Summer is usually a time of lull on the financial markets. There are less market events scheduled and governments from many countries go on a recess so there is also less of a political talk. However, while markets in general are more calm, it does not mean that trading on individual securities is lacklustre as well. Wall Street earnings season for the second quarter of 2021 begins this week and as usual major financial institutions will be the first to report results.

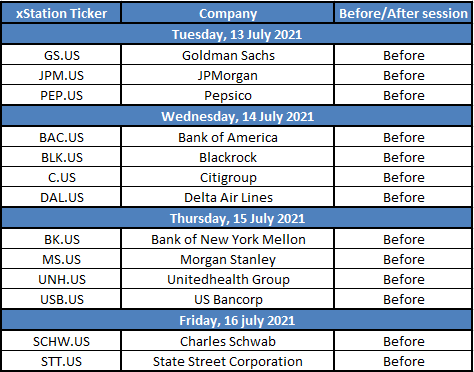

JPMorgan (JPM.US) and Goldman Sachs (GS.US) are the first major US banks to report Q2 2021 earnings on Tuesday, July 13. Earnings releases from other banks - Bank of America (BAC.US), Citigroup (C.US) or Morgan Stanley (MS.US) - will follow in the later part of the week. Apart from banks, financial institutions like BlackRock (BLK.US) or State Street (STT.US) will also report. A total of 3 Dow Jones members are set to report this week (Goldman Sachs, JPMorgan and UnitedHealth Group).

Traders will focus mainly on banking reports this week with special attention being paid to dividend announcements (Fed decided to lift restrictions on dividends and buybacks after major US banks performed well in stress tests).

Top US earnings reports to watch this week. Source: Bloomberg, XTB

Top US earnings reports to watch this week. Source: Bloomberg, XTB

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