Shares of Standard Chartered (STAN.UK) are rallying over 10% today. Stock surged on news that the First Abu Dhabi Bank is exploring a takeover bid for Standard Chartered. However, the First Abu Dhabi Bank responded to those rumors and said that it is no longer in talks with Standard Chartered and is no longer evaluating a bid for the company. Stock pared a big part of the gains since. Stock was trading around 20% higher on the day but has pared this gain to around 10% now.

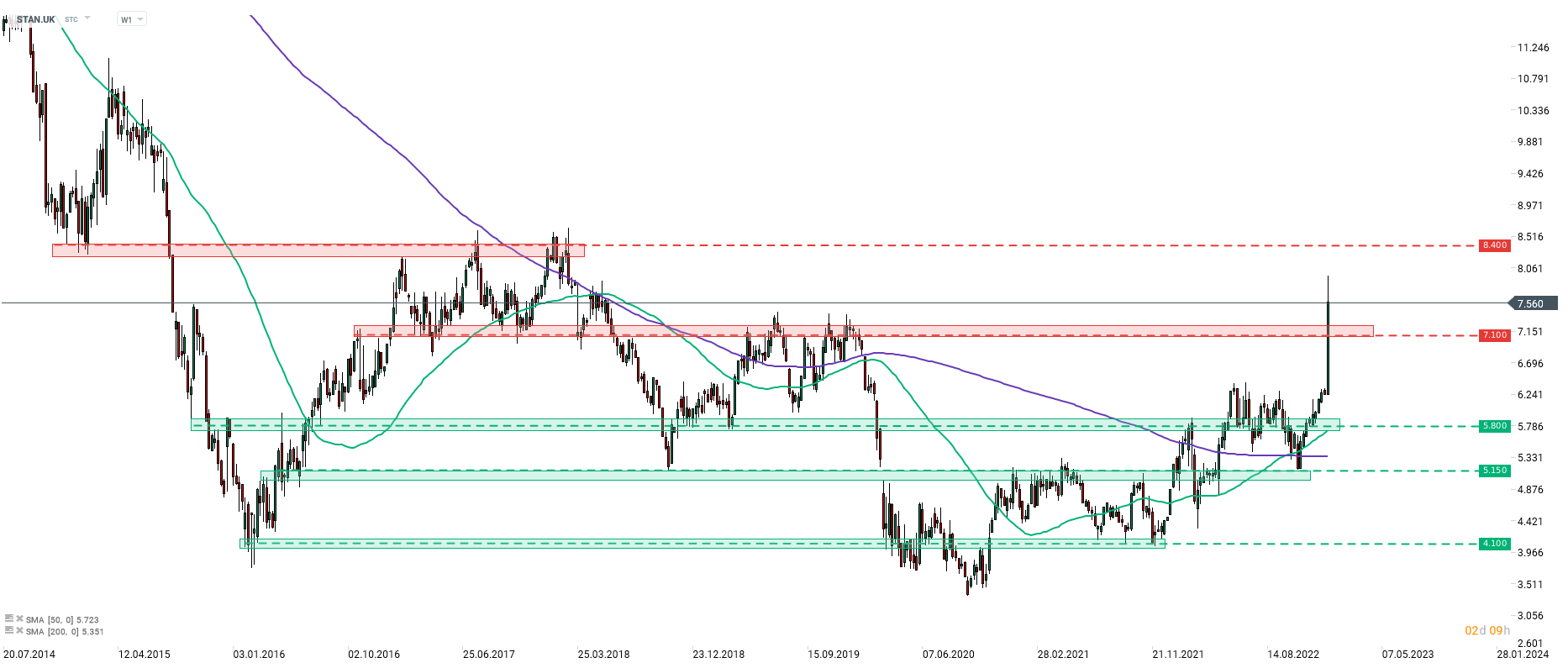

Taking a look at Standard Chartered (STAN.UK) chart at weekly interval (W1) we can see a massive jump in share price today. Stock jumped above 7.10 GBP per share resistance zone and continued to move higher until it reached a daily high just shy of 8.00 GBP per share. Stock trimmed gains after First Abu Dhabi Bank rejected rumors and from a technical point of view a lot will not depend on whether price remains above 7.10 GBP per share price zone or pulls back below.

Standard Chartered (STAN.UK) at W1 interval. Source: xStation5

Standard Chartered (STAN.UK) at W1 interval. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales