Tesla (TSLA.US) stock surges over 10.0% on Tuesday after Musk at a conference in Qatar arranged by Bloomberg said the company would cut salaried staff by about 10% over the next three months, resulting in an overall reduction of about 3.5%.

- Earlier this month Reuters said TESLA CEO wanted to reduce jobs by 10%, citing an internal email. In the memo, Musk reportedly said he has a “super bad feeling” about the economy. However later on CNBC revealed, Musk clarified the company will be reducing its salaried head count by 10% and increasing its hourly staffing. “A year from now, I think our head count will be higher in both salaried and obviously in hourly,” Musk said.

- Meanwhile two former Tesla employees from gigafactory plant in Sparks, Nevada sued the company Sunday, alleging it violated U.S. federal laws regarding “mass layoffs” and are looking to claim 60 days' worth of pay and benefits. According to the suit, at least 500 of workers in Nevada lost their jobs in June.

- Nevertheless Musk comments regarding competition and demand sparked an upward move. “As anyone knows who has tried to order a Tesla, the demand for our cars is extremely high and the wait list is long,” Musk said. Currently Tesla CEO is mostly concerned about raw materials shortages which could affect production, while new competition or price increases due to inflation fell to the background.

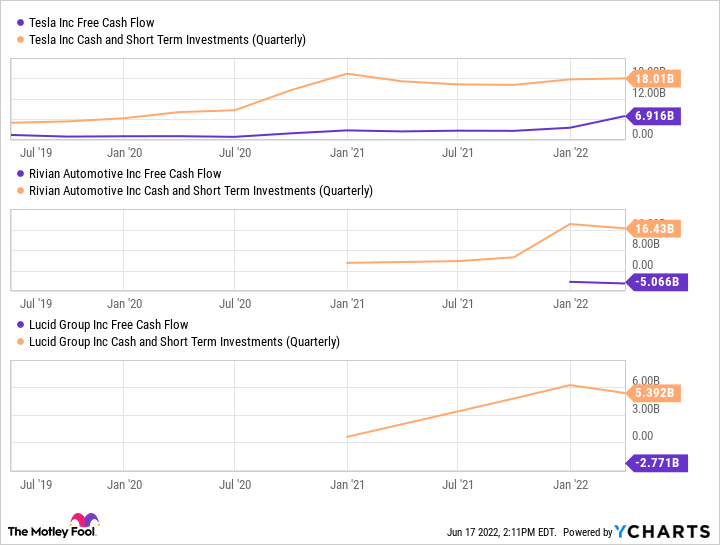

- Also when looking at the numbers, one can notice that in case of an economic downturn Tesla is in a better financial position than its competitors.

Upstart companies from the EV sector - Lucid Group (LCID.US) and Rivian Automotive (RIVN.US) are burning huge amounts of money. On the other hand, Tesla generates billions in free cash flow and has $ 18 billion in cash on its balance sheet, while debt accounts only to $ 3 billion. Source: Ycharts via The Motley Fool

Tesla (TSLA.US) - last week buyers once again managed to halt declines around key support at $625.00 which is marked with a lower limit of the 1:1 structure. Today price easily broke above psychological $700.00 level and if current sentiment prevails, upward move may accelerate towards major resistance at $797.00 which coincides with 38.2% Fibonacci retracement of the upward wave launched in March 2020. Source: xStation5

Nvidia expands into software AI sector? Wired reports on NemoClaw

Market Wrap: Energy Stocks Retreat as Hopes for End to Iran War Grow 🌍 (10.03.2026)

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster