Sugar futures (SUGAR) on the ICE exchange are up more than 2% today, making them the best-performing agricultural commodity. Commitment of Traders (CoT) data from August 12 indicated a modest reduction in speculative short positions, suggesting the market may be entering a phase of “testing the strength” of the downtrend.

Brazilian harvests remain a key driver for the market. UNICA, the country’s largest sugar industry association, reported last week that sugar output in the Centre-South region through July fell 7.8% year-on-year. At the same time, in the second half of July, the share of cane allocated to sugar production rose to 54.10% versus 50.32% a year earlier. This shift contributed to price weakness earlier in the week, but the market is now rebounding on “technical” grounds after reaching multi-year lows.

In India—one of the world’s largest cane producers—the new harvest season begins in less than two months, with forecasts pointing to solid crops, raising uncertainty over whether the rebound can hold. Additional sugar supplies from Thailand are also expected to hit the market later this year. At present, the demand–supply balance appears stable, suggesting prices may move sideways while awaiting a stronger catalyst.

SUGAR (D1 interval)

On the daily chart, prices have been forming higher lows for several weeks, with the contract approaching a test of the EMA50 (orange line). The key short-term resistance zone is currently around 17 USD (price action).

Source: xStation5

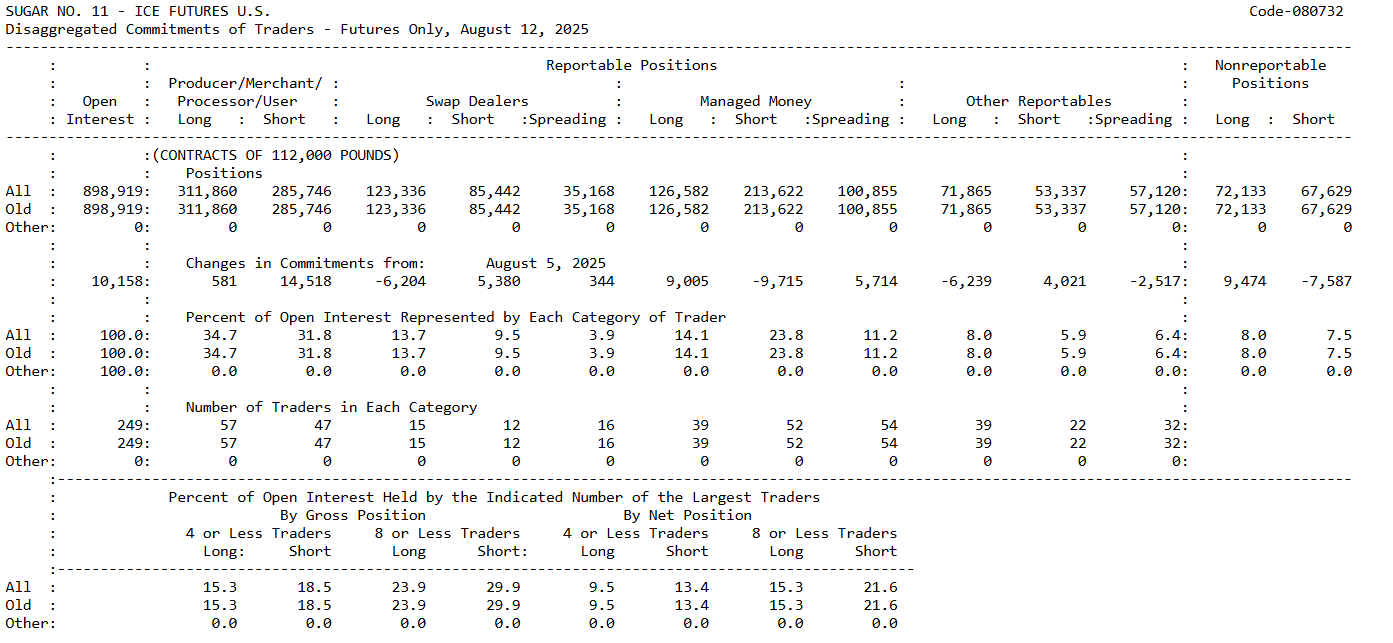

CoT Analysis (August 12)

Commercials – Producers and processors remain strongly positioned on the hedging side. This is evident from the sharp increase in short positions (+14.5k), signaling a stronger push to secure future production against potential price declines. Their net position remains slightly long (~+26k contracts), but the shift toward heavier hedging is clear. For the market, this indicates that physical players do not expect major price rallies and are focused on protecting margins.

Managed Money – Large speculative funds are still holding a distinctly net short exposure (~-87k contracts), maintaining bearish pressure on sugar. However, the latest changes show a notable pattern: +9k new longs and -9.7k shorts cut. This is a classic sign of short-covering and potentially the first stage of a sentiment shift. While funds remain net bearish, the weekly dynamics suggest that some are beginning to position for a rebound. The largest eight traders still control nearly 30% of total short positions. If the trend of short covering among Managed Money continues in upcoming reports, a sustained rally could follow.

Producers are aggressively hedging against further declines, while speculative funds are starting to unwind shorts, pricing in the risk of a trend reversal. Source: CoT, CFTC

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!