Peloton (PTON.US) shares fell more than 13% after the company decided to voluntarily recall two treadmill machines for safety reasons. Reports of several injuries and one death have been attributed to the products. Consumers are advised to immediately stop using the aforementioned products and contact exercise equipment company for a full refund or other qualified remedy. Company is working on a repair that will be offered to treadmill owners in the coming weeks.

"I want to be clear, Peloton made a mistake in our initial response to the Consumer Product Safety Commission’s request that we recall the Tread+. We should have engaged more productively with them from the outset. For that, I apologize," Peloton Chief Executive Officer John Foley said in a statement. "Today’s announcement reflects our recognition that, by working closely with the CPSC, we can increase safety awareness for our Members."

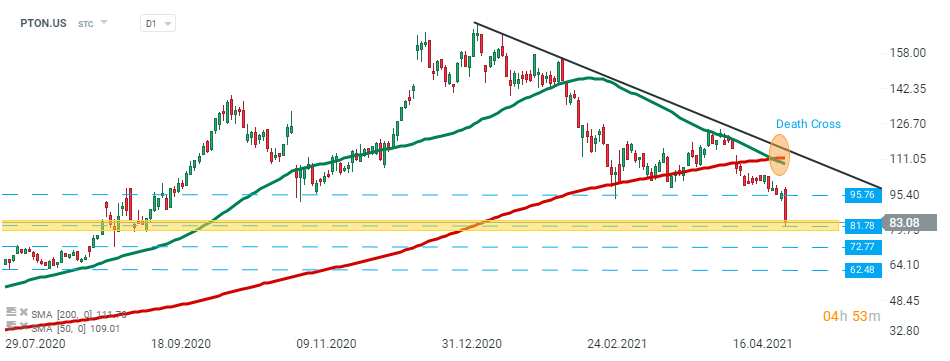

Peloton (PTON.US) stock fell sharply during today’s session and reached a level not seen since September 2020. If the current sentiment prevails downward move may be extended to the $72.77 or even $62.48 level. Also recently medium-term 50-day SMA (green line) crossed under the long-term 200-day SMA (red line). This has formed a ‘death cross’ formation which additionally supports bearish scenario. However if buyers manage to halt declines at $81.78 support then upward impulse towards local resistance at $95.76 could be launched. Source: xStation5

Peloton (PTON.US) stock fell sharply during today’s session and reached a level not seen since September 2020. If the current sentiment prevails downward move may be extended to the $72.77 or even $62.48 level. Also recently medium-term 50-day SMA (green line) crossed under the long-term 200-day SMA (red line). This has formed a ‘death cross’ formation which additionally supports bearish scenario. However if buyers manage to halt declines at $81.78 support then upward impulse towards local resistance at $95.76 could be launched. Source: xStation5

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals