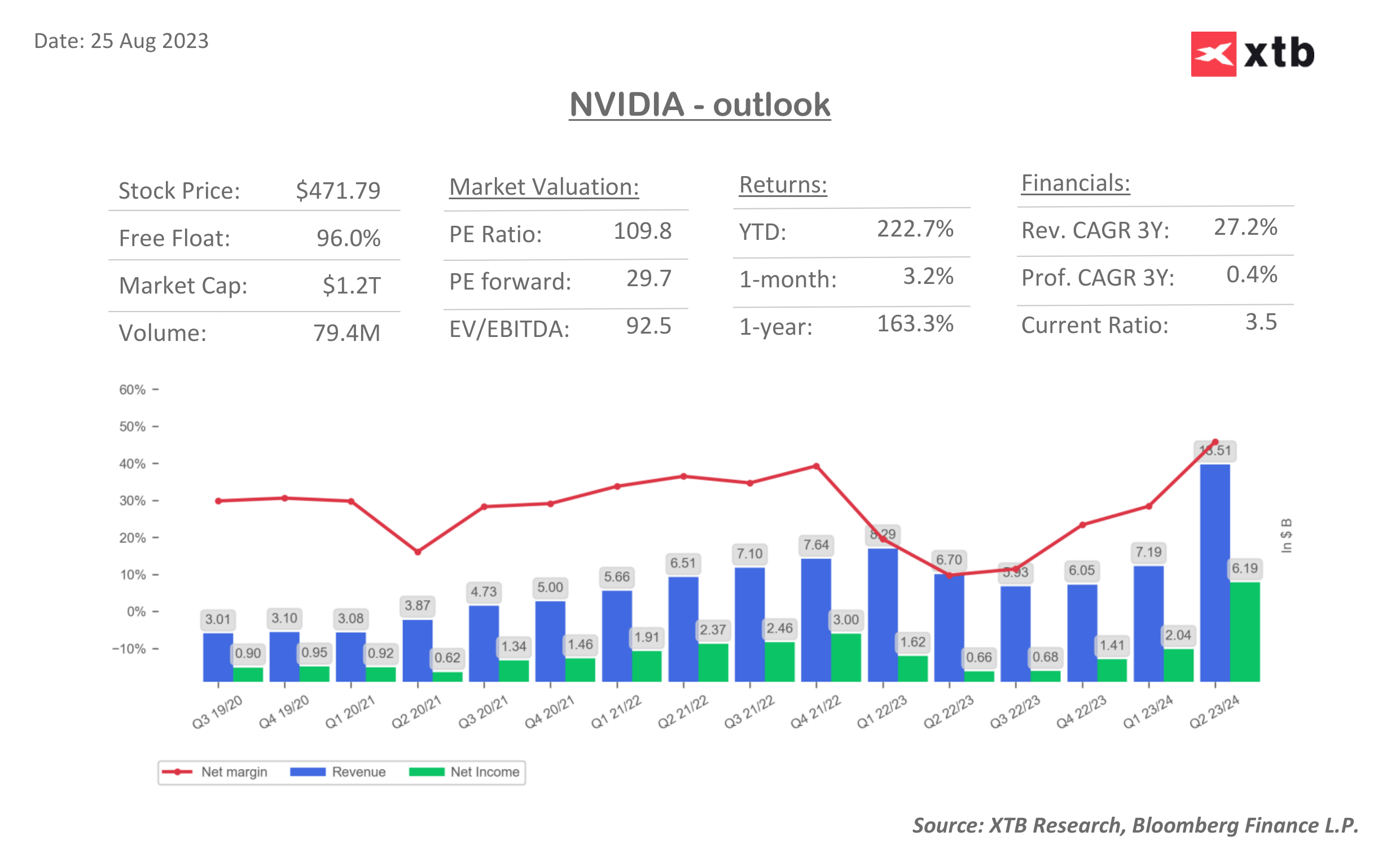

Nvidia (NVDA.US) released its earnings report for fiscal-Q2 2024 (May - July 2023) this Wednesday after the close of the Wall Street session. Results turned out to be superb with both sales and profits beating expectations significantly. However, the market's reaction has been much more tame than following the previous quarterly earnings release. This has raised questions whether company valuation did not run ahead of fundamentals.

Fiscal-Q2 2024 earnings

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appThe latest quarterly earnings release from Nvidia was stellar. Revenue grew by over 100% YoY, to $13.51 billion, and was over 20% higher than $11.04 billion expected by the market. A bulk of this revenue growth came from the Data Center segment which saw 171% YoY jump in sales, to $10.32 billion (exp. $7.99 billion). Nvidia reported operating profit of $6.8 billion - translating into a roughly 50% operating margin. A more detailed review of Nvidia's earnings can be found here.

Market is not convinced

Market is not convinced

Nvidia's quarterly report was very strong and led to an around-8% gain in the after-hours trading on Wednesday. However, those gains did not stand the test of time with the stock erasing almost all of it during the cash trading session yesterday and finishing just 0.1% higher. Pullback in Nvidia shares put pressure on the whole tech sector with Nasdaq dropping almost 1.9% yesterday.

This could, of course, by a simple profit taking following steep gains Nvidia has made this year. However, it could also hint that the market realized how high Nvidia's valuation is and whether AI-boom justifies such high multiples.

Questions about valuations

Nvidia is at the forefront of an AI revolution and there is no doubt about it. Thanks to the AI-craze, the stock has rallied over 200% year-to-date and joined a group of stocks with a market capitalization of $1 trillion or more. However, did the company get disconnected from fundamentals?

Running a simplified discounted cash flow analysis (DCF) with assumption of Nvidia maintaining 50% operating margin over the next 5 years, a weighted average cost of capital of around 13.5% (current WACC) as well as a terminal revenue growth rate of 5%, achieving current market valuation would require the company to grow its revenue by 55-60% each year over the next 5 years! However, as it is usually the case with DCF models, the outcome is highly sensitive to assumption. A sensitivity matrix for different terminal rates of revenue growth (after the 5th year) and weighted average cost of capital is presented below and it shows how wide the range of estimates is.

While this is not impossible given that the company managed to grow revenue at a much higher pace in recent quarters, it should be said that AI-field will attract more players and investments as the time passes and Nvidia may find it hard to maintain its dominance.

Source: XTB

A look at the chart

Taking a look at the Nvidia chart (NVDA.US) at the H1 interval, we can see that the stock has almost completely filled the bullish price gap by the end of the session yesterday. Stock broke back below the $475 price zone, marked with previous highs. A near-term level to watch is $467.00 area as the lower limit of a market geometry can be found there. A break below would, at least in theory, hint a bearish trend reversal and may herald deeper declines. In such a scenario, the next support zone to watch will be the $450 area, where previous price reactions as well as 50- and 200-hour moving averages can be found.

Source: xStation5

Source: xStation5