Currency woes are nothing new for Turkey – the last episode in 2018 involved inadequate economic policy and tensions with the US and while the situation stabilized in 2019, the lira has been under increased pressure this year again. First of all, pandemic and related safe haven flows acted against it and forced central bank to tap its shrinking reserves and now we have a de ja vu – Turkey is engaged in geopolitical conflicts but this time on multiple fronts. The rift with US is mostly about S400 defense system from Russia, Turkey argues with Greece over maritime rights and has been dragged into Nagorno-Karabakh conflict. If that wasn’t enough, president Erdogan attacked French president over his criticism of Muslims and called on Turks to boycott French goods.

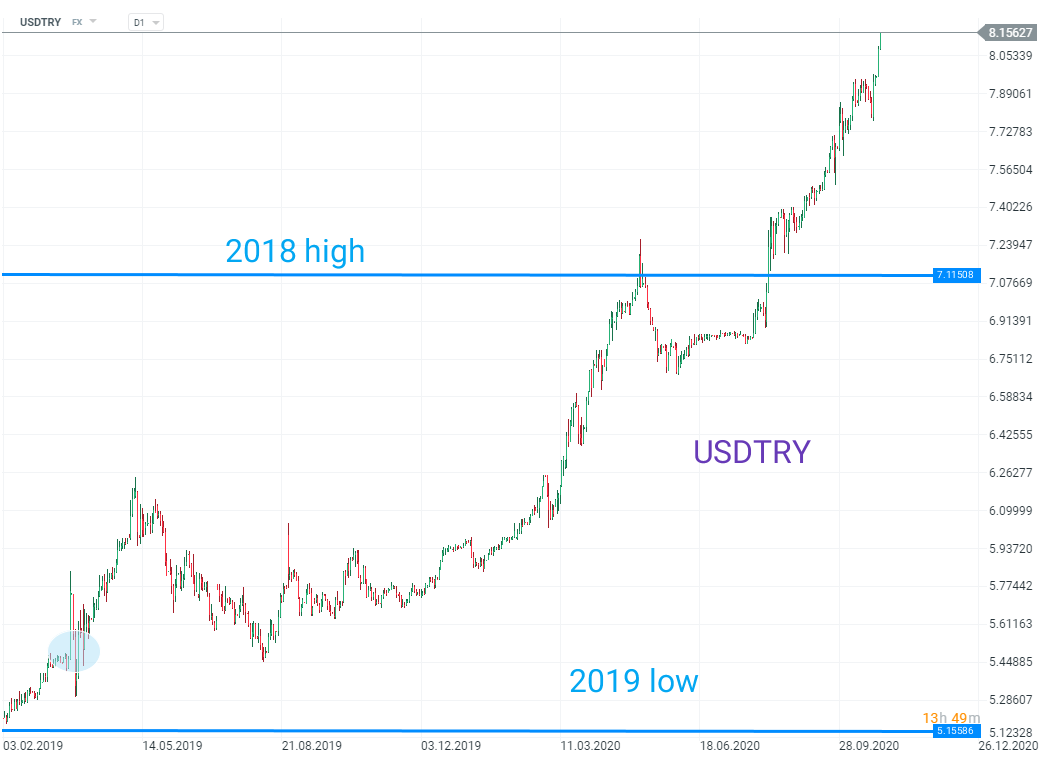

USDTRY, up 37% this year, has been rallying strongly since Friday with no signs of stabilization. The pair is trading above 8.15 – at the highest level ever.

USDTRY, up 37% this year, has been rallying strongly since Friday with no signs of stabilization. The pair is trading above 8.15 – at the highest level ever.

Daily summary: Markets capitulate under the influence of the Persian Gulf

🚨 EURUSD deepens decline, falls to key support zone

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Three markets to watch next week (27.02.2026)