- Tech stocks are leading gains at the start of the week.

- Alphabet is lifting the indices again with the launch of Gemini 3 and its new NATO contract.

- Rising risk appetite isn’t hurting defensive sectors such as healthcare and pharmaceuticals.

- Tech stocks are leading gains at the start of the week.

- Alphabet is lifting the indices again with the launch of Gemini 3 and its new NATO contract.

- Rising risk appetite isn’t hurting defensive sectors such as healthcare and pharmaceuticals.

US equities are extending Friday’s rebound, attempting to erase the recent sell-off that even strong Nvidia earnings failed to stop. Tech leads the move higher (US100: +2%, US30: +0.3%) as risk appetite is boosted by renewed hopes for a December Fed rate cut.

Rate-cut expectations jumped above 70% on Friday after comments from the New York Fed’s John Williams, who said monetary policy remains somewhat restrictive. Another dovish signal came today from Christopher Waller — considered a contender for Fed Chair — who cited labour-market concerns and voiced support for a December cut.

The return of dovish rhetoric is giving Wall Street fresh momentum, supported further by upbeat news from key tech names, including the release of Gemini 3, Alphabet’s latest AI model. The company also announced a multimillion-dollar cloud-services contract with NATO.

Big Tech is driving the rally, including the Magnificent 7 (Alphabet: +5.4%, Amazon: +2.5%, Tesla: +6.5%, Meta: +3.4%). Nearly the entire semiconductor sector is also in the green (Broadcom: +9%, AMD: +4%, Micron: +6.7%). Interestingly, today’s tech euphoria isn’t weighing on more defensive sectors like pharmaceuticals and healthcare (Pfizer: +1.1%, Merck: +3.5%). Source: xStation5

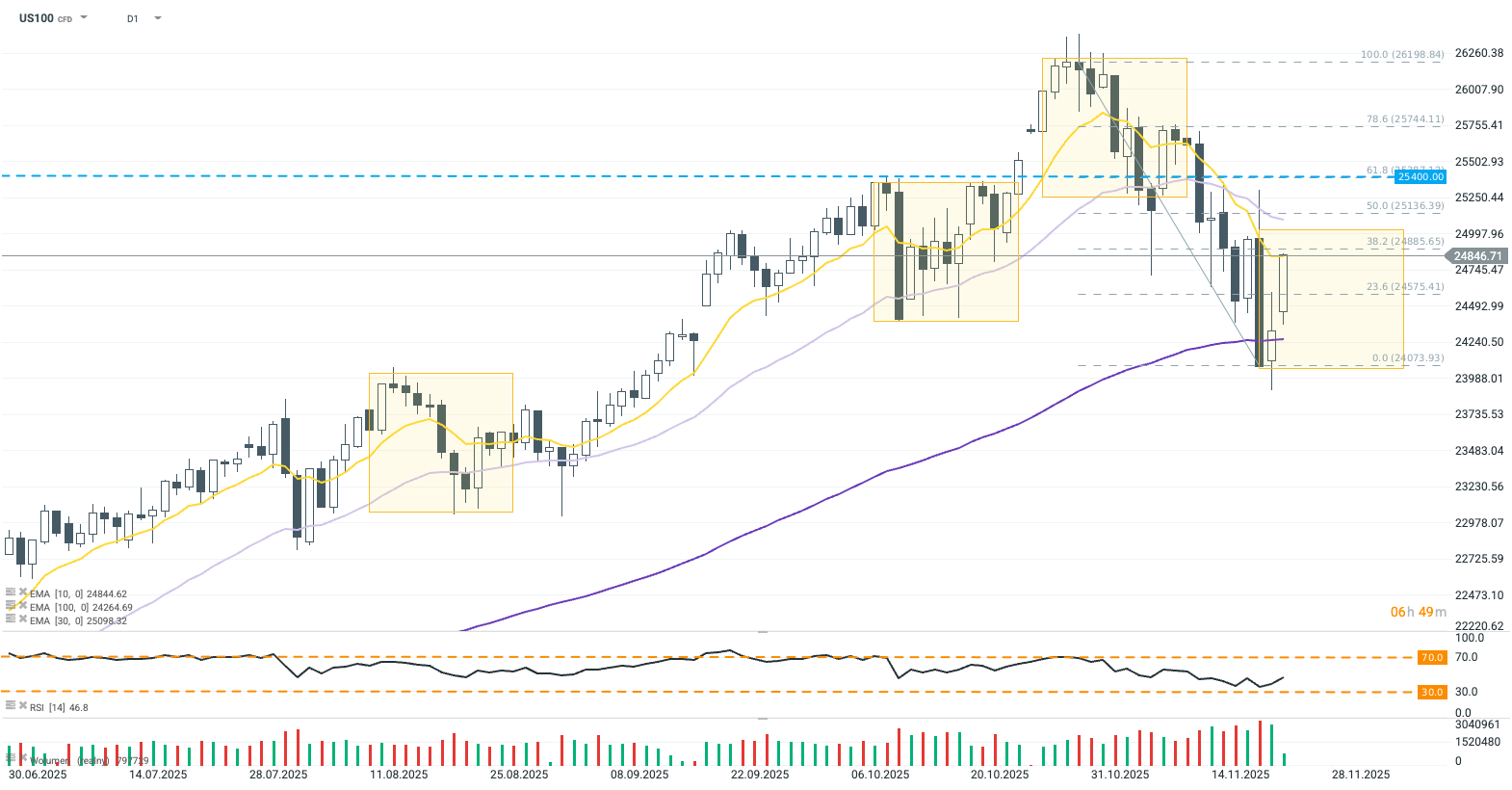

The US100 contract continues to climb despite already bullish opening. The index has broken above the 23.6% Fibonacci retracement and is pushing toward a test of the 10-day EMA (yellow), which roughly aligns with the 38.2% Fibo level and the upper geometry boundary. Erasing Thursday’s sell-off would open the door to a broader recovery on Wall Street, supported by neutral RSI. A rejection at the 10-day EMA, however, would signal growing investor caution ahead of the Fed decision. Source: xStation5

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Michael Burry and Palantir: A well-known analyst levels serious accusations

Palo Alto earnings: Is security cheap now?