Oil price tumbled on Wednesday, extending a recent sell-off after OPEC members and their allies failed to reach an agreement on the output strategy for 2022 with no new meeting planned. Today's situation worsened after the United Arab Emirates reportedly threatened to open up the spigot and start pumping more oil into the marketplace in order to diversify its economy.

Meanwhile US EIA reduced its forecast for 2021 global oil demand growth by 80K bpd and now sees 5.33 mbpd increase this year. When it comes to next year, EIA increased its forecast by 80K bpd and now expects 3.72m bpd increase. On the data front, API report is expected to show a seventh straight week of declines in US crude inventories.

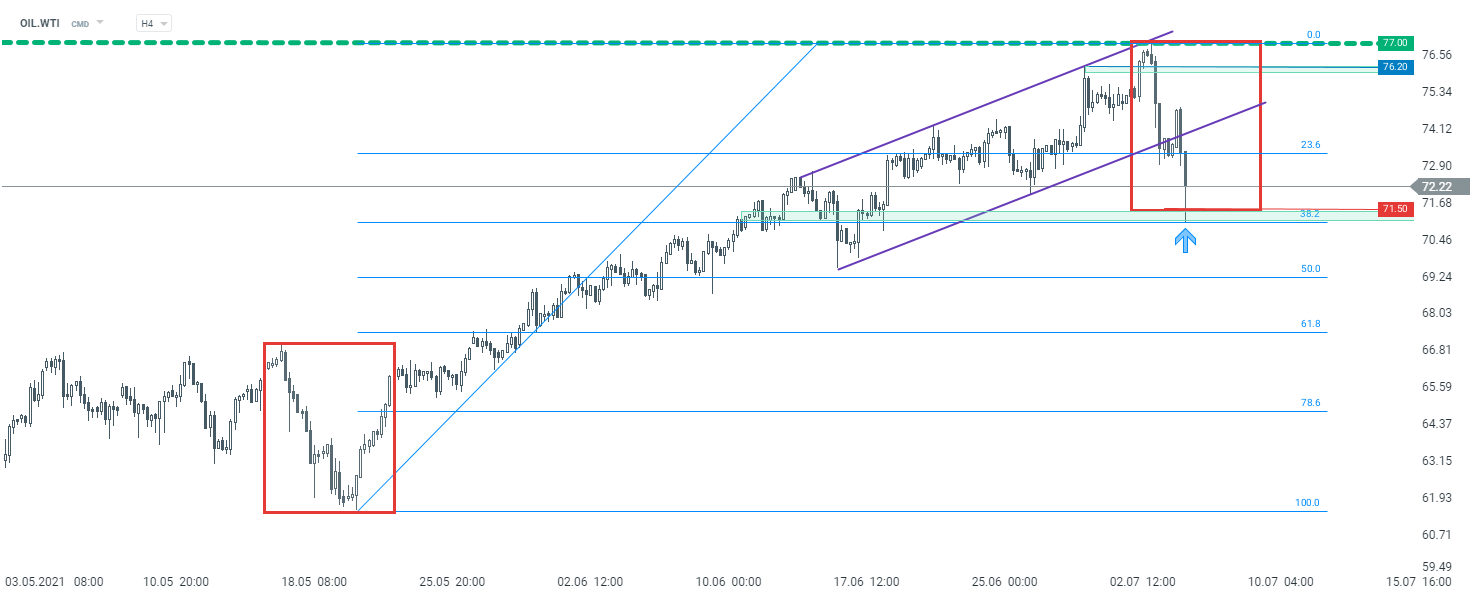

OIL.WTI price broke below the lower limit of the upward channel, and then the downward movement accelerated. However, the declines stopped around the major support at $71.50, which is marked with the lower limit of the 1: 1 structure and 38.2% Fibonacci retracement of the last upward wave. Source: xStation5

OIL.WTI price broke below the lower limit of the upward channel, and then the downward movement accelerated. However, the declines stopped around the major support at $71.50, which is marked with the lower limit of the 1: 1 structure and 38.2% Fibonacci retracement of the last upward wave. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

NATGAS muted amid EIA inventories change report