Analog Devices, a global leader in analog semiconductors and industrial solutions, reported fiscal first-quarter 2026 results that significantly exceeded market expectations. Second-quarter guidance also came in above analyst consensus, underscoring the company’s strong positioning across key industrial, data center, and AI infrastructure segments.

Q1 2026 Financial Results

-

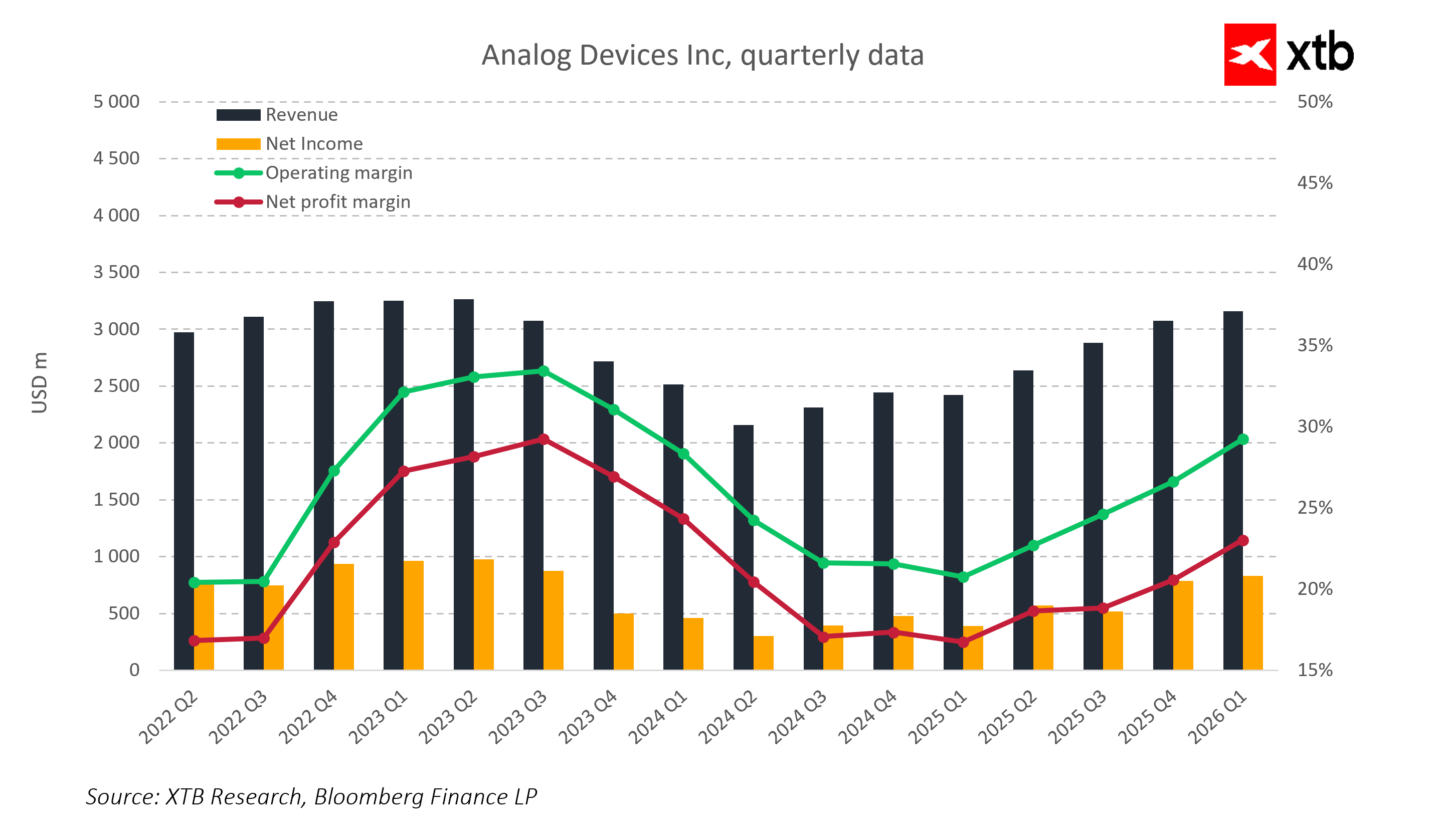

Revenue: $3.16 billion (+30% YoY; consensus $3.12 billion)

-

Earnings per share (EPS): $2.46 (consensus $2.31; $1.63 a year ago)

Revenue by segment:

-

Industrial: $1.49 billion (consensus $1.50 billion)

-

Communications: $476.8 million (consensus $432 million)

-

Automotive: $794.4 million (consensus $815.3 million)

-

Consumer: $399.8 million (consensus $362.7 million)

-

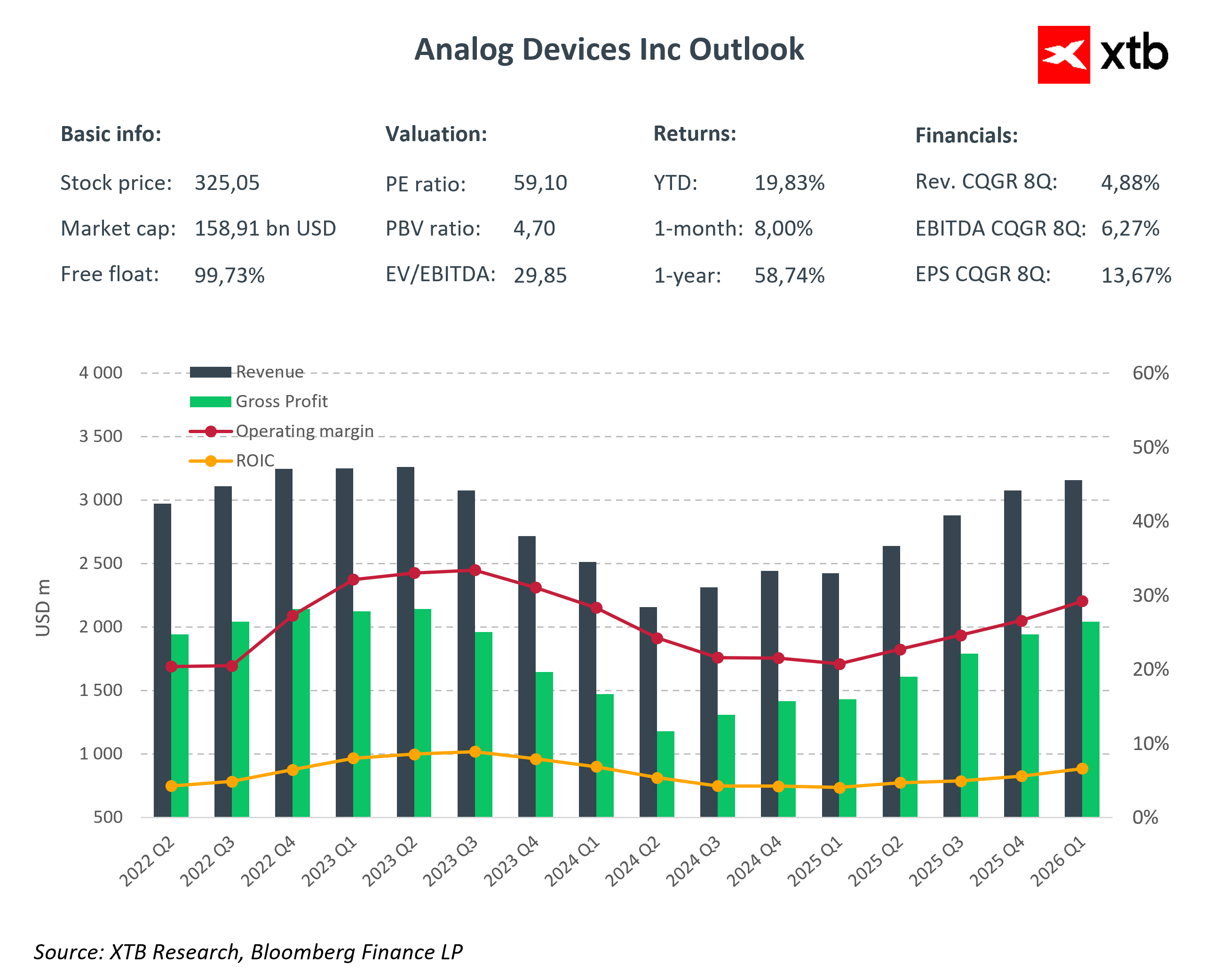

Gross margin: 71.2% (consensus 70%)

-

Operating margin: 45.5% (consensus 43.8%)

