Wall Street is showing signs of stabilization today following yesterday’s sell-off. Futures on major indices are slightly higher, suggesting that the market is attempting to recover some of the losses.

The focus remains on the Federal Reserve’s decisions. Markets are speculating whether the Fed will shift its tone regarding future interest rate moves, which would have a significant impact on growth stock valuations, particularly in the technology sector. Technology companies and firms involved in artificial intelligence, which have been key drivers of gains in recent months, are now the most sensitive to market sentiment swings and changing expectations regarding monetary policy.

Additional pressure came from yesterday’s ISM Manufacturing PMI data, which showed that the U.S. industrial sector is again contracting. In November, the PMI stood at 48.2 points, down from 48.7 in October, marking the ninth consecutive month of weakening activity. Particularly concerning were declines in new orders, which fell to 47.4 points, and in the employment sub-index, which dropped to 44.0 points. At the same time, the prices index rose to 58.5 points, indicating growing cost pressures despite weakening demand.

This combination of data presents a challenge for the Fed. On one hand, weakening industrial activity and slowing demand suggest a cooling economy, which would normally support a more dovish monetary policy. On the other hand, persistent cost pressures could maintain inflation concerns and limit the scope for rapid rate cuts. As a result, the Fed may adopt a balanced and cautious approach, taking into account both economic risks and inflationary pressures.

Overall, the current market situation reflects a moderate rebound, uncertainty over future Fed actions, weak industrial data, and rising concerns about the health of technology companies.

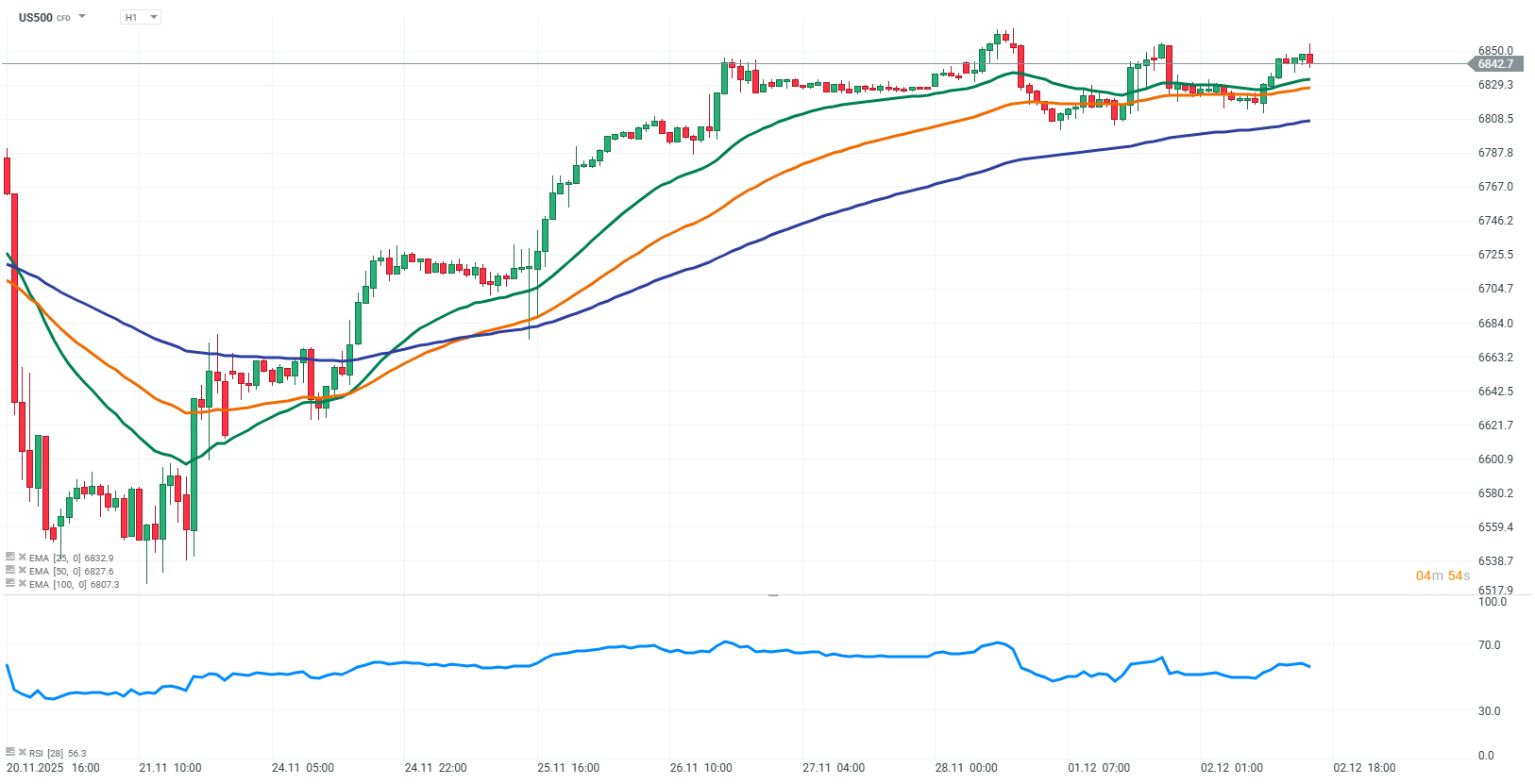

Source: xStation5

US500 (H1 Interval)

S&P 500 futures are slightly higher today, marking a rebound from yesterday’s local correction. The market remains above key moving averages (EMA 25, 50, and 100), indicating technical dominance by bulls and the potential for continued gains. The RSI is in a neutral, slightly optimistic zone, suggesting that room for further upside remains. Markets remain moderately cautious, monitoring consolidation and upcoming macroeconomic data that could influence the market’s direction. Support around the moving averages remains stable, but upcoming market signals and global sentiment will be key.

Source: xStation5

Company News

- Janux Therapeutics (JANX.US) shares fell sharply following the release of preliminary Phase 1 prostate cancer trial results. Despite generally positive safety and early efficacy data, the market reacted negatively, judging that the results do not provide a clear advantage over competing therapies and suggesting that the path to full commercialization may take longer.

- Marvell Technology (MRVL.US) shares are up 2.5% intraday on news that the company is in advanced talks to acquire AI chip startup Celestial AI. The deal could exceed $5 billion and has the potential to strengthen Marvell’s position in the AI segment and accelerate the development of new technologies. At the same time, the market is cautious about integration challenges involving teams and technology. Investors also await Marvell’s third-quarter results, due after today’s session, which are expected to show EPS of $0.74 and revenues of $2.07 billion, representing year-on-year growth of 72% and 36%, respectively.

- Credo Technology (CRDO.US) shares are rising intraday following results that exceeded market expectations and an optimistic outlook for upcoming quarters, with the stock gaining nearly 25%.

- MongoDB (MDB.US) shares have surged over 20% after third-quarter results showed strong growth in Atlas platform revenues and increasing relevance in AI applications. Atlas revenues grew approximately 30%, and analysts forecast continued robust expansion in the coming years.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war