Tesla (TSLA.US) stock jumped 3% at the beginning of today's session following upbeat sales figures of its vehicles produced in China. According to data from the China Passenger Car Association (CPCA) Tesla sold 33,463 China-made electric cars in May, including exports, a 29% jump compared to previous month. One can see that sales recovered after the April slump which is very important as China is one of Tesla's largest and most critical markets accounting for nearly a third of its total sales. Therefore many investors perceive the data from China as a kind of indicator of the overall condition of the company.

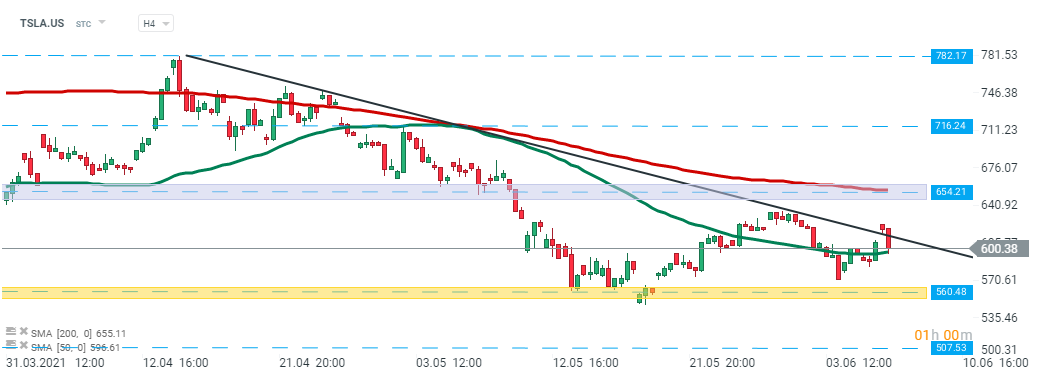

Tesla (TSLA.US) stock launched today’s session higher and even managed to temporarily break above the downward trendline. However buyers failed to uphold momentum and price pulled back and is currently testing 50 SMA ( green line). Should break lower occur, then support at $564.48 may be at risk. Aforementioned downward trendline acts as the nearest resistance. Source: xStation5

Tesla (TSLA.US) stock launched today’s session higher and even managed to temporarily break above the downward trendline. However buyers failed to uphold momentum and price pulled back and is currently testing 50 SMA ( green line). Should break lower occur, then support at $564.48 may be at risk. Aforementioned downward trendline acts as the nearest resistance. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street