Shares of dental and veterinary company Patterson (PDCO.US) are trading on a rally today as the company beat analysts' forecasts and reported a net growth rate on revenue growth, indicating that it has improved business margins despite a challenging environment in the US. The market expected a y/y decline in earnings per share, this one surprised with a 20% increase.

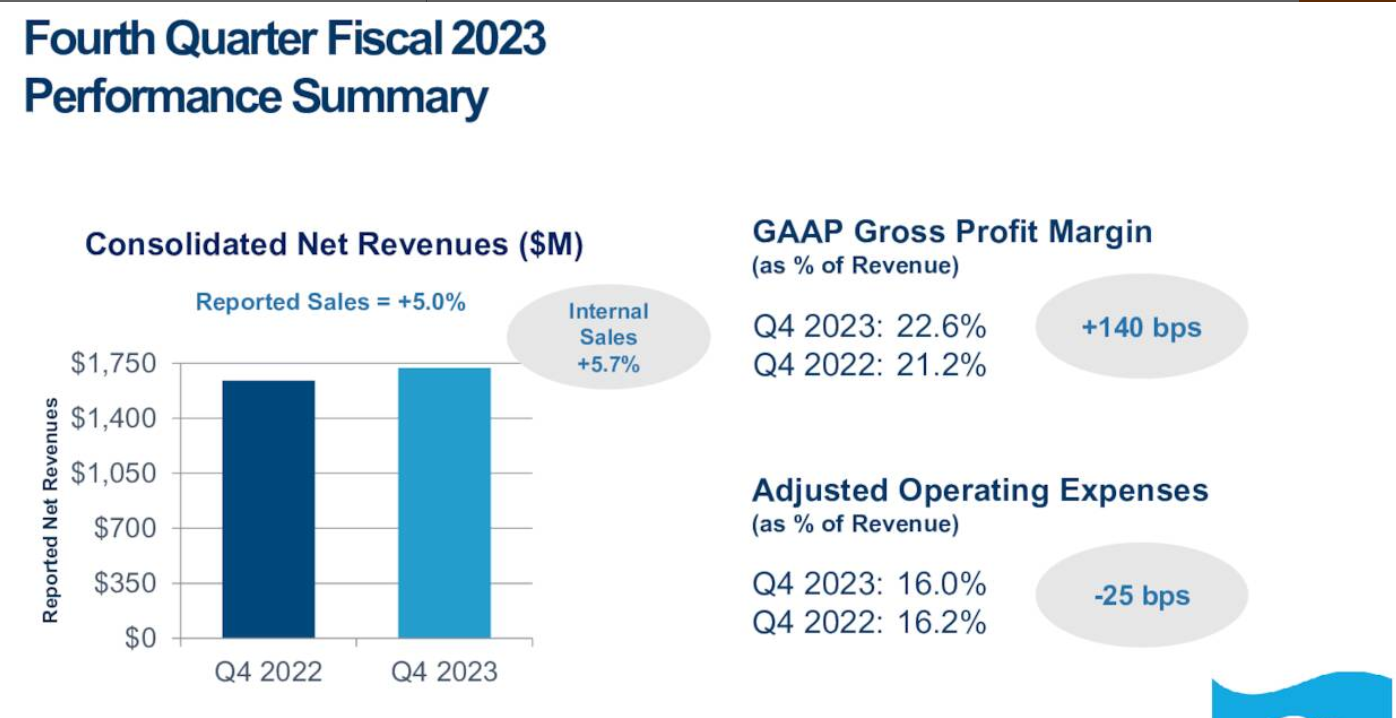

Revenue: $1.72 billion vs. $1.71 billion forecast, $61 million above consensus ($1.64 billion a year ago)

Earnings per share: $0.84 vs. SD 0.70 forecasts ($0.71 a year ago)

The company said it repurchased 1.5 million shares during the fourth quarter of fiscal 2023 and decided to pay $0.26 in quarterly dividends to shareholders (over $25 million). At the same time, the company's free cash flow fell from $194 million to $180 million.

The company's operating expenses fell, margins and consolidated net income increased. Source: Patterson Earnings Report

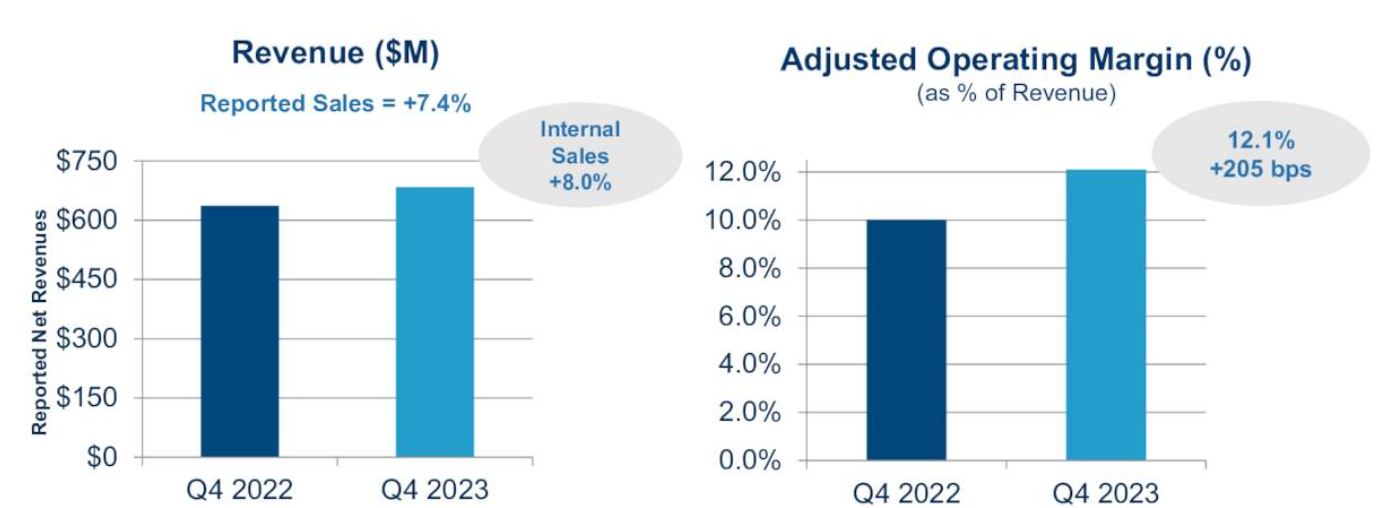

International sales rose 8% y/y with 12.1% operating margins (up more than 2% y/y). Source: Patterson Earnings Report

Patterson (PDCO.US) shares rose today above long-term resistances near the SMA100 and SMA200 (red and black lines). A retest of $38 per share, the local highs of 2021, may become possible.Source: xStation5

Nvidia expands into software AI sector? Wired reports on NemoClaw

Market Wrap: Energy Stocks Retreat as Hopes for End to Iran War Grow 🌍 (10.03.2026)

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster