Summary:

-

UK Manufacturing PMI: 47.4 vs 48.4 exp. 48.0 prior

-

Subcomponents also make for grim viewing

-

GBPUSD falls back beneath $1.21 handle

A widely viewed survey has raised alarm bells for the uK with the manufacturing PMI for August falling to its lowest level since July 2012. The print of 47.4 was below the 48.4 expected and marks the 3rd time in the past 4 months that this metric has disappointed and come in below consensus forecasts. Looking more closely at the report, the overall picture gets worse with rising inventories and a drop in exports - despite the recent GBP depreciation - key areas of weakness. In fact the latest decline in orders has only been exceeded once (in 2012) since the 2008/9 financial crisis.

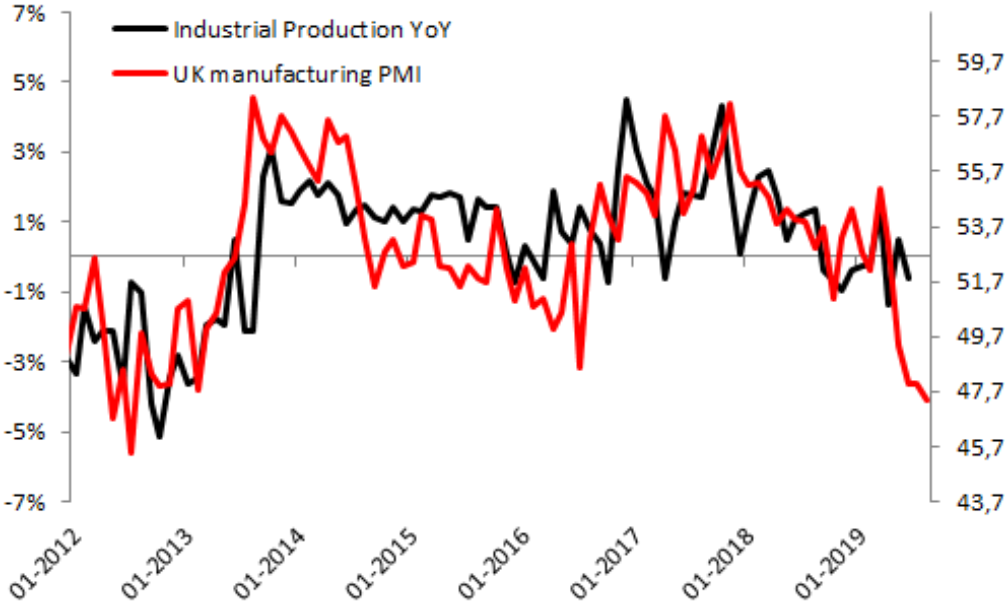

The recent decline in UK manufacturing is alarming and has opened up a large divergence with the industrial production equivalent. The PMI has tended to lead this relationship in the past 7 years so it could be worthwhile keeping a close eye on the industrial production releases next out. Source: XTB Macrobond

In terms of the market reaction it’s been fairly muted with economic data remaining very much of secondary importance for the pound at present, with the markets far more interested in the latest developments on the Brexit front. Before the release, the pound was already sliding lower at the start of what could be a big week for the currency, with the coming days set to reveal how opponents to the government’s Brexit plan will respond. Boris Johnson is clearly pursuing a confrontational approach with the PM threatening to purge any lawmaker in his party that votes against government and the end game is looking increasingly likely to be a so-called “people vs parliament” General Election. Following the announcement last week of the proroguing of parliament the battle lines have been quite clearly drawn and the emphasis is now very much on the opposition to make their move.

MPs are set to return from their summer recess and the opposition will waste little time in making their move, with the most likely plan being an attempt to pass legislation through parliament that will block a no-deal - similar to the Cooper-Letwin bill earlier this year. Another possible course could be to bring a vote of no-confidence in the government but this seems less likely as a first attempt.

After an attempted move higher at the start of last week the pound is coming back under pressure and is once more languishing near multi-decade lows against the US dollar. 8/21 EMAs remain in a bearish orientation and the focus is now on whether recent lows around 1.2015 can hold on a retest. Source: xStation

After an attempted move higher at the start of last week the pound is coming back under pressure and is once more languishing near multi-decade lows against the US dollar. 8/21 EMAs remain in a bearish orientation and the focus is now on whether recent lows around 1.2015 can hold on a retest. Source: xStation

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

Daily summary: Markets capitulate under the influence of the Persian Gulf

🚨 EURUSD deepens decline, falls to key support zone