Brexit talks going are to the wire as the Article 50 deadline of 29th March is drawing ever nearer and there’s still no clear indication of what the ultimate outcome will be. The UK Parliament is scheduled to hold another meaningful vote on PM May’s Brexit deal tomorrow (Tuesday) and this could well be a key event for the pound.

Summary:

-

Parliamentary vote will likely see another defeat for May;

-

Loss would pave the way for UK to seek Article 50 extension

-

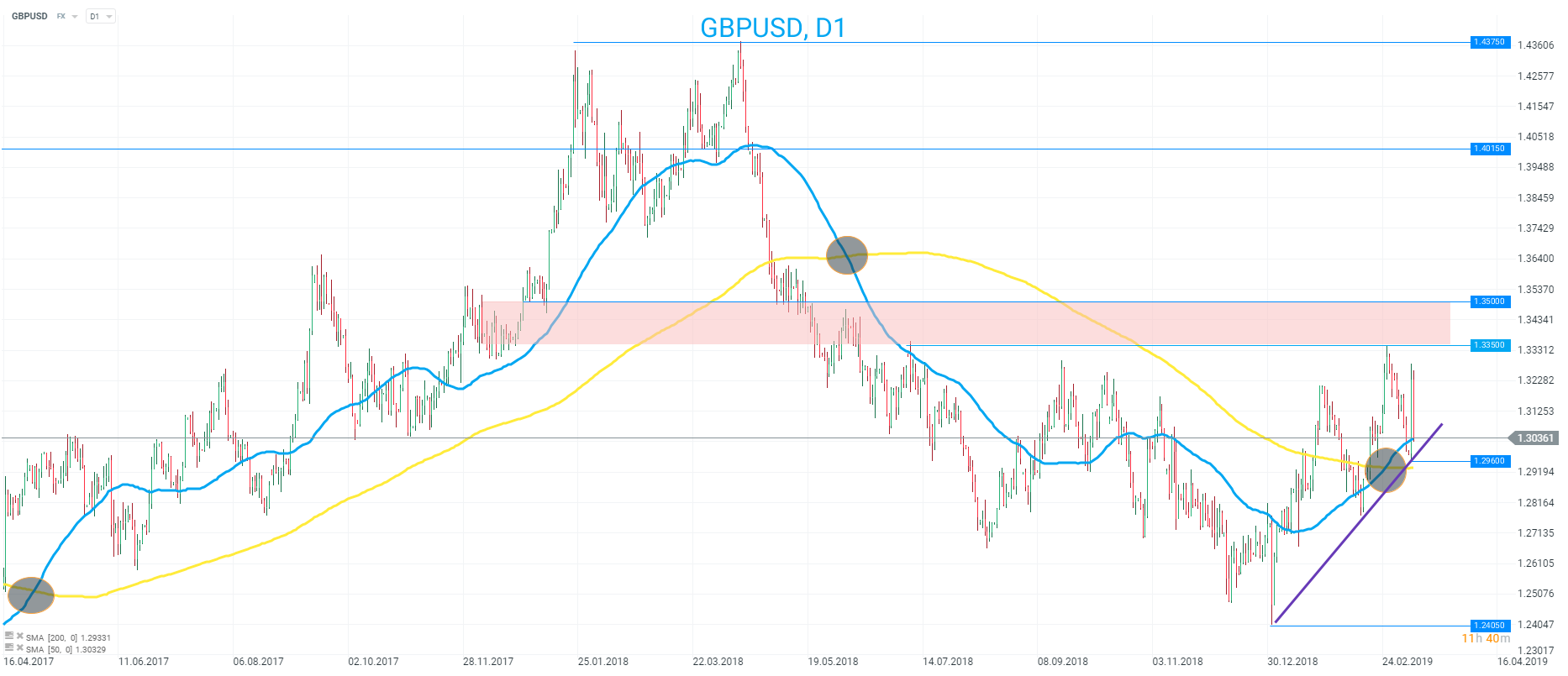

Golden cross printed on GBPUSD

There’s still elevated levels of uncertainty around what will actually happen with the PM having a history of cancelling these votes, but it can be broadly split into three main scenarios:

Scenario 1: May loses vote heavily (Margin of 100+)

Assuming that there’s no backing down at the 11th hour and the vote this evening goes ahead, it is widely expected to be another defeat for PM May. The deal brought to the table does mark an improvement on the one presented back in January when the government suffered its heaviest ever defeat in parliament by a margin of 230 seats, but many believe this won’t be enough to swing the requisite number of votes. Several backers of May still predict a 3-figure defeat and this would then trigger the further two votes; firstly on whether to halt a no-deal exit and if that is approved then on whether or not to seek an Article 50 extension.

Parliament has already voted in favour of avoiding a no-deal (in a non-legally binding amendment), and therefore would be expected to do so again, which would likely mean MPs also backing an extension to Article 50 - If parliament reject both May’s deal and no-deal there isn’t enough time to construct and alternative before March 29th. There is no scheduled time for these subsequent two votes but they are set to be carried out before Thursday - likely Wednesday evening.

Despite PM May’s Brexit deal suffering the heaviest ever defeat for government in parliament (230 vote margin) back in January the pound rallied in response, with investors seemingly seeing this as an indication that a softer Brexit outcome was more likely. Source: xStation

Scenario 2: May loses vote narrowly (less than 100)

News late last night that the PM has managed to secure last-minute concessions from the EU following a meeting with Juncker have raised hopes, but a ruling from Attorney General Geoffrey Cox that these aren’t legally binding has taken the shine off the apparent breakthrough. Of the 230 votes that comprised the losing margin in January, 118 were Tory MPs and all 10 DUP MPs voted against it. Due to parliamentary arithmetic meaning only 116 votes need to flip for it to pass, this could well be a closer run thing. Should this occur the PM could well take heart and believe that another attempt closerstill to the March 29th deadline would be successful - especially with the threat of no deal looming large.

Scenario 3: Vote gets pulled at the last minute

Despite further assurance on Monday, there is still a chance that the PM chooses to cancel this meaningful vote and seek further concessions from the EU - as she did back in December. There’s several reports that May doesn’t have the support of her cabinet and rumours that resignations of her closest ministers could occur should she press ahead with the vote. This would likely make her increasingly precarious position as PM even more in doubt and could well lead to her being replaced. Her replacement would almost certainly be a harder Brexiteer and this would see the chances of a no-deal Brexit increase significantly. This second scenario contains fair higher levels of uncertainty and may actually be seen to cause larger moves in the pound.

Technical overview - GBPUSD

Due to the high levels of uncertainty as to what will happen next it’s not too surprising that the the technical outlook for GBPUSD is a little muddled. The pair printed a bearish engulfing candle on W1 last time out and price has now fallen back below the $1.30 handle after the market hit an 8-month high just a couple of weeks ago. Bulls will point to a golden cross between the 50 and 200 day SMA as a sign that the long term trend has turned higher and also be looking for a rising trendline from the low of 1.2405 seen at the start of the year to provide support. However, in the near-term the market will likely be very much driven by the latest developments on the Brexit front and therefore traders would be wise to keep a close eye on these upcoming votes and the subsequent market reaction.

Some recent weakness in the pound has seen the GBPUSD pair fall back to the $1.30 mark but a golden cross and rising trendline could still give support to the bull’s view. Source: xStation