The season of releasing the financial results of major banks and other key financial institutions for Q4 2021 has just begun. Today we learned the results of giants such as JP Morgan (JPM.US), Citigroup (C.US) and Wells Fargo (WFC.US). Investors also got to know the results of the BlackRock (BLK.US). Leaders of the financial sector did not disappoint and reported better than expected quarterly results, which are as follows:

JP Morgan (JPM.US)

Revenue - $30.35 billion (expected - $ 29.9 billion)

Net profit - $10.14 billion (previously - $ 12.14 billion)

EPS - $3.33 (expected - $ 3.79)

The results published by the bank disappointed investors, who decided to sell some of their positions. Currently, the bank's shares are losing about 4.3% before the opening of the session. Source: xStation 5

Wells Fargo (WFC.US)

Revenue - $20.86 billion (expected $18.85 billion)

EPS - $1.38 (expected - $1.02)

The bank reported much better results than analysts' consensus expectations. Investors are buying the company's shares, which are appreciating by about 2% before the stock market opens. Source: xStation 5

Citigroup (C.US)

Revenue - $17.02 billion (expected - $16.80 billion)

EPS - $1.99 (expected - $1.62)

The bank's shares lost about 3.5% before the opening of the US session.Source: xStation 5

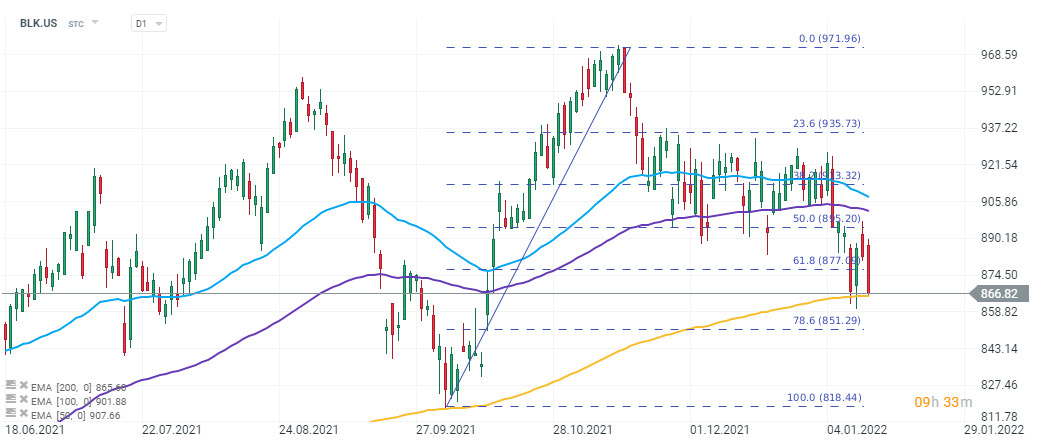

BlackRock (BLK.US)

Revenue - $5.11 billion (expected - $5.16 billion)

EPS - $10.42 (expected - $10.15)

Assets under management -$10.1 trillion (expected - $9.85 trillion)

The stock loses about 1.7% before the session on Wall Street. Source: xStation 5

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals