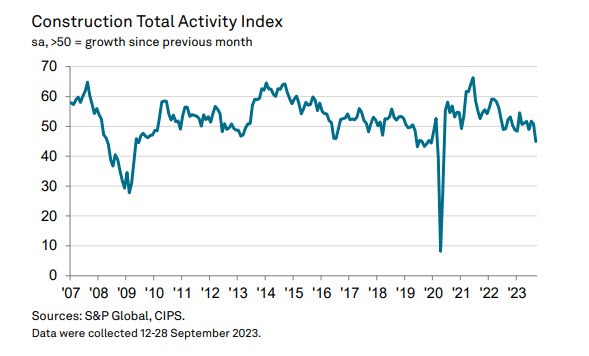

The UK's construction PMI reading came in well below forecasts at 45 versus 49.9 forecasts and 50.8. The downturn came from a slump in housing construction. Manufacturing also recorded the steepest decline since May 2020. New orders also recorded the fastest decline in more than three years. previously.

S&P Commentary

- September's downturn marked the worst overall performance since the early stages of the 2020 pandemic. Construction frms widely commented on cuts in new development projects due to weak demand and rising borrowing costs.

- Concerns about the outlook for the domestic economy curbed customer spending in September, contributing to the fastest decline in new commercial building completions since January 2021.

- Forward-looking indicators in the survey once again remained relatively pessimistic, with orders falling at an accelerated pace. Expectations for business activity fell to the lowest level ever this year.

- Fewer project starts meant that the availability of subcontractors increased at the highest rate since the summer of 2009. Lower demand across the supply chain contributed to a significant improvement in delivery times for construction products and materials, as well as a stabilization of purchasing costs in September.

Source: S&P Global, CIPS

Despite a devastatingly weaker-than-forecast reading (analysts had anticipated a very slight weakening), shares of one of the UK's largest property development and construction companies, specializing in house building Persimmon (PSN.UK), are gaining nearly 1.5% and attempting to stem the recent dynamic sell-off at the lower boundary of the symmetrical triangle formation. We can relate the increases more to 'selling the news'. At the same time, however, the macro environment in the UK, according to the 'Construction PMI' reading, is not positive for the momentum of the property development sector, and thus shares may still extend the downward trend. If the rebound proves unsustainable, a potential breakout from the bottom of the triangle formation could result in a dynamic sell-off. Key support is currently located around GBP 10 per share.

Source: xStation5

Nebius shares surge 10% amid Nvidia $2 bln investment 📈

BREAKING: EURUSD muted after stable US CPI report 🇺🇸 📌

Market Wrap: Market awaits Middle East resolution and US CPI🕞

Economic calendar: US CPI inflation the key release 🔎