Coronavirus panic and responses from central banks and governments led to abnormal movements in the financial markets. Let's take a look at the current technical situation on the US Dow Jones index, German DAX index and the GBPUSD currency pair.

US30

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appLet’s start today's analysis with Dow Jones (US30), the US index that experienced a bigger drop than the one during the Global Financial Crisis (in terms of points). The index is trading almost 40% off the February’s high. Technical landscape is not looking too encouraging for bulls. The price bounced off the 18,000 handle where the 50% Fibonacci retracement is located. However, the mid-term trend remains downward and as long as the price sits below earlier broken 22,000 pts handle (lower limit of Overbalance structure), further declines are the base case scenario. The nearest support to watch can be found near 15,500 pts, where the low from 2015 and 2016 are located.

US30 MN interval. Source: xStation5

US30 MN interval. Source: xStation5

DE30

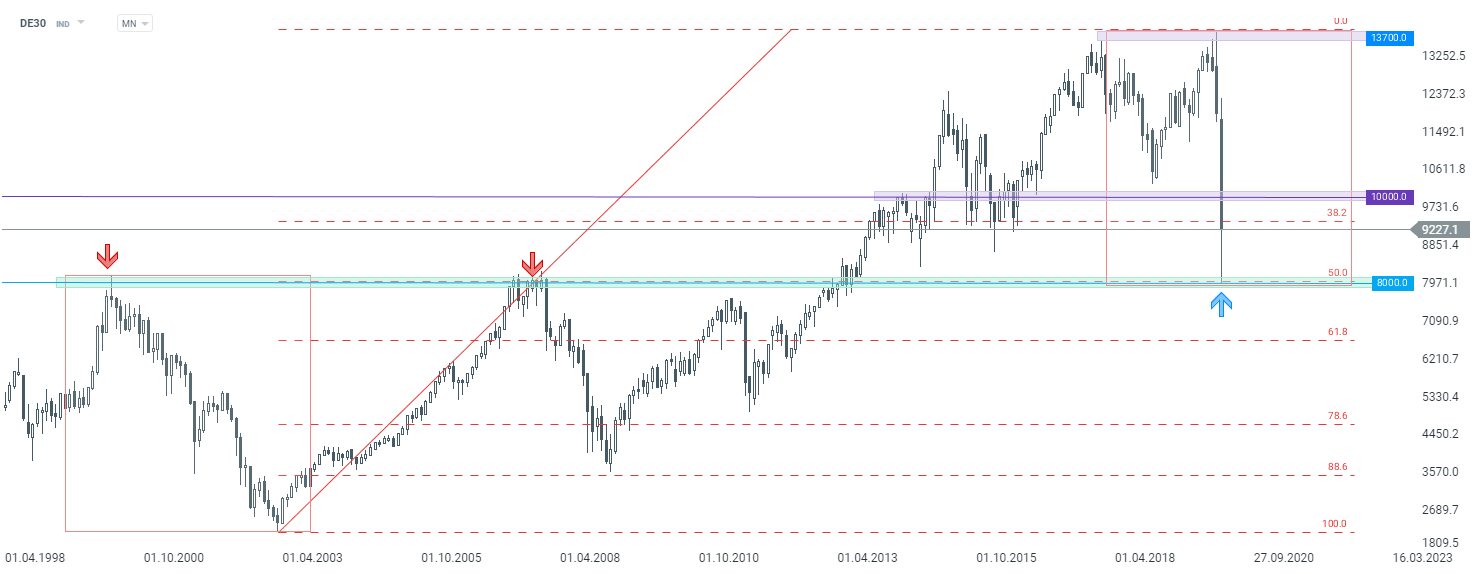

The enormous sell-off can also be spotted on other stock markets, including DAX (DE30). German index launched a new week with a bearish price gap. However, sellers failed to deepen declines and break below recent lows at 8000 pts handle leading to a start of an upward correction. Looking on the chart from a technical point of view, one can see that the aforementioned 8000 pts is a key support to watch. Should the ongoing correction continue, bulls may take aim at the nearest major resistance (10,000 pts). Nevertheless, traders should keep in mind that coronavirus pandemic is still far from being over and equities are prone to downside risks.

DE30 MN interval. Source: xStation5

DE30 MN interval. Source: xStation5

GBPUSD

Last but not least, let’s look at the technical situation on GBPUSD chart. Looking at the daily time frame, one can see that the pair has been trading in a strong downward move since 9th March. The price plunged more than 1500 pips in less than two weeks. Buyers managed to halt decline at 127.2% Fibonacci retracement but the main trend remains downward. The pair did not manage to break above the upper limit of Overbalance structure (marked with green colour on the chart below). Nevertheless downward momentum eased recently therefore an upward correction could be on the cards. However, one should remember that as long as the price sits below the resistance area at 1.20 USD, market’s seem to favour bears.

GBPUSD D1 interval. Source: xStation5

GBPUSD D1 interval. Source: xStation5