents an increase of about 300,000 barrels.

However, production is expected to slightly decline in Q4-2025. Significant increases are also registered in Latin America, mainly Brazil and Argentina.

OIL.WTI (H1)

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)