The December inflation data for the UK was stronger than expected. UK price growth picked up in December, in line with rising inflation rates in the US and across Europe. The monthly pace of headline CPI was 0.4%, the annual rate edged up to 4% from 3.9% in November. Core data also disappointed the market and failed to fall below 5%, a level it has not reached for 2 years. Instead, annual core price growth stayed steady at 5.1%.

Upward contributors to the inflation rate came from alcohol and tobacco prices. This was due to the planned increase in ‘sin taxes’ announced by the Chancellor, and so it will be a one-off adjustment, and the increase in duty should not impact future months’ inflation data. Airfares also added upward pressure to the December inflation rate. The The price of air fares rose by 57.1% in 2023, this was lower than the 61.1% recorded a year ago, but it is good reminder that the era of cheap air travel is over.

Service sector inflation is also driving the UK’s overall inflation rate and has experienced stickier price growth compared with goods prices. Service prices grew by 0.7% last month, and the annual rate was 6%, according to the ONS.

Bright spots for the UK’s inflation outlook

There was some good news in this data set, the largest downward contribution came from food and non-alcoholic beverages. Added to this, owner occupier housing costs, which have had a big upward impact on inflation in recent years, have stabilized. The annual rate remained steady at 5.3% in December, the same rate as in November. Not so encouragingly, the monthly rate for owner occupiers housing costs rose by 0.4% in December, the same rate of growth as December 2023, most likely driven by rental costs as mortgage rates have fallen substantially.

As you can see, upward price pressures in December were a mix of temporary factors and more structural increases. The UK is now in line with its G7 peers, and the UK’s 4% headline CPI rate is below France’s inflation rate for the first time in two years.

Where could inflation go next?

There are three factors that could determine the direction of price growth in the future. Firstly, the minimum wage will rise by 12.4% for over 21 year olds from April this year. This could increase upward pressure on the CPI rate, if businesses try to pass through higher wage costs to consumers. Secondly, the energy price cap is expected to decrease by 14% in April, and the average energy customer could see a £268 reduction ion their bills compared with January’s prices.

Lastly, concerns about the geopolitical tensions in the Red Sea and their impact on the global inflation rate, could be overdone. Even though events in the Red Sea are serious from a geopolitical standpoint, the effects on the inflation rate could be less severe. The oil price has failed to move significantly higher on the back of the Houthis attacks, and Brent crude is currently below $78 per barrel. Added to this, some ships are still sailing through the Red Sea, and a re-route around the horn of Africa adds approx. 9 days to a tanker’s journey to the West. This is not disastrous for the shipping industry, or for the price of consumer goods, in our view. We do not think that the global economy will face the same level of supply disruption as it did during the pandemic, and for now the markets are not in panic mode, for good reason.

On balance, we think that the disinflation trend remains intact for the UK economy, and that price pressures remain manageable. However, wage growth linked to the rise in the minimum wage is an unknown, and is a reminder that some upside inflation risks remain.

What does the inflation data mean for the Bank of England?

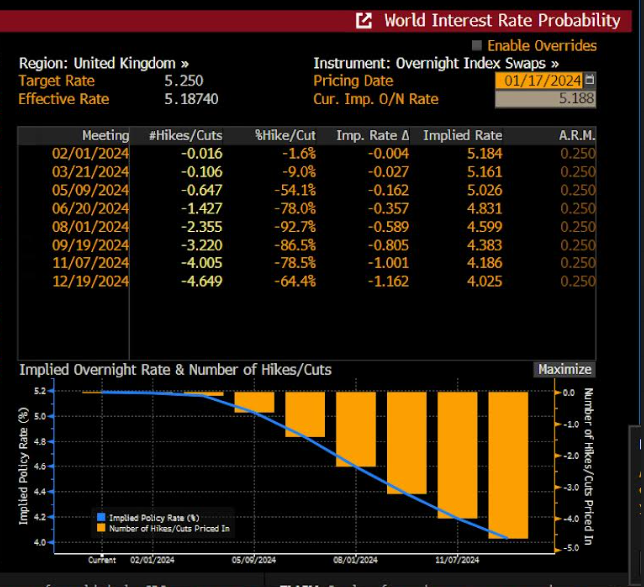

In the aftermath of the UK’s CPI data, the market has pushed back its expectations of when the BOE will start to cut interest rates. The first cut is now expected in June, a few days ago the market had expected the first rate cut to come in May, as you can see in the chart below. The market is now pricing in just over 5 rate cuts this year, it had been more than 6 rate cuts a few weeks ago. However, if we see further increases in the inflation rate in the coming months or if we see economic data pick up, then we could see expectations for the first rate cut from the BOE to move deeper into 2024, and potentially out to the late summer.

Chart 1: Bloomberg, market based interest rate expectations

Source: Bloomberg

The UK is not alone in seeing rate cut expectations shift this week. Central bankers have given the markets a dose of reality on rate cut expectations in recent days, and we have seen a scaling back of expectations for the US and Europe along with the UK.

The market impact:

Sterling initially rallied on the back of the inflation data, however GBP/USD could not extend gains above $1.27. As we mentioned above, the Federal Reserve is also pushing back on the market’s expectations for US rate cuts, which is also putting upward pressure on the dollar. In the hours after the inflation data had been released, GBP/USD was mostly stable. UK bond yields also rose sharply on the back of this data. The 2-year Gilt yield rose by 19 basis points to 4.36% on Wednesday. UK stocks also came under pressure, as global risk sentiment waned, and as bond yields surged.

Volatility is here to stay

Overall, the UK’s inflation data suggests that inflation does not fall in a straight line. Also, as the market reacts to economic data, this has a big effect on interest rate expectations. When interest rate expectations shift, as they have in recent days, this causes volatility, which moves markets. This volatility also generates opportunities for traders. Looking ahead, we see a much higher rate of volatility in financial markets in the next few months as we wait for central bankers to start loosening monetary policy.

US100 gains 1% before Nvidia earnings📈

Will Powell remain hawkish❓

Market story: Valentine's Day has never been so expensive? The prices of coffee, chocolate and gold are at an all-time high

Will the ECB be forced to follow the Fed?