Traders are waiting for the FOMC decision scheduled for the evening (6:00 pm GMT). Volatility is expected to be elevated across many markets. US100, GOLD and DE30 are among markets that may experience big moves after Fed meeting.

US100

Let’s start today’s analysis with the US tech index - Nasdaq (US100). Looking at the H4 interval, one can see that yesterday's sharp correction stopped at the 100 - period moving average, which was additionally strengthened by the 50% Fibonacci retracement of the upward move started on the 19th of July. However, the upward move reached the key short-term resistance at 15,000 pts, marked with previous price reactions. Should buyers manage to break above it, an upward move may accelerate towards new all time highs. On the other hand, if the price stays below 15,000 pts, downward correction may be resumed and deepened. The key mid-term support lies at 14,575 pts, where the lower limit of 1:1 structure is located.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app US100 H4 interval. Source: xStation5

US100 H4 interval. Source: xStation5

GOLD

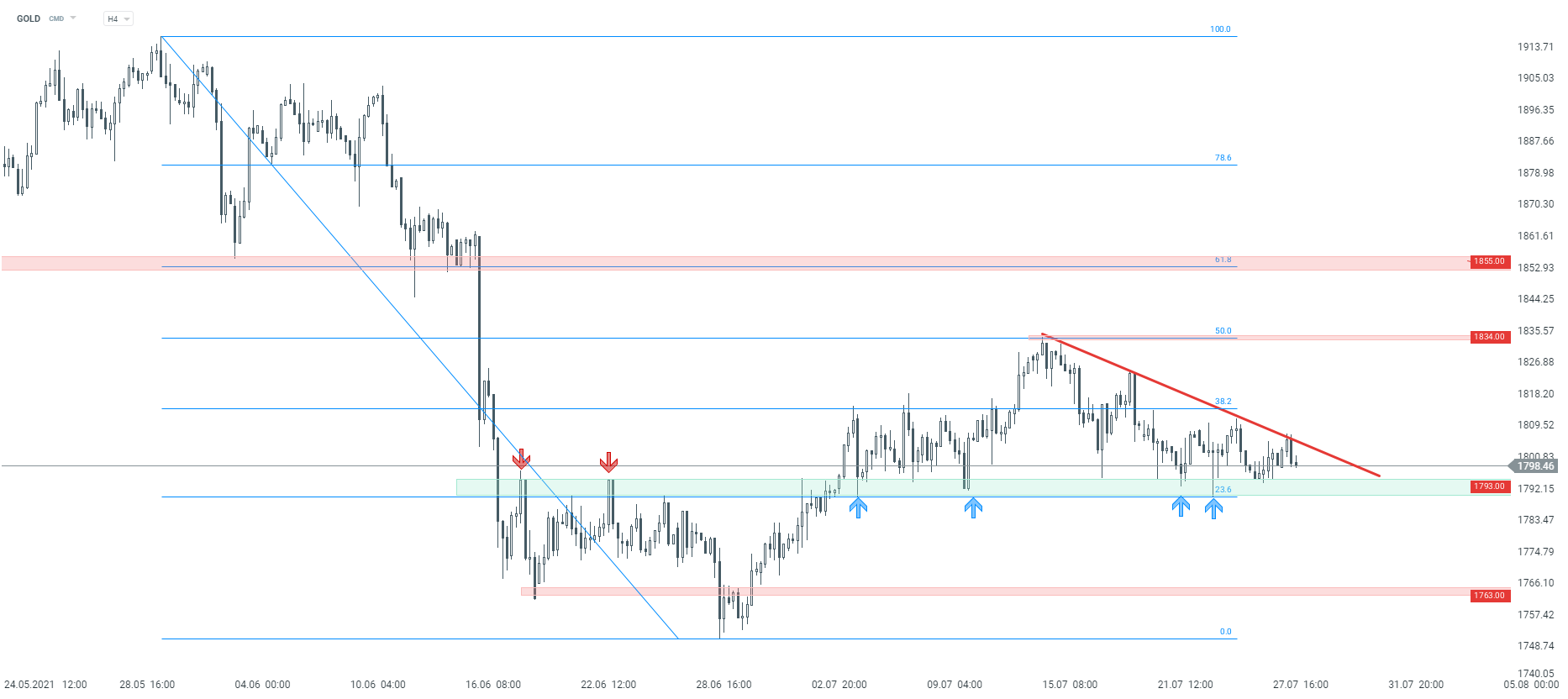

Moving to the gold market, the precious metal has been stuck in a local sideways move. Looking at the H4 interval, one can see that the recent upward correction was stopped at the 50% Fibonacci retracement, but the declines have also slowed down. The area marked with green colour near $1,793 is the key support for now. If sellers manage to break below, the way towards the next demand zone at $1,763 will be left open. On the other hand, if there'll be another rebound and the price breaks above the downward trendline (red line on the chart below), the resulting upward move may target the aforementioned resistance at $1,834.

GOLD H4 interval. Source: xStation5

GOLD H4 interval. Source: xStation5

DE30

Last but not least, let’s take a look at the German index - DAX (DE30). Looking at the H4 interval, one can see that recent downward correction reached the key support at 15,055 pts and a dynamic recovery move was launched. According to the Overbalance strategy, bouncing off the lower limit of 1:1 structure confirms the upward trend on the index. Should buyers manage to keep the momentum, all time highs may become a target for bulls. On the other hand, if the index resumes decline and the aforementioned lower limit of 1:1 structure is breached, the next key support to watch can be found at 14,800 pts.

DE30 D1 interval. Source: xStation5

DE30 D1 interval. Source: xStation5