Silver continues its strong rebound for the second week in a row and is on track to close above $30 per ounce barrier, the highest point since February 2013. Metals continue to rise, despite China's mixed data, although at the same time the promise of more support for consumers and the real estate market is creating a positive impact on the overall metals market.

Source: xStation5

Silver and other precious metals are moving in pursuit of gold, and sustained high levels in the price of gold bullion should provide chances for a continuation of the bull market in the other precious metals. Where to look for important levels?

The ratio of gold and silver prices has already fallen to the 10-year moving average, which can be considered the first important milestone. The next could be the 20-year static average, which is close to the 2017 and 2021 lows. This average is located at level 68. Assuming a gold price of $2,400, this would give a valuation for silver of $35.3 per ounce, or more than 15% of the implied move from current levels. It would also mean a test of the local peaks of September 2012. Source: Bloomberg Finance LP, XTB

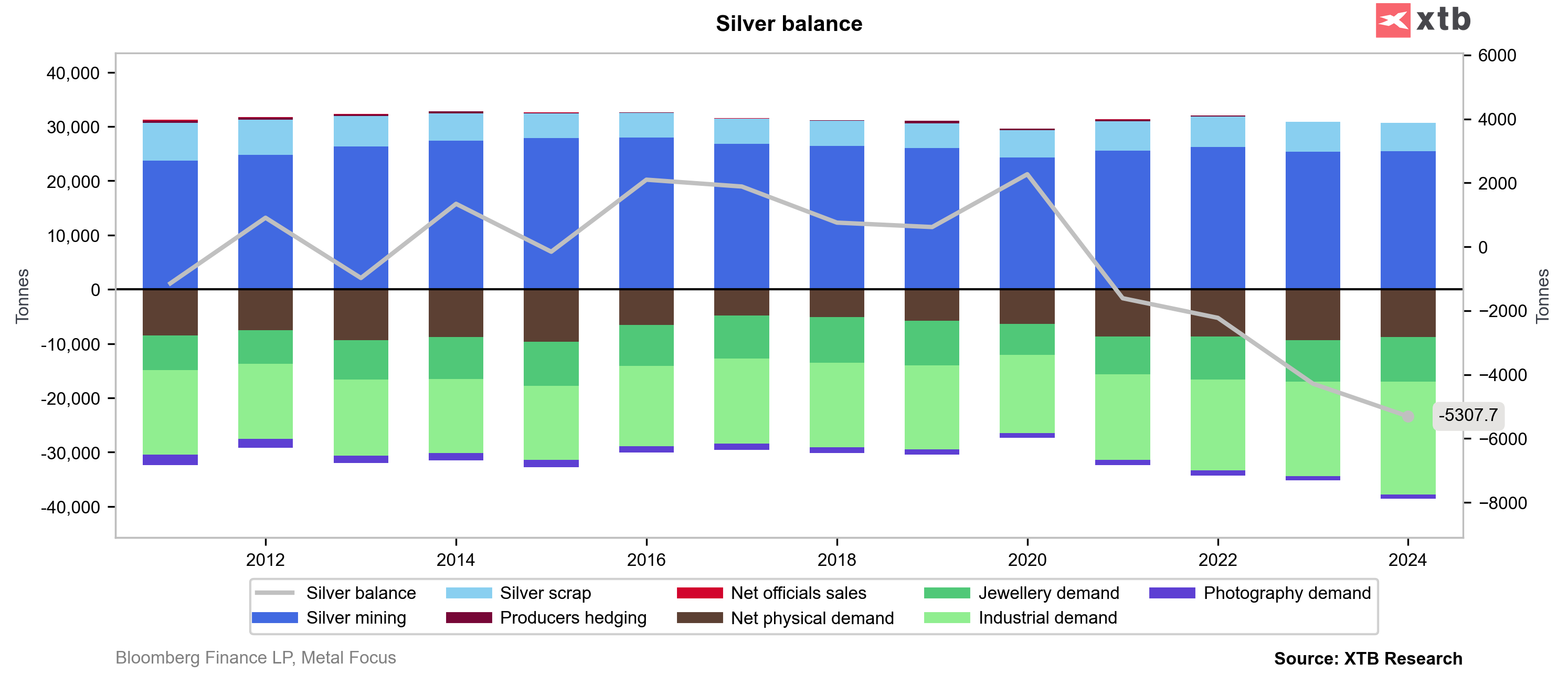

However, it is worth remembering that silver, in addition to the sheer pressure from gold, also has a fundamental basis in terms of growth. It is preparing for the 4th consecutive major shortage in the market, and the metal is used in new technologies, primarily related to energy.

Source: Bloomberg Finance LP, XTB

Daily Summary: Middle East Sparks Oil Market

Oil Under Pressure as G7 Decision Remains Pending

US Open: Oil too expensive for Wall Street!

OIL: Prices soar to $120 a barrel; Israel bombs Iran's oil facilities 📌