WTI oil price dropped over 2.5% extending declines from recent high of $93 amid strengthening greenback and global demand concerns. USD continues to appreciate as markets believe that the Fed will push ahead with its aggressive tightening plans, making dollar-priced oil more expensive for buyers holding other currencies. Meanwhile, rising numbers of covid cases in major Chinese cities forced local authorities to announce stricter testing until mid-November and significantly increasing worries that the world’s second largest oil consumer could face fresh lockdowns. Moreover rising concerns over global slowdown put additional pressure on oil price. Yesterday World Bank President David Malpass and International Monetary Fund Managing Director Kristalina Georgieva pointed to the growing risk of global recession and said that inflation remains a continuing problem. Still, last week OPEC+ decision to lower production and an ongoing energy standoff between Russia and the West still provide support for buyers. It is also worth noting that oil stockpiles around the world, and above all in the USA (including strategic reserves), are at extremely low levels.

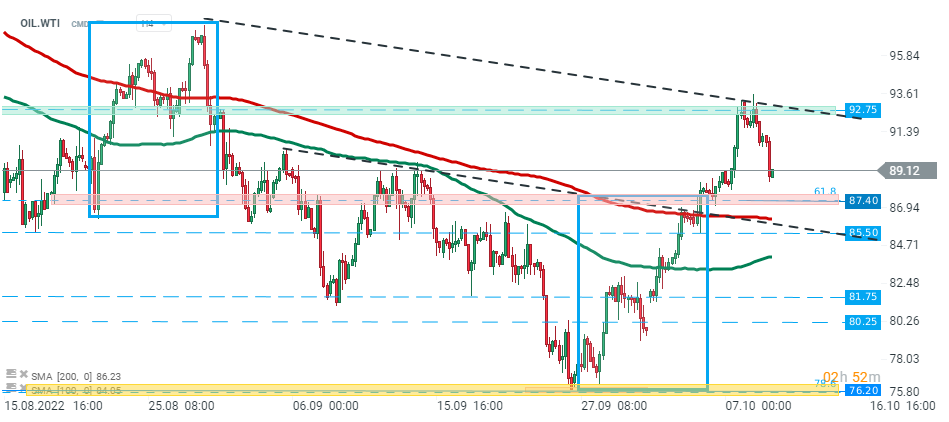

OIL.WTI pulled back sharply today after buyers failed to break above major resistance at $92.75, which is marked with previous price reactions and downward trendline. If current sentiment prevails, support at $87.40 may be at risk. This level coincides with 61.8% Fibonacci retracement of the upward wave launched in December 2021. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