Risk-off tones can be spotted on the global equity markets at the beginning of a new week. Pick-up in the US yields remains one of the key themes in the markets and Powell is likely to be questioned about it when he appears before Congress on Tuesday and Wednesday.

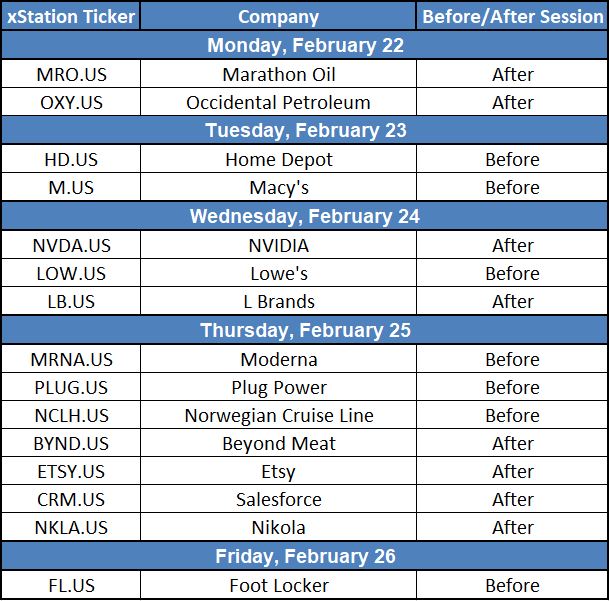

While most of the big US companies have already released their quarterly earnings reports, the season is not over yet. Among this week's highlights, investors can find reports from 2 Dow Jones members - Home Depot (Tuesday) and Salesforce (Thursday) - as well as a report from Nvidia (Wednesday). Apart from that, investors will also be offered results from EV industry - namely reports from Plug Power and Nikola on Thursday. Coronavirus vaccine manufacturer Moderna will report results on Thursday ahead of the Wall Street open. Last but not least, the week will be abundant in releases from the US retailers - the aforementioned Home Depot, L Brands, Macy's and Lowe's among others.

Top stock reports to watch this week. Source: Bloomberg, XTB

Top stock reports to watch this week. Source: Bloomberg, XTB

Market wrap: European and US stocks try to rebound rebound 📈

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China