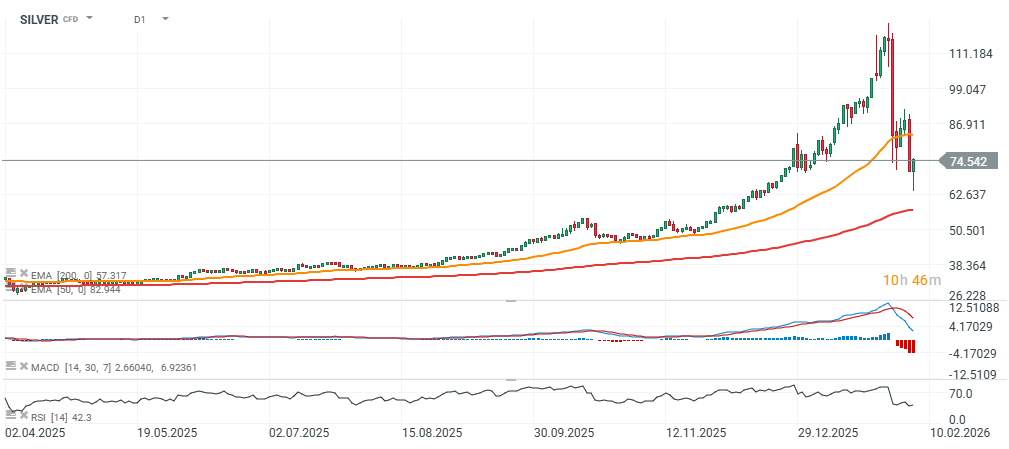

Silver (SILVER) is up more than 5% today, while gold (GOLD) is rebounding by about 2.5% to nearly $4,900 per ounce, supported by improved global risk sentiment. Silver has bounced from around $64 to above $74 per ounce, and at this stage the move appears to be driven more by technical factors than by fundamentals. Reuters data show that analysts have raised their average 2026 silver price forecast to $79.50 per ounce.

- Yesterday, silver plunged by roughly 12%, and CME — the US metals futures exchange (COMEX) — increased margin requirements for silver futures from 15% to 18%. This directly raised the cost of holding positions and forced some investors to close trades. JPMorgan warned that elevated silver valuations make the market particularly vulnerable to sharp sell-offs during periods of risk aversion.

- Recently, a stronger US dollar has been one of the key headwinds. The dollar is still hovering near two-week highs today, which is historically negative for precious metals. On the other hand, yesterday’s weaker US labor-market indicators (JOLTS, jobless claims, and the Challenger report) could reduce the dollar’s momentum — especially if today’s University of Michigan release (consumer sentiment and inflation expectations) reinforces the narrative of a slowing economy.

- China has also seen serious disruptions in its local silver market. The UBS SDIC Silver Futures fund fell another 10% (its daily limit) and trading was halted. The product is now more than 40% below its January 26 peak, yet it still trades at roughly a 29% premium to its net asset value (NAV).

Meanwhile, Julius Baer analysts have pointed to softer industrial demand — including from solar panel manufacturers - and weaker jewellery demand, which could limit the scope for a sustained rebound. CME has also flagged the planned launch of new 100-ounce silver futures on February 9 (pending regulatory approval), which could increase market activity but may also lift volatility in the short term.

SILVER, GOLD charts (D1)

