- Tesla delivered record revenue and free cash flow on higher vehicle volumes and surging energy-storage deployments, though auto margins stayed pressured.

- Management emphasized an AI-led roadmap (FSD v14, Robotaxi pilots) and new products (Model 3/Y Standard, Megapack 3/Megablock).

- Outlook remains growth-oriented but cautious given tariffs and macro uncertainty.

- Stock declines 1.30% after hours.

- Tesla delivered record revenue and free cash flow on higher vehicle volumes and surging energy-storage deployments, though auto margins stayed pressured.

- Management emphasized an AI-led roadmap (FSD v14, Robotaxi pilots) and new products (Model 3/Y Standard, Megapack 3/Megablock).

- Outlook remains growth-oriented but cautious given tariffs and macro uncertainty.

- Stock declines 1.30% after hours.

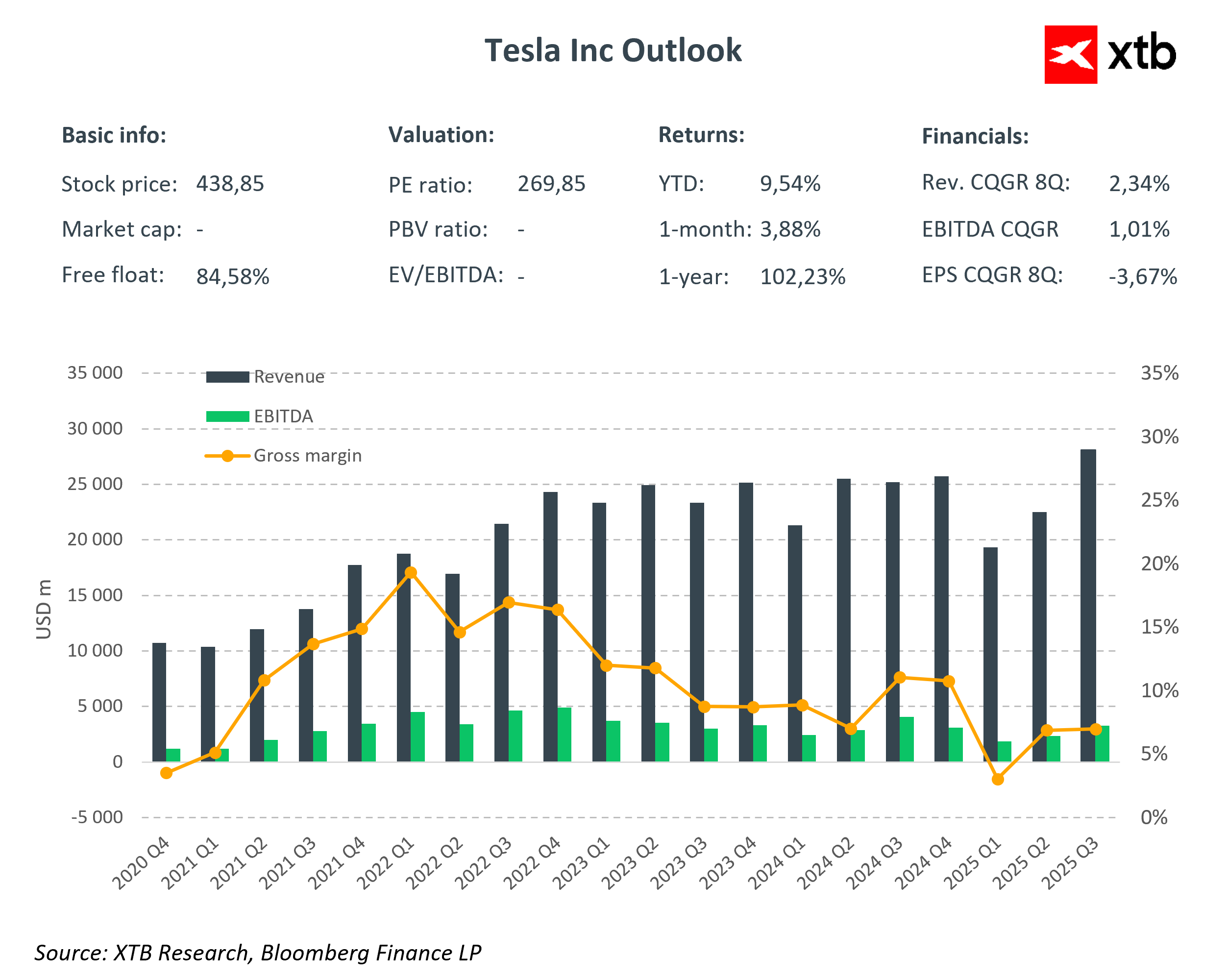

Tesla reported record quarterly revenue and significantly higher free cash flow, driven by the highest vehicle deliveries in its history and record energy-storage deployments. Automotive margins remain lower year-on-year due to higher operating costs, tariffs, and sales mix. Nevertheless, the company still managed to generate substantial cash surplus. Management continues to lean heavily into AI (FSD v14 rollout, Robotaxi pilots) and new products (Model 3/Y Standard, Model YL, Megapack 3/Megablock) while maintaining a cautious tone regarding macro and trade risks.

Key results

- Total revenue: $28.10B (+12% YoY)

- GAAP operating income / margin: $1.62B / 5.8%

- GAAP net income: $1.37B; non-GAAP net income: $1.77B (non-GAAP EPS $0.50)

- Adjusted EBITDA / margin: $4.23B / 15.0%

- Operating cash flow / FCF: $6.24B / $3.99B (record)

- Cash & investments: $41.65B (+$4.9B QoQ)

- Vehicle deliveries: 497,099 (+7% YoY); days of inventory: 10

- Energy storage deployments: 12.5 GWh (+81% YoY)

- Supercharger network: 7,753 stations / 73,817 connectors (+16–18% YoY)

Management commentary

Management remains optimistic, emphasizing that current production serves as the foundation for monetizing the company’s AI-based services offering. Comments indicate short-term uncertainty related to trade and fiscal policy, but upcoming production lines (Cybercab/Robotaxi, Semi, Megapack 3, Optimus) sustain strong commercialization potential.

- FSD v14 has begun rolling out, integrating a large portion of the Robotaxi model with improved handling of complex scenarios. The Robotaxi service was expanded in Austin, and a ride-hailing program was launched in the Bay Area to collect data ahead of full commercial scaling.

- Management points to rising tariffs and supply-chain uncertainty as factors driving costs and limiting pricing flexibility. Localized sourcing of batteries and drivetrains is expected to reduce these risks over time.

- AI training capacity increased to approximately 81,000 H100-class GPUs, with further growth expected through collaboration with Samsung on advanced AI chip manufacturing in the U.S.

Segment details

- Deliveries: 497,099 vehicles (+7% YoY); inventory days fell to 10. Model 3/Y accounted for 481,166 deliveries.

- Energy storage: 12.5 GWh deployed (+81% YoY) and a record quarterly gross profit in the energy segment ($1.1B TTM).

- Network & services: Around 7,753 Supercharger stations and 73,817 connectors (+16–18% YoY). The first v4 units were launched, featuring higher power density and throughput.

Tesla shares declined 1.3% to $433 in after-hours trading.

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood