Investors' attention during this week's first market session was primarily focused on the equity market, which reacted directly to updates on liquidity uncertainty in the banking market. The mood from the US equity market spilled over into other directions, including currencies and Emerging Markets, which also recorded massive volatility. Particularly interesting appear to be the cases of currency pairs linked to the Hungarian forint and the Mexican peso, which recorded massive declines due to sharp movements in the EM credit default swap market, which rocketed to levels not seen since November 2022.

Source: Bloomberg

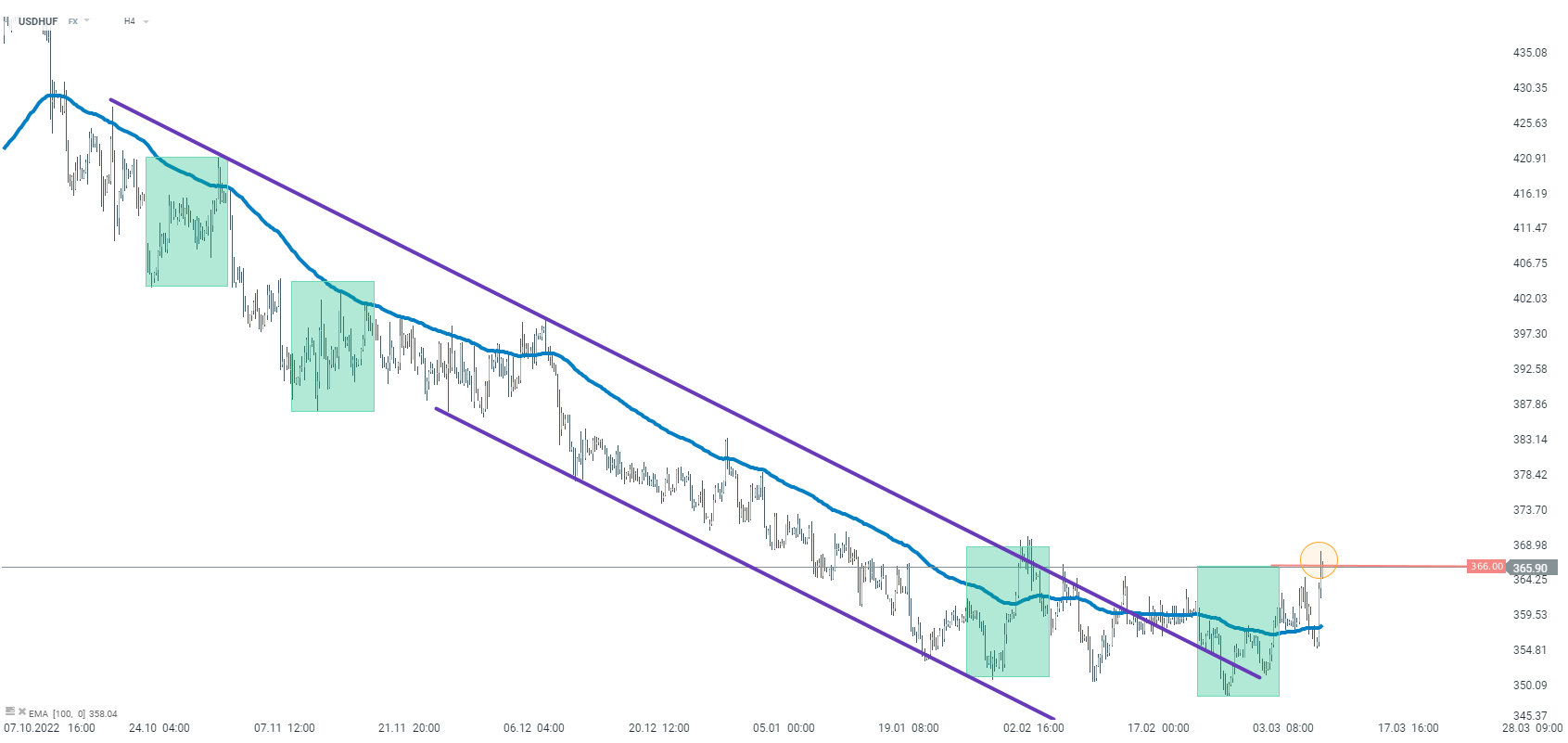

The downward trend on the USDHUF has clearly slowed recently. The price has managed to break out above the downtrend channel and has also crossed and is holding above the EMA100 average. The last obstacle to be overcome remained the upper limit of the 1:1 system at 366.00, which is currently being tested. If it is crossed according to the Overbalance methodology, the long-term trend could change. Source: xStation5

The downward trend on the USDHUF has clearly slowed recently. The price has managed to break out above the downtrend channel and has also crossed and is holding above the EMA100 average. The last obstacle to be overcome remained the upper limit of the 1:1 system at 366.00, which is currently being tested. If it is crossed according to the Overbalance methodology, the long-term trend could change. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)