Source: xStation5

Source: xStation5

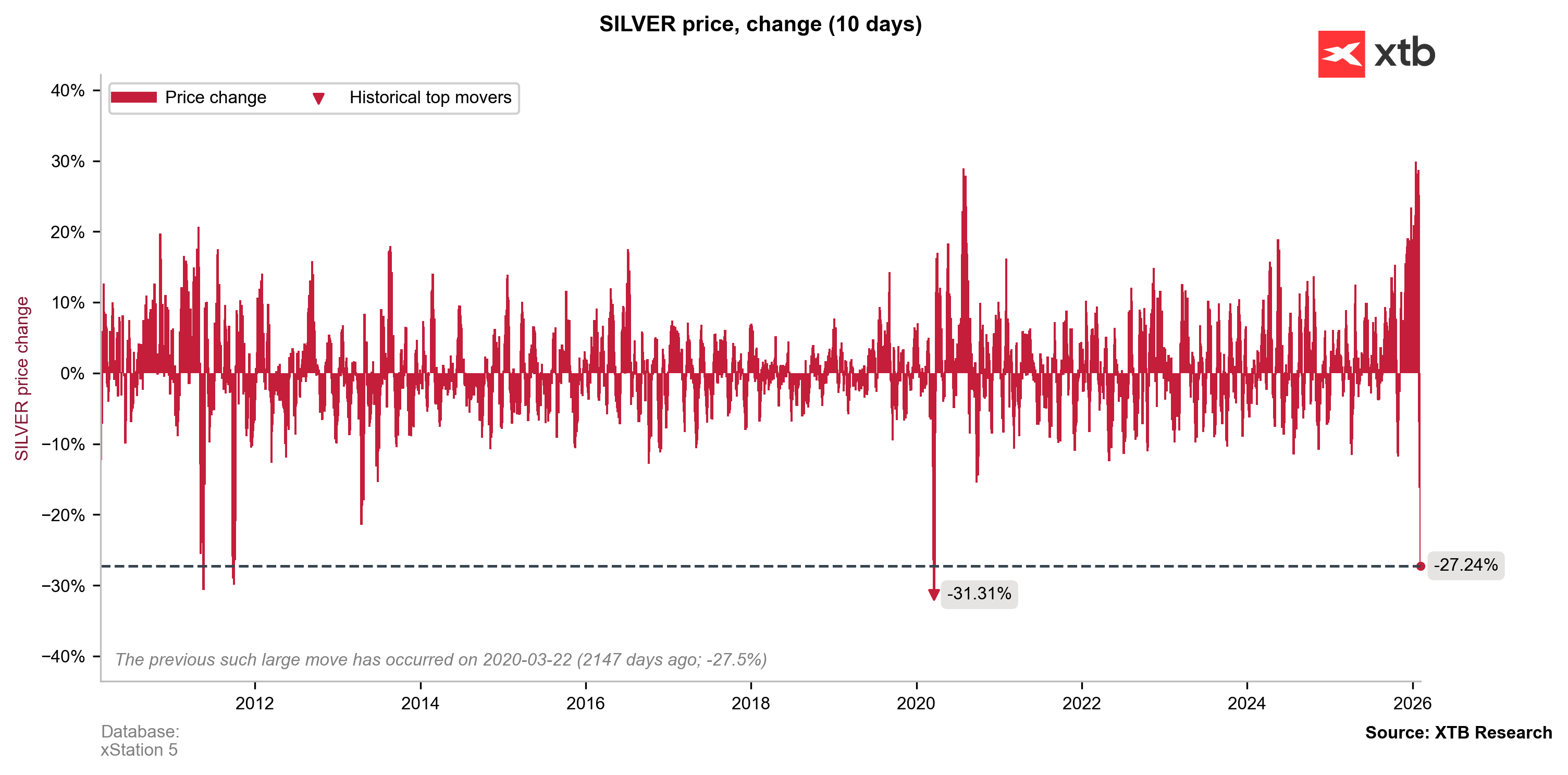

The last time silver experienced a move of this magnitude was in March 2020 during the COVID crash. All signs suggest volatility is likely to remain elevated in the near term.

Source: Bloomberg Finance L.P. XTB Research

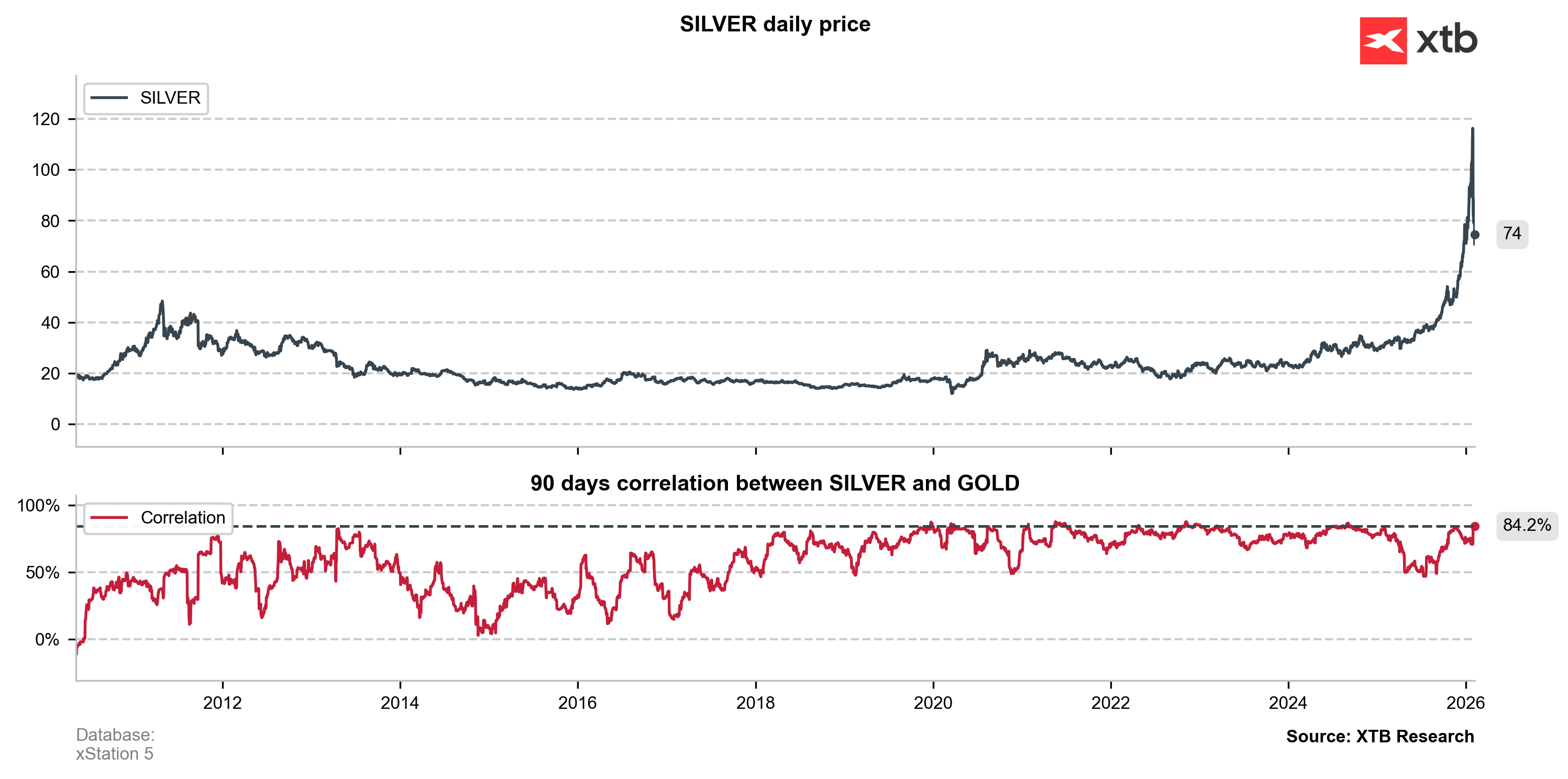

At the moment, silver and gold are moving almost in tandem - with correlation running at historically high levels.

Source: Bloomberg Finance L.P. XTB Research

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Will Europe run out of fuel?

US OPEN: War in Iran hits the markets

Crypto news: Bitcoin gains almost 2% despite the war in the Middle East 📈