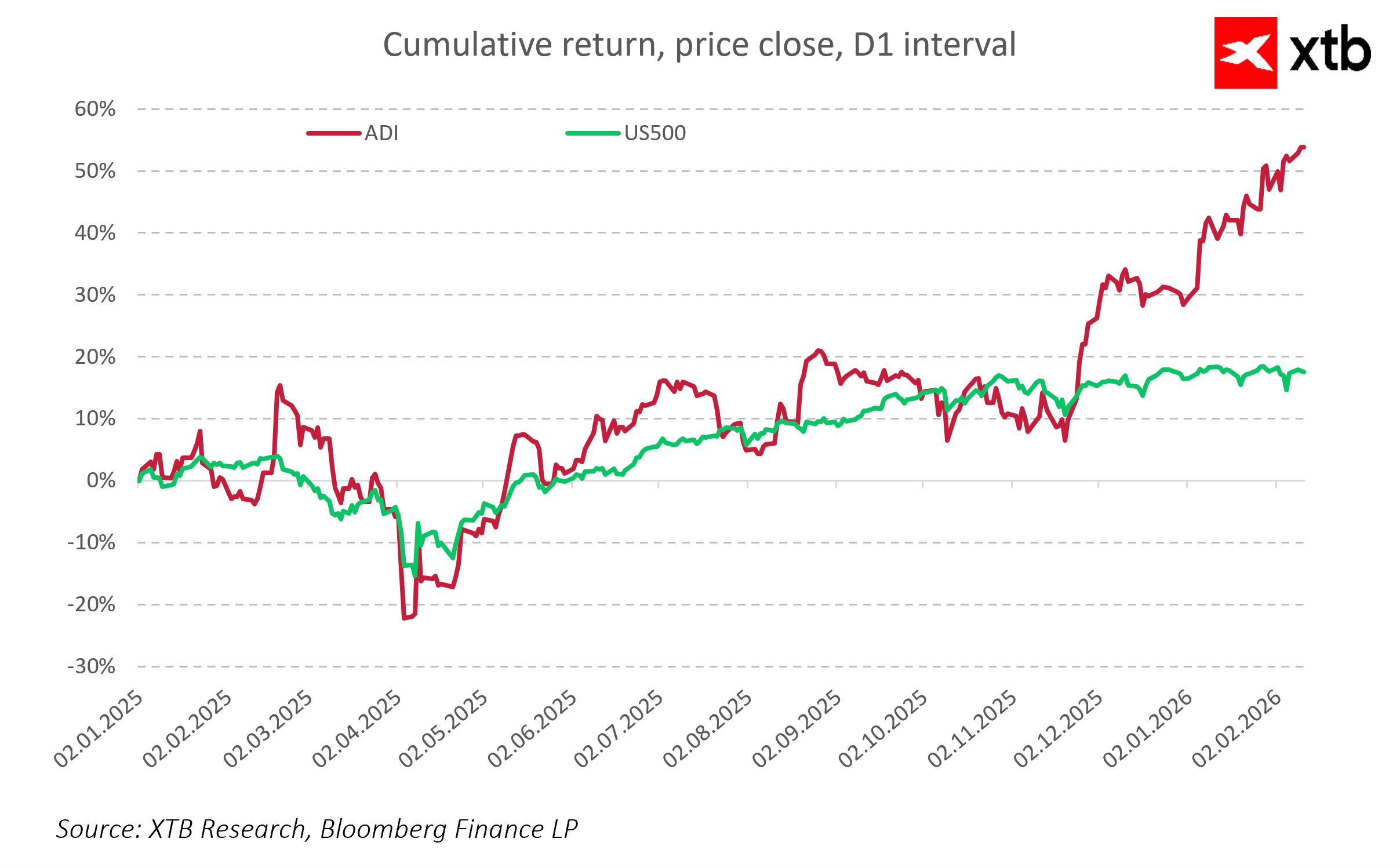

Following the earnings release, ADI shares rose by more than 3%, reflecting a positive market reaction.

Q2 2026 Outlook

-

Revenue: $3.50 billion (consensus $3.23 billion)

-

EPS: $2.88 (consensus $2.31)

The guidance points to sustained strong demand across industrial, communications, and data center markets, primarily driven by ongoing investment in generative artificial intelligence. Management highlighted that expected second-quarter revenue could mark a new record level for the company.

Market Reaction and Investor Implications

The positive share price response following the results and guidance reflects constructive investor sentiment. The quarterly performance and forward outlook indicate that the company continues to scale effectively while maintaining solid growth across strategic semiconductor and AI-related markets.

Business Context and Outlook

Analog Devices remains a leader in the analog semiconductor space and industrial solutions market. The company’s growth trajectory is supported by increasing investment in AI infrastructure, expansion of data centers, and resilient demand from core industrial customers.

Key strengths:

-

Operational scale and revenue visibility

-

Strong demand across industrial, communications, and consumer segments

-

High gross and operating margins

Key challenges:

-

Macroeconomic and geopolitical pressures

-

Intense competition within the semiconductor sector

-

The need to sustain innovation in a rapidly evolving market

Despite these factors, ADI’s recent performance and forward guidance suggest continued revenue and earnings growth potential, reinforcing its position in strategic technology and AI infrastructure markets.

Key Takeaways

-

Strong Q1 2026 results: Revenue of $3.16 billion (+30% YoY) and EPS of $2.46 — both above consensus.

-

Solid Q2 2026 guidance: Revenue of $3.50 billion and EPS of $2.88, supported by AI-driven infrastructure demand.

-

Positive market response: Share price appreciation reflects investor confidence.

-

Competitive positioning: Operational scale, revenue visibility, high margins, and strong exposure to AI and industrial semiconductor markets.

US Open: US100 gains 1% 📈 Nvidia gains amid big orders from Meta

Palo Alto earnings: Is security cheap now?

BAE Systems earnings: Record after record in the defense industry

US OPEN: Market under pressure from AI