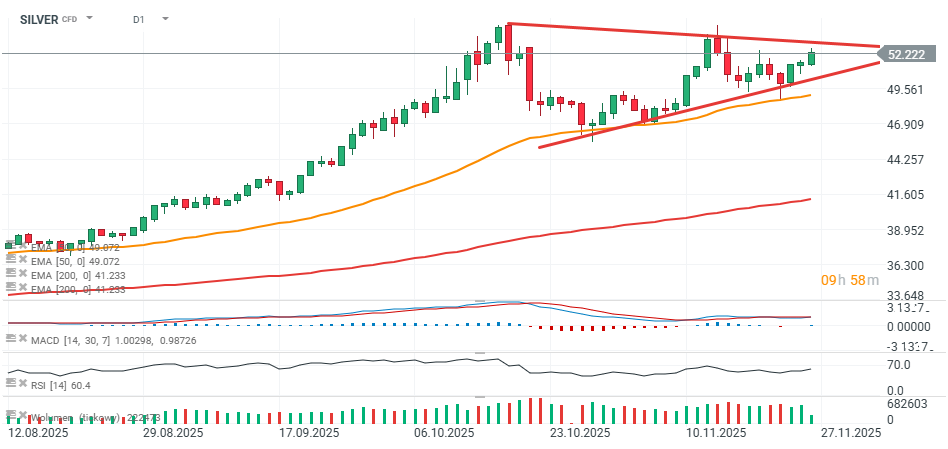

Silver has been gaining recently, mainly driven by rising expectations for a Federal Reserve rate cut in December and dollar weakness. The price climbed above $52 per ounce, recovering losses after dropping below $46 in October. Looking at the RSI, we can see that despite the solid rebound, the reading around 60 does not indicate excessive euphoria, which — together with a positive MACD outlook — suggests potential for further upside.

Importantly, the price has built strong support around $46 per ounce. At the same time, we observe a pattern of higher lows forming. Silver prices appear to be moving within a triangle formation, where the key zone could turn out to be the $53 level. If the price fails to break above this area, a dynamic return to declines may follow. However, if the price rises above it, this would represent a textbook breakout from a bullish formation. In such a scenario, the price could resume its move toward historical highs around $54.5 and potentially surpass them if optimism around U.S. rate cuts persists and “anti-dollar” sentiment remains strong.

On the other hand, it is important to note that silver has been very volatile lately, and any change in U.S. bond yields or interest rate expectations could significantly affect the trend — in both directions.

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)