- GAIN AI Act: The new law requires chip manufacturers, such as Nvidia and AMD, to prioritize serving the domestic market before exporting, especially to China. This is part of a broader U.S. strategy aimed at maintaining technological superiority and national security.

- The strategic role of advanced AI chips: Integrated circuits used in artificial intelligence have become a key resource in the U.S.-China rivalry, on par with energy commodities.

- GAIN AI Act: The new law requires chip manufacturers, such as Nvidia and AMD, to prioritize serving the domestic market before exporting, especially to China. This is part of a broader U.S. strategy aimed at maintaining technological superiority and national security.

- The strategic role of advanced AI chips: Integrated circuits used in artificial intelligence have become a key resource in the U.S.-China rivalry, on par with energy commodities.

In recent years, the technological rivalry between the United States and China has intensified significantly. Advanced integrated circuits used in artificial intelligence (AI) have come to play a key role in this geopolitical confrontation and are now considered a strategic resource almost on par with crude oil and energy commodities. The growing strength of China’s military technology, surveillance systems, and AI solutions has prompted the U.S. to impose a series of export restrictions, including bans on the sale of chips produced by Nvidia, limiting Beijing’s access to the latest technologies such as the H100 chips used, among other things, for advanced AI computations.

In response to escalating trade and technology tensions, the U.S. Senate passed the GAIN AI Act. This legislation requires chip manufacturers such as Nvidia and AMD to prioritize meeting domestic customer demand before exporting products to foreign markets, including China. The law is part of a broader U.S. strategy aimed at maintaining technological superiority in the AI sector and restricting Beijing’s access to cutting-edge solutions. It also responds to the intensifying competition for dominance in the semiconductor industry, a critical area for both the economy and national security.

The administration of Donald Trump, which began its second term in January 2025, continues the policy of protecting American dominance in AI while simultaneously supporting domestic semiconductor manufacturers. Although the GAIN AI Act still awaits approval by the House of Representatives and the president’s signature, it has already sparked diverse reactions. Supporters emphasize the need to protect national interests, while critics warn of the risk of escalating trade tensions and disruptions in global supply chains.

