Today we can see that futures on silver are rising more than 3.5% and we can see the reason of that in some 'dovish' data and market climate. Yesterday Bank of Canada, today European Central Bank and Danmarks National bank eased policy by slightly cutting rates. Those decisions were awaited, but the situation is looking more dovish, as also the US Federal Reserve may see some dovish pressure amid weaker US job market data.

- Today US jobless claims came in higher than expected (229k vs 220k exp. and 219 k. previously), while US job costs were also revised lower to 4% vs 4.9% in first reading and 4.7% previously. This week, also ADP report came in weaker than expected and JOLTS data came in the lowest level since 2021 signalling dropping free vacancies in US economy.

- According to IMF, Federal Reserve should be very a cautious and data-dependent approach to cutting rates, as US labour market is slowing. Tomorrow, market will know the most important job market data (Non-Farm Payrolls), which will probably increase volatility in both, silver and US dollar at 1:30 PM BST. To sum up, US labour market shows some weakness and oil prices are dropping, which may be a signal for the Fed to think about a small rates cut; maybe in the beginning of autumn.

More pressure on the dovish 'Fed pivot' may help speculative rally of US dollar negative correlated assets such as gold, silver or Bitcoin. Bitcoin also gains today, climbing to $71.500 level.

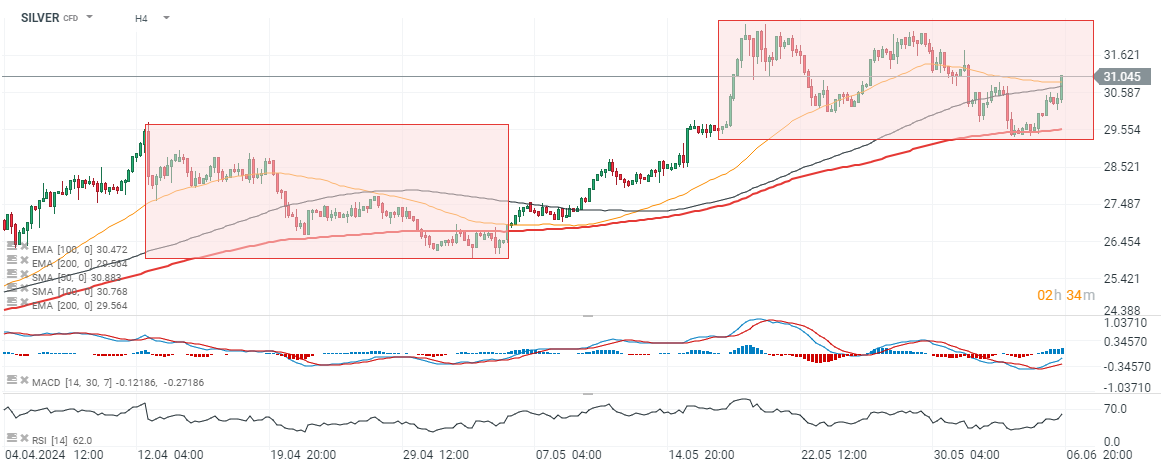

SILVER (H4 interval)

USDIDX vs SILVER (golden chart)

USDIDX vs SILVER (golden chart)

Source: xStation5

Source: xStation5

Economic calendar: US CPI in the spotlight (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause