The Solana is gaining 12% today, thanks to Thursday's scheduled launch of the Saga phone, running Android powered by Solana's blockchain. Solana developers can create decentralized financial applications (DeFi) and token projects (NFT) on its blockchain. The rally supported Bitcoin's rise above $30,000, which sent a bullish signal for the entire crypto market. Nevertheless, altcoin's gains remain somewhat muted:

- Solana's rapid rise was supported by liquidations of $2.7 million worth of short positions on the contracts. The market expects the Saga smartphone to allow users to create their own NFTs from anywhere and access an ecosystem of Solana-based applications and projects driving adoption. The estimated price of the device in June is expected to be around $1,000;

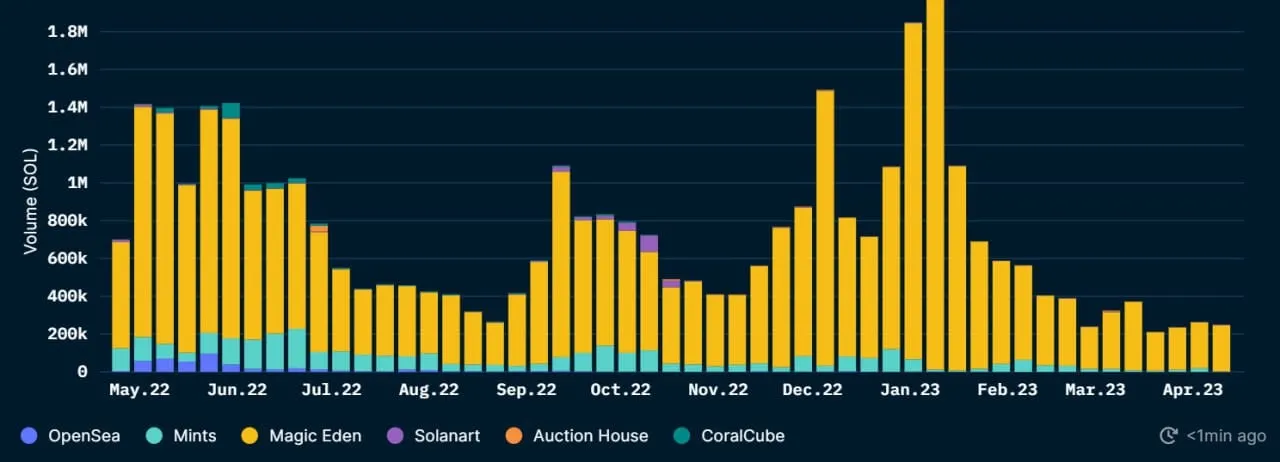

- The total blocked value (TVL) in DeFi applications increased by nearly 40% from $208 million in Q1 2022 to $294 million according to DeFiLlam. It is worth pointing out that the increase came at a very difficult time for the cryptocurrency market as a whole. On the other hand, however, the volume of NFT token trading fell from around $30 million in January to $20 million in March

Weekly trading volume of NFT tokens on Solan. Source: Nansen

SOLANA chart, H4 interval. The price of the cryptocurrency has climbed above the SMA200 and the 23.6 Fibonacci retracement of the December 2022 downward wave. Bulls may want to test $26 level, which indicates the local peaks after the cascading sell-off caused by the collapse of FTX. Source: xStation5

SOLANA chart, H4 interval. The price of the cryptocurrency has climbed above the SMA200 and the 23.6 Fibonacci retracement of the December 2022 downward wave. Bulls may want to test $26 level, which indicates the local peaks after the cascading sell-off caused by the collapse of FTX. Source: xStation5

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?