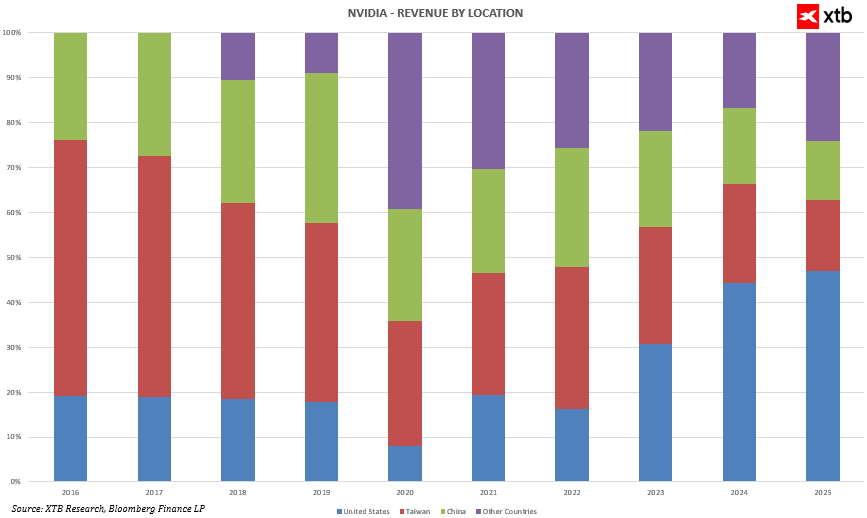

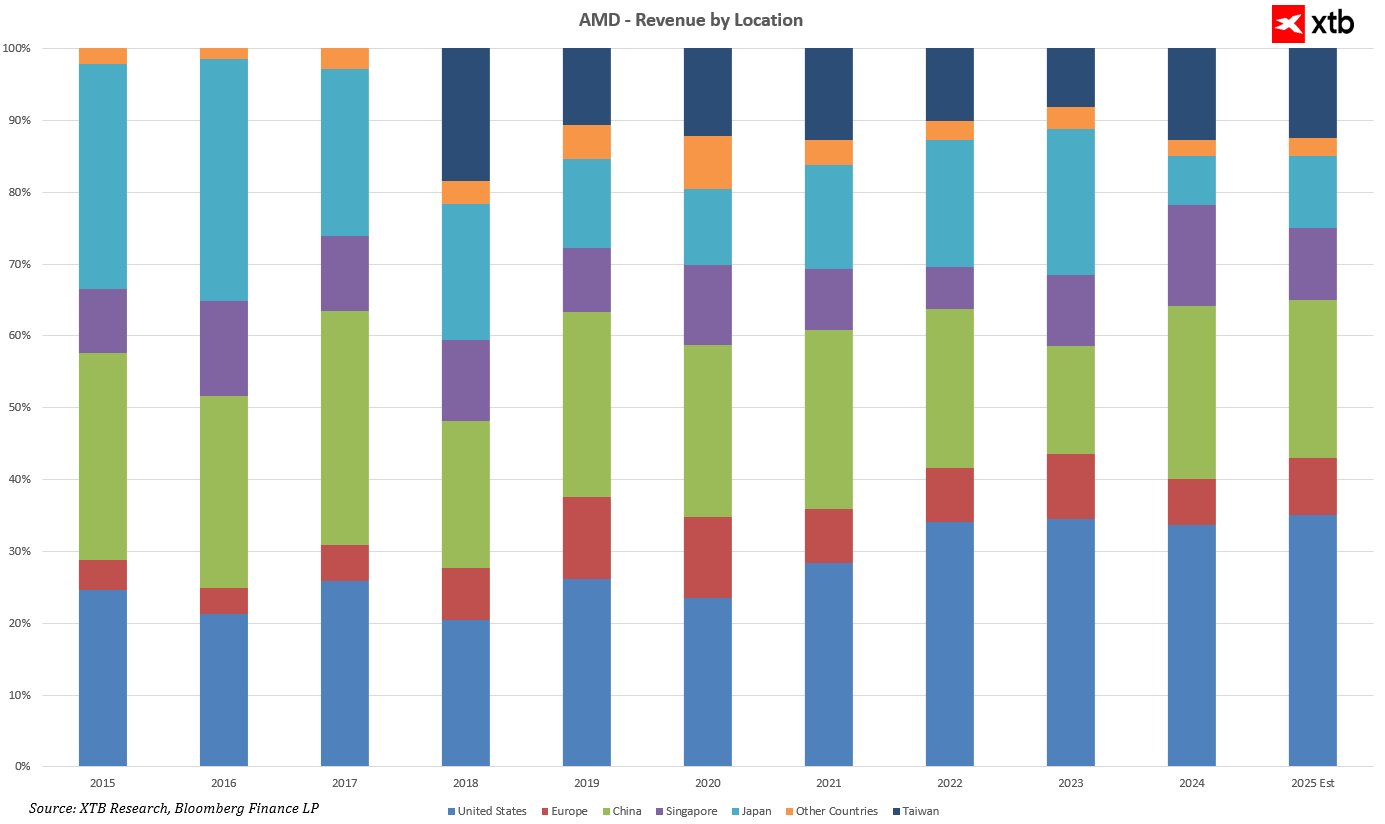

Giants like AMD and Nvidia are the main beneficiaries of the AI technology boom. Their advanced chips drive the development of artificial intelligence and fuel current growth in the technology market. These companies report dynamic revenue growth, particularly in the American market, which has become crucial for them. However, significant revenues also come from China and other important Asian markets such as Taiwan and Singapore, which are increasingly exposed to risks associated with rising geopolitical tensions and export restrictions.

The GAIN AI Act may enhance sales stability in the domestic market but simultaneously limit expansion opportunities into foreign markets, especially China. In the coming quarters, companies may feel pressure to adjust to the new regulations, which could slow revenue growth outside the U.S.

