Spotify (SPOT.US) released an earnings report for the second quarter of 2022 today ahead of the Wall Street session open. Release was viewed positively by the market and the Swedish audio streaming company is one of the best performing Wall Street stocks today with a gain of around 15%. Highlights of the report:

-

Revenue: €2.86 billion vs €2.81 billion expected (+23% YoY)

-

Monthly active users (MAU): 433 million vs 429.4 million expected (+19% YoY)

-

Average revenue per user: €4.54 vs €4.44 expected

-

Operating profit: -€194 million vs -$153.4 million expected

-

Loss per share: -€0.85 vs -€0.70

-

Gross margin: 24.6% vs 25.4% expected

As one can see, company's results for Q2 2022 were mixed. Revenue turned out to be better-than-expected while loss was deeper than expected. However, what is seen as the biggest positive is that the company managed to maintain a strong growth in the number of monthly active users.

Spotify remains optimistic about Q3 2022 and expects its monthly active user count to increase to 450 million in July-September period. Revenue in the current quarter is expected at €3 billion and operating loss at €218 million. Revenue guidance was slightly higher than market expected while forecasted operating loss is wider than expected. Spotify also announced that it will stop manufacturing Car Thing hardware devices as those were negatively impacting gross margin and will take a €31 million charge on the decision.

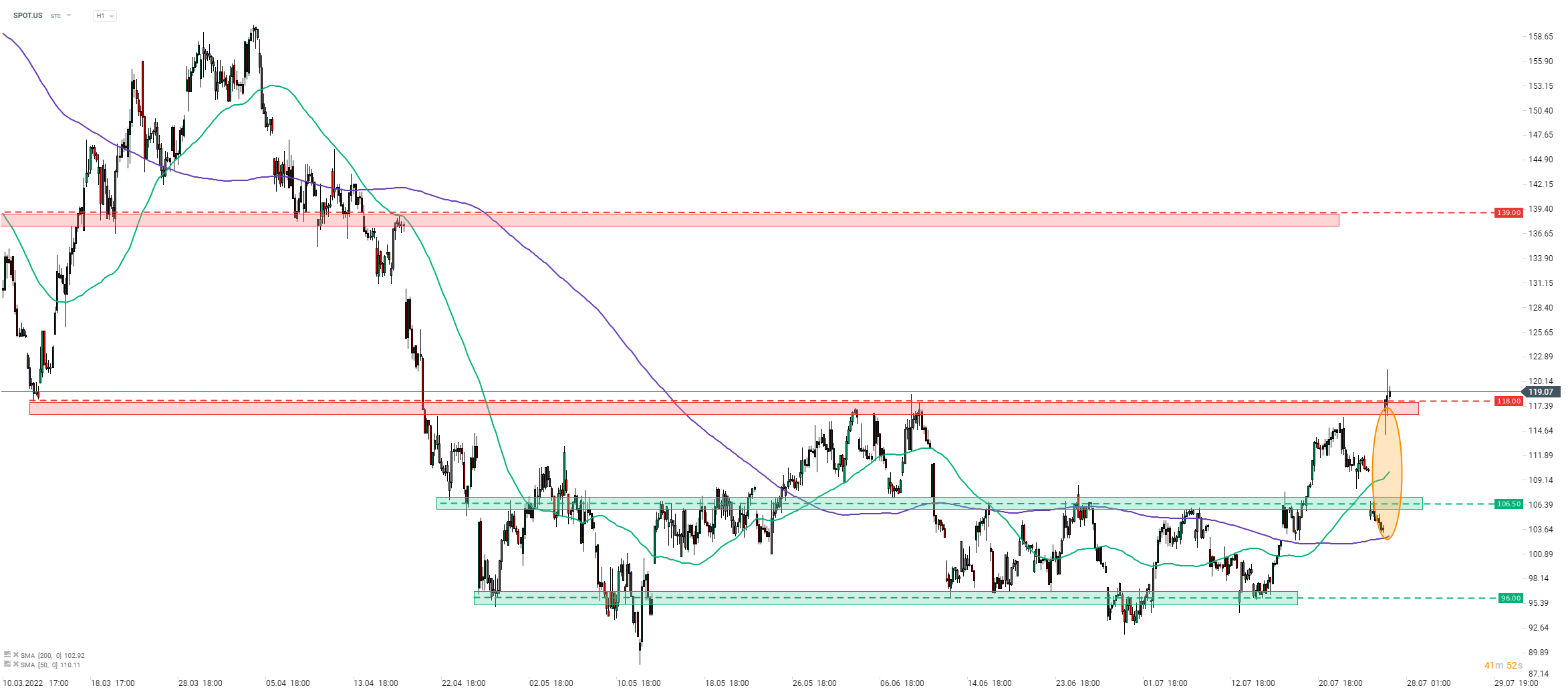

Spotify (SPOT.US) jumped following the release of Q2 2022 earnings report (orange circle). Stock managed to break above the $118.00 resistance zone and is trading at the highest level since April 21, 2022. Strong growth in MAU is fuelling share price gains today. The next resistance zone to watch can be found ranging below $139.00. Source: xStation5

Spotify (SPOT.US) jumped following the release of Q2 2022 earnings report (orange circle). Stock managed to break above the $118.00 resistance zone and is trading at the highest level since April 21, 2022. Strong growth in MAU is fuelling share price gains today. The next resistance zone to watch can be found ranging below $139.00. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street