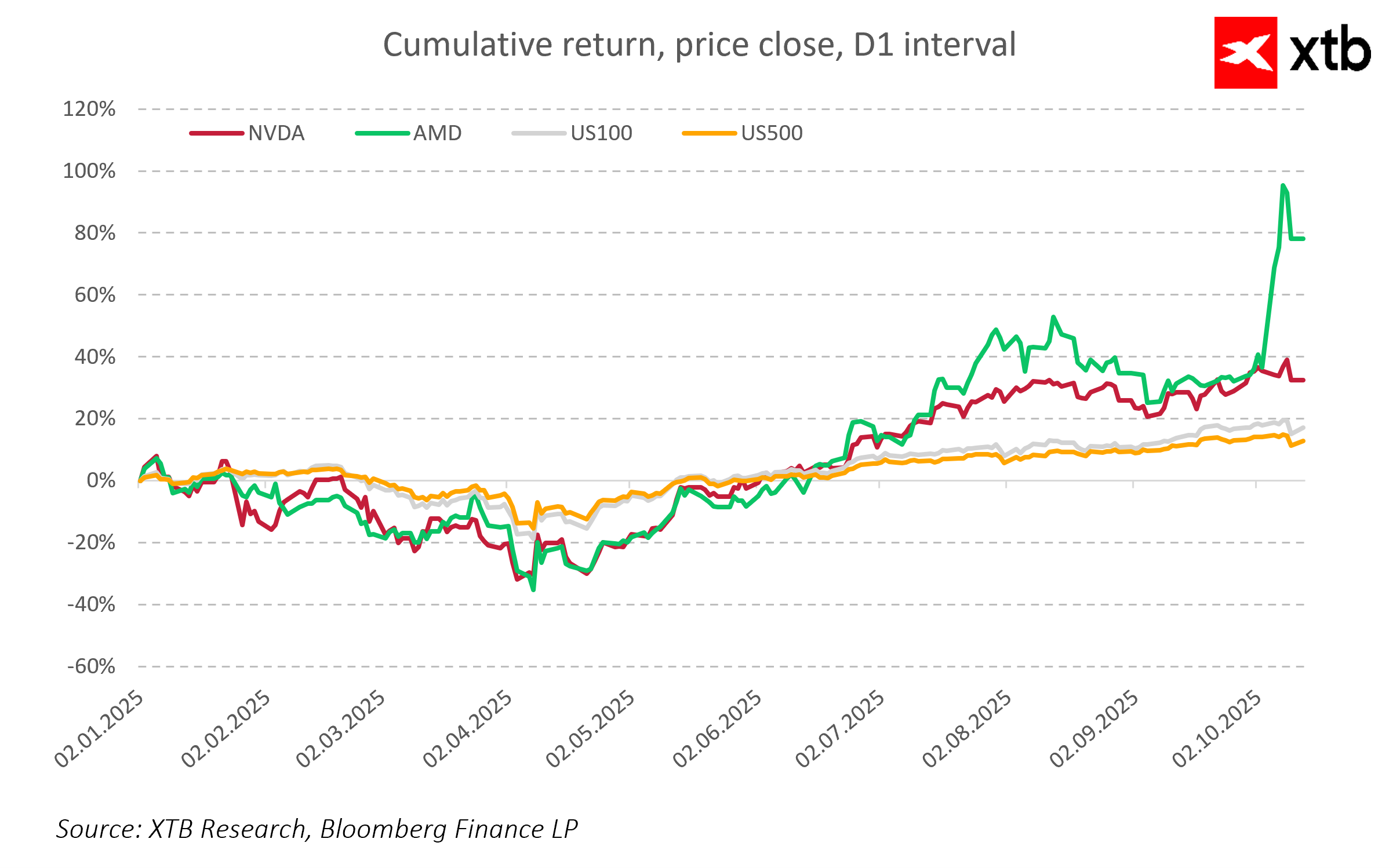

For investors, these changes pose a challenge. Despite impressive stock price increases for AMD and Nvidia since early 2025, the prospect of further export restrictions and growing regulatory uncertainty may raise concerns about the companies’ long-term stability and growth potential. This could lead to increased stock price volatility and selling pressure, especially in the short term.

The future of AMD and Nvidia will largely depend on their ability to respond flexibly to rapidly changing political and economic conditions that currently shape the global technology market. These companies must not only continue technological innovation but also effectively manage risks arising from tightening export regulations and growing geopolitical pressure, particularly amid escalating tensions between the U.S. and China. A key factor will be the ability to adapt supply chains, revise sales strategies, and develop relationships with domestic customers while seeking new expansion opportunities in markets less affected by sanctions. Investors should closely monitor the legislative process related to the GAIN AI Act and the responses of AMD and Nvidia to these regulations. Actions taken by these companies, such as diversifying product portfolios, investing in research and development, and forming strategic partnerships, may be decisive for their long-term growth and financial stability.

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Arista Networks closes 2025 with record results!

